What is Corporate Finance

corporate finance, the acquisition and allocation of a

corporation’s funds, or resources, with the objective of

maximizing shareholder wealth (i.e., stock value). In the

financial management of a corporation, funds are generated from

various sources (i.e., from equities and liabilities) and are

allocated (invested) for desirable assets.

Written and fact-checked by The Editors of Encyclopaedia Britannica

The terms "corporate finance" and "corporate financier"

tend to be associated with transactions in which capital is

raised in order to create, develop, grow or acquire businesses.

Corporate finance refers to planning, developing and

controlling the capital structure of a business. It aims to

increase organizational value and profit through optimal

decisions on investments, finances as well as dividends. It

focusses on capital investments aimed at meeting the funding

requirements of a business to attain a favorable capital

structure.

Corporate finance deals with the capital structure of a

corporation, including its funding and the actions that

management takes to increase the value of the company.

Corporate finance also includes the tools and analysis utilized

to prioritize and distribute financial resources.

Corporate Finance-12e-Ross, Westerfield, Jaffe, Jordan

Corporate Finance-12e-Ross, Westerfield, Jaffe, Jordan

According to the balance sheet model finance can be

thought of as answering the following questions,

• in what long-lived assets should the firm invest?

• how can the firm raise cash for the required capital

expenditure?

• how should short-term operating cash flows be

managed?

All the decisions made in a business has financial

implications, and any decision that involves the use of money

is a corporate financial decision

The basic principles remain the same, whether at large or small

businesses.

All businesses have to

invest their resources wisely

find the right kind and mix of financing to fund these

investments

return cash to the owners if there are not enough good

investments

• Corporate finance attempts to find the answers to the

following questions:

– What

investments should the business take on?

THE INVESTMENT DECISION (Capital Budgeting)

– How

can finance be obtained to pay for the required

investments?

THE FINANCE DECISION ( Capital Structure)

– Should

dividends be paid? If so, how much?

THE DIVIDEND DECISION (Distribution)

Corporate Finance & Financial Accounting

Corporate Finance

inherently forward-looking and based on cash flows.

Financial Accounting

historic in nature and focuses on profit rather than cash.

Corporate Finance & Management Accounting

Corporate Finance

concerned with raising funds and providing a return to investors.

Management Accounting

concerned with providing information to assist managers in

making decisions within the company.

Corporate Objectives

❑

❑

❑

❑

❑

❑

Leveraged buyout

A leveraged buyout is a financial strategy in which a group

of investors gain voting control of a firm and then liquidate

its assets in order to repay the loans used to purchase the

firm’s shares. How leveraged buyouts would be viewed by

the shareholder wealth maximization model compared to

the corporate wealth maximization model

Conglomerates

Conglomerates are firms that have diversified into

unrelated

fields.

How

would

a

policy

of

conglomeration be viewed by the shareholder wealth

maximization model compared to the corporate

wealth maximization model?

Agency & Corporate Governance

Managers do not always act in the best interest of their

shareholders, giving rise to what is called the ‘agency’

problem

Agency is most likely to be a problem when there is a divergence

of ownership and control, when the goals of management differ

from those of shareholders and when asymmetry of information

exists

Monitoring and performance-related benefits are two potential ways

to optimize managerial behavior and encourage ‘goal oriented’

Two Key Concepts in Corporate Finance

The fundamental concepts in helping managers to

value alternative choices are

Relationship between Risk and Return

Time Value of Money

Relationship between Risk and Return

This concept states that an investor or a company takes on more risk only

if higher return is offered in compensation.

Return refers to

• Financial rewards gained as a result of making an

investment.

• The nature of return depends on the form of the investment.

• A company that invests in fixed assets & business

operations expects return in the form of profit (measured

on before- interest, before-tax & an after- tax basis)& in the

form of increased cash flows.

Relationship between Risk and Return

Risk refers to

Possibility that actual return may be different from the expected return.

When Actual Return > Expected Return

This is a Welcome Occurrence.

When Actual Return < Expected Return

This is a Risky Investment

Investors, Companies & Financial Managers are more likely to be concerned

with

• Possibility that Actual Return < Expected Return

Investors & Companies demand higher expected return

Possibility of actual return being different from expected return increases.

