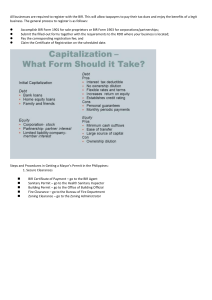

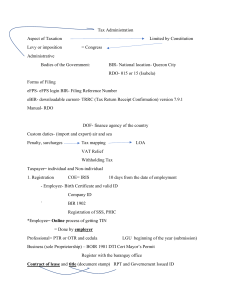

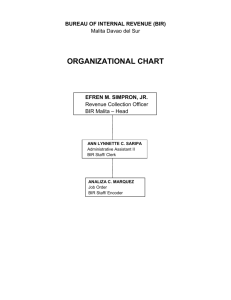

lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S FINANCIAL IMPACT OF THE STRATEGIC PLAN: LONG-RANGE FINANCIAL PLAN AND TAXATION PLANNING In Partial Fulfillment of the Requirements in 1MBA654 Financial Controllership for the 2nd Semester of School Year 2021-2022: by Joshua Laure Shelly Manto Shannen Louisse Palomores Margarette De Sagun Jezalynn Sumilla Mark Anthony Visca Submitted to: Dr. Carmela Perez 1 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S Chapter 10 Financial Impact of the Strategic Plan: Long-Range Financial Plan KEY ELEMENTS OF A STRATEGIC PLAN Strategic planning is a process in which organizational leaders determine their vision for the future as well as identify their goals and objectives for the organization (Pratt, 2016). The following eight (8) elements probably should be included in the business plan presentation: 1. A basic statement by the division general manager or subsidiary president about: o The mission of the center or SBU o The key issues and opportunities critical to its future o The long-range objectives o The basic strategies 2. The long-range plan for each business area, including: o A definition of the products and services to be provided o Principal markets served and the primary customers o Principal competitors in each market, their primary characteristics, strengths, weaknesses, and anticipated strategies, as well as how the operating center expects to compete with them o Key issues of each business area, including the threats and opportunities o Objectives for the business area o Strategies to be pursued o Milestones for each business area that will describe the key steps to be reached, on a scheduled basis, as an indication of progress toward carrying out the strategy and reaching the objective o The most vulnerable or weakest strategies or objectives in the strategic plan, and reasons for this judgment 3. Summarized financial schedules for the SBU or business area and operating center 4. Human resources overview of the operating center—a summary of the plans for growth, retention, productivity improvement, upgrading quality of management, or other key factors, external or internal, relating to this subject 5. Perhaps an information resource management overview of the data processing function for the operating center, including major systems to be acquired, renovated, or developed 6. A facilities overview of the operating center, including the impact of any changing technology, or major subcontract plans, and other significant factors that would impact such matters as sales per square foot of covered area or square foot of covered area per employee 7. An overview of productivity improvement plan for the operating center 8. An overview of any other functional area, such as R&D activity, that is crucial to the success of the SBU or operating center. Such narrative would relate to 2 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S programs, strategies, and objectives, each time-phased. These elements provide some sense of the scope of the strategic plan review, above and beyond the financial aspects. CAPITAL INVESTMENT o o o It refers to any amount of money that a company usually receives to help it achieve and further its business. For plant and equipment planned expenditures, the annual plan usually includes a section on the capital budget. Purposes are described in some detail and a specific cost or expenditure for each identified. In the long-range planning cycle, each strategic plan usually contains only a highly condensed summary of expected plant and equipment expenditures. CAPITAL INVESTMENT – long range planning cycle A plan may identify the estimated expenditure in one of these ways, depending on the relative amount of financial resources needed, and the extent of the analysis or study undertaken to quantify the planned cost: By a single one-figure item for each year of the strategic plan By identifying by plan year the amount of the planned expenditure as to purpose, such as: Expansion (higher sales volume) Diversification (new products) Increased efficiency (e.g., reducing manufacturing costs) Replacement (e.g., worn-out or obsolete equipment) By identifying the expenditures by product line or business unit, such as electronics, telecommunications, or aircraft assemblies, for each of the plan years RISK ANALYSIS The proper assessment of risks that may occur and their probability is important in both plans, but it is especially significant in strategic planning. Some of the risks that might need consideration include: Competitive response. Competitors will have a response to any new product introduction or expansion into a new geographic area. The response may be price cuts, lawsuits, lobbying for government regulation, or other possibilities. Capital cost overruns. Construction projects have been known to exceed budgets. A worst-case scenario could help management anticipate funding requirements. Nationalization of facilities. Some countries have a history of nationalizing certain industries with little or no compensation to the previous owners of expropriated facilities. If management becomes aware of such a problem, then it may wish to relocate its new facilities. 3 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S Ecological costs. Some industries (e.g., the tobacco industry and pharmaceutical companies) have been targets of lawsuits due to products that were later found to be unsafe. In addition, any product or process that has significant chemical waste by-products should be brought to the attention of management, because resulting lawsuits or government fines could destroy any profits from sale of the product. Sales fluctuations. Sales projections are sometimes inaccurate. Management should be aware of the worst- and best-case scenarios. The worst case may result in significant losses to the company, and the best case may require construction of additional production facilities. Raw material scarcity. Some raw materials are in short supply (computer chips) or are tightly controlled by the producer (such as oil). If so, sales projections may fall short due to the inability of the company to produce enough of the product to meet demand. Deterioration of margins. Competing products may come onto the market that will force margins to deteriorate due to price cuts. The company should make some attempt to identify this risk from both national and international competitors and derive a likely range of margin percentage reductions to factor into the long-range plan. Technological advances. Advances in technology may make a product obsolete. Though these advances may be hard to predict, some rudimentary technology can be found in trade literature that will allow the company to forecast a decline in its market. For example, the movie DVD rental market is projected to decline in the face of on-demand movie rentals through cable television companies. NOTE: Proper risk assessment is essential in business planning. Consideration of such exposures can help in building a plan that keeps such risks within an acceptable level. OBJECTIVES OF THE LONG-RANGE FINANCIAL PLAN Comprehend the results of the strategic planning, in financial terms, as to all important factors, including: o Income and expense o Cash sources and uses o Capital (fixed assets) commitments and expenditures Be aware of the significant financial risks or exposures, if any. Be assured that all reasonable financial resources probably will be available as needed, on an acceptable basis, to meet the needs of the company. Recognize that the planned financial position or health of the entity must be continuously maintained in an acceptable manner so as to command respect from 4 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S investors of all types (shareholders, institutional investors, commercial bankers, and others) over the longer term. Have confidence that the terms of any existing or potential credit agreements—bond indentures, commercial bank lending agreements, long-term loan contracts—can be met without endangering the company. Expect that the various approved financial goals can be met, for example, increasing the return on shareholders’ equity, the return on assets, increasing earnings per share, and so forth. CONSOLIDATION AND TESTING PROCESS ILLUSTRATIVE FINANCIAL EXHIBITS IN THE PLAN PRESENTATION The actual exhibits to be presented to the executives will vary from industry to industry and from company to company, depending on, among other things, the critical success factors, past problem areas, and those facets of particular interest to the audience. In any plan, the assumptions often are critical, and management should be advised of the important ones. 5 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S The exhibit shows the trend of those factors that management (and the industry) regard as key to progress. The format is highly condensed as each item later will be discussed in detail by the use of a supporting slide. The exhibit presents a traditional income and expense statement showing net sales and the related major functional costs and can indicate the percentage of sales operating margin and net income ratios. This exhibit relates the individual sales to each other and to the whole. 6 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S The trend of planned sales for five years, compared with the actual company sales of the past year and estimated sales for the current year is illustrated. This exhibit reveals how much firm business has already been contracted for several years in the future, and the relative share of each SBU. These exhibits reflect the trend of consolidated net income, together with the net income of each SBU. 7 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S The Board of Directors and the management, as expected, are interested in the earnings per share and the growth rate. Because plan achievement is never certain, the impact of selected other strategies is quantified. Comparable charts are prepared for cash flow, return on assets, return on shareholders’ equity, and so on. The sources and uses of cash are identified in this highly condensed statement—with no detail by working capital items. 8 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S A condensed statement of planned financial position is presented, and points of compliance (or noncompliance) with the bond indenture requirements, important contracts, or management standards are identified. The trend in total is discussed, and performance by each SBU is reviewