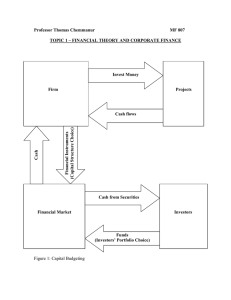

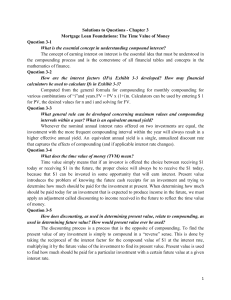

Time Value of Money CPA Ansbert Kishamba Time value of money Time value of money means that the value of a given amount of money is different at different points in time. • The value of a particular amount of money received today is more than its value if received in future. • The worth of money that a person has today is more than the expectation of receiving that money in the future. Money in hand today can be invested and returns can be earned on that investment. Money has time value because of the following reasons: i. Risk ii. Consumption iii. Investment opportunity iv. Inflation Perspectives of time value of money There are two perspectives to converting the cash flows to a common point in time: i. Compounding technique (future value) ii. Discounting technique (present value) COMPOUNDING TECHNIQUE Compounding is the technique of calculating future value of cash flows when the present values are stated. Future value represents the amount that an investment made today will grow to at some point of time in future if invested at a specific rate of interest. Formula to compute compound value: Where: 𝑖 𝑛𝑚 𝐴 = 𝑃(1 + ) 𝑚 A= amount at the end of the period P= principal at the beginning of the period i = rate of interest n= number of years m= number of times compounding is done in a year Annuity An annuity is a level stream of regular payments that lasts for a fixed number of periods. 𝐹𝑉 = 𝐶 (1+𝑟)𝑛 −1 𝑟 Continuous Compounding FV = 𝐶 × 𝑒 𝑟𝑡 Example: Calculate the amount to be received by an investors when they invest Tshs10,000 for 2 years at an interest rate of 10% compounded: i. Annually ii. Semi annually iii. Quarterly. Present Value or Discounting Technique Present value is the current value of a future amount. Present value of money that will be received in the future will be less than the value of money in hand today hence this technique is also called discounting technique. This technique determines the present value of a future amount assuming that the investor has an opportunity of earning a return on his money. This return is known as the discount rate. Present value equation is as follows: 𝐴 𝑃= (1 + 𝑖)𝑛 WHERE: P = present value of future sum to be received A = sum to be received in future i = interest rate n = number of years Annuity 𝑃𝑉 = 𝐶 1−(1+𝑟)−𝑛 𝑟 Growing annuity 𝑃𝑉 = 𝐶 1+𝑔 𝑛 1− 1+𝑟 𝑟−𝑔 Perpetuity A perpetuity is a constant stream of cash flows without end. 𝐶 𝑃𝑉 = 𝑟 Growing perpetuity 𝐶 𝑃𝑉 = 𝑟−𝑔 Effective Annual Rate R = (1 + )𝑚 −1 𝑟 𝑚 Use of Time Value of Money in Financial Management Time value of money is a very important concept in financial management. It is of more significance in the following decisions: i. Investment decision ii. Financing decision INVESTMENT DECISION The concept of time value of money is very important for decisions pertaining to long-term capital investments. A person intending to invest in a business project needs to understand the returns expected from the business. Since returns from a business accrue over a number of years after the business is set up while investment has to be made in the current period, the cash inflows and outflows occur in different periods and cannot be compared with each other directly. FINANCING DECISION The time value of money concept is useful when comparing costs of different sources of financing to determine the minimum cost source. In case of borrowings, cash inflow occurs immediately on disbursal of borrowings and cash outflows occur over a number of years in the form of interest payment and principal repayment. Present value of costs of various alternatives of financing are compared to decide the source of financing. For example, when a company borrows funds from a bank or financial institution to be repaid in equal annual instalments, it uses the present value technique to find out the size of the instalment. Comprehensive example: Ms. Mwang’onda will be retiring from her soon. Her employer has offered her two options for postretirement benefits: a) Tshs3.5 million lump sum b) Tshs0.4 million for 10 years The rate of interest is 10%. Required: Which option should Ms. Mwang’onda choose?