SAMPLE DRAFT Summary of Benefits

advertisement

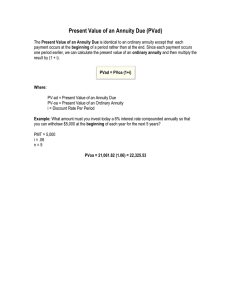

TEACHERS COLLEGE, COLUMBIA UNIVERSITY September 24, 2015 SAMPLE DRAFT Summary of Benefits 6% Charitable Gift Annuity ASSUMPTIONS: Annuitant Cash Donated Payout Rate from ACGA2012 Table Payment Schedule 76 $10,000.00 6% quarterly at end BENEFITS: Charitable Deduction Annuity $4,573.90 $600.00 Tax-free Portion $459.60 Ordinary Income $140.40 After 11.8 years, the entire annuity becomes ordinary income. Equivalent Rate of Return 11.6%* * Adjusted upward because tax-free portion of $460 makes the $600 annuity equivalent to $952 of taxable income for a beneficiary in the 43.4% income tax bracket. Basic Gift Illustrations IRS Discount Rate is 2.2% These calculations are for illustration purposes only and should not be considered legal, accounting, or other professional advice. Your actual benefits may vary depending on several factors, including the timing of your gift.