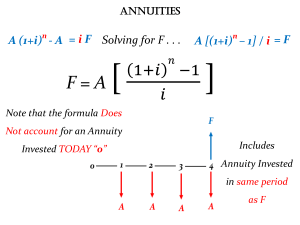

Manipulating Present and Future Value Formulas Introduction to Corporate Finance Professor Michael R. Roberts An important skill to acquire from this course is comfort in manipulating the present value and future value formulas. Many questions that arise in practice require this skill. This note discusses some of these manipulations and corresponding situations. Consider the annuity formula, PV = ( ) CF −N 1− (1+ i ) i , (1) where PV is present value, CF is the periodic cash flow, i is the periodic discount rate (equal to the APR, R, divided by the number of compounding periods per year, k), and N is the number of periods (equal to the number of compounding periods per year, k, times the number of years T). For annual cash flows and annual compounding, i = R and N = T so that PV = ( ) CF −T 1− (1+ R ) R . If we want to know the future value of the annuity, FV, we would multiply both sides of equation (1) by (1+i)N. This operation produces PV (1+ i ) = FV = N ( ) CF (1+ i )N − 1 i . (2) A few algebraic operations on equations (1) and (2) reveal that the periodic cash flow for an annuity is given by CF = PV × i −N 1− (1+ i ) , (3) CF = FV × i (1+ i )N − 1 . (4) and Equation (3) can be used to solve for your mortgage payment or your auto lease payment, for example. Equation (4) can be used to determine the amount of periodic savings needed to reach a certain goal in the future, for example. 1 We can also manipulate equation (1) to find the number of periods for an annuity, ⎛ PV × i ⎞ ln ⎜ 1− ⎟ ⎝ CF ⎠ N=− ln (1+ i ) . (5) This equation can help you determine how long you can withdraw a constant amount of money each period until exhausting a savings account or other investment vehicle. Now consider the growing perpetuity formula, CF R−g . (6) CF +g PV , (7) CF PV . (8) PV = Algebra reveals the discount rate is given by R= and the growth rate is given by g =R − Without context, this may seem like a meaningless mathematical exercise. Yet, equations (6) through (8) are central to valuing companies and analyzing stocks. Recall that the present value of a cash flow stream can be interpreted as today’s fair price of a claim to that stream of future cash flows. Call PV the price of a stock, and CF the dividend or total payout (i.e., dividend plus share repurchase). The result is called the Gordon Growth Model (a.k.a., Dividend Discount Model) or Total Payout Model, depending on whether CF represents dividends or dividends plus share repurchases. The equation expresses the price of a stock today as the present discounted value of the cash flows received by shareholders. (Stocks have no “maturity” like bonds so that they can be viewed as perpetuities.) A full exploration into this model is beyond the scope of this course but I hope this brief discussion reinforces the importance of what we learn in this class. You might try manipulating the other formulas (e.g., present/future value of a single cash flow or growing annuity) on your own. 2