Time Value of Money

Time value of money is relevant to both

Companies

Investors

In a wider context,

Anyone expecting to pay or receive money over a period of time.

Time value of money refers to the fact that

Value of money changes over time.

What is time value of money?

A rupee today is more valuable than a year hence.

Why ?

Present value

Single cash flow

Annuity

Future value

Single cash flow

Annuity

Compounding

is the way to determine the future value of a sum of money invested now.

⚫ FV

= PV(1 + r)t

FV = future value

⚫ PV = present value

⚫ r = period interest rate, expressed as a decimal

⚫ T = number of periods

⚫

Rs. 20 deposited for five years at an annual interest rate of 6% will have future

value of:

Compounding takes us forward from current value of an investment to its

future value.

Future Value as a General Growth Formula

⚫Suppose

your company expects to increase unit

sales of computer by 15% per year for the next 5

years. If you currently sell 3 million computers in

one year, how many computers do you expect to

sell in 5 years?

Discounting - way to determine the present value of future cash flows

⚫ How

much do I have to invest today to have some amount in

the future?

= PV(1 + r)t

⚫ Rearrange to solve for PV = FV / (1 + r)t

⚫ FV

⚫ When

we talk about discounting, we mean finding the present

value of some future amount.

⚫ When we talk about the “value” of something, we are talking

about the present value unless we specifically indicate that we

want the future value.

⚫Suppose

you need Rs.10,000 in one year for the

down payment on a new car. If you can earn 7%

annually, how much do you need to invest today?

want to begin saving for your daughter’s college

education and you estimate that she will need Rs.150,000

in 17 years. If you feel confident that you can earn 8%

per year, how much do you need to invest today?

⚫You

Annuities

A series of constant cash flows for a specified period of time

Ordinary annuity –

• The payment or receipt of cash flow at

the

end

of

each period

Annuity Due –

• The payment or receipt of cash flow at

of each period

the beginning

Future Value of an Ordinary Annuity

FVA = PMT [

n

{(1+i)

– 1} / i]

FVA - Future value of an annuity in n periods

PMT

- Annuity amount

i

- Rate of compounding interest per period

n

- Number of periods

How much would you have in 5 years if you deposit

Rs.5000 a year at the end of each year into an account

that pays 7% interest per year

FVA = PMT [

n

{(1+i)

– 1} / i]

Future Value of an Annuity Due

FVAD = PMT

n

{[(1+i)

– 1] / i} (1+i)

How much would you have in 10 years if you deposit Rs.1000

a year at the start of each year into an account that pays 4%

interest per year

Present value of an Ordinary Annuity

1 – [1/(1+i)n]

PVA = PMT

i

An investment will pay you Rs.100 at the end of each

year for 12 years. What is the value of this investment

today if the interest rate is 8% per year

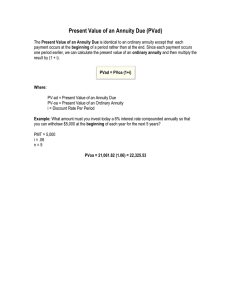

Present Value of an Annuity Due

1PVAD = PMT

1

(1 + i)n

i

(1 + i)

An investment will pay you Rs 1000 at the start of each year

for 12 years. What is the value of this investment today if the

interest rate is 10% per year?

Aim of Financial Manager

While accountancy plays an important role within

corporate finance, the fundamental problem addressed by

corporate finance is economic, i.e. how best to allocate

the scarce resource of capital.

The aim of the Financial Manager is the optimal

allocation of the scarce resources available to them.

High level of interdependence existing between decision

areas should be evaluated by financial managers when

making decisions

Interrelationship between Investment, Financing &

Dividend Decisions

Company decides to take on a large number of attractive new

investment projects

corporate governance systems have

traditionally stressed

internal controls and financial reporting rather than external

legislation.

Financial manager can maximize a company’s market value

by making good investment, financing and dividend decisions

Enron Scandal (2001)

What happened: Shareholders lost $74 billion, thousands of

employees and investors lost their retirement accounts, and

many employees lost their jobs.

Penalties: former CEO died before serving time; CEO got 24

years in prison. The company filed for bankruptcy. Arthur

Andersen was found guilty of fudging Enron's accounts.

Fun fact:

Fortune Magazine named Enron "America's Most Innovative

Company" 6 years in a row prior to the scandal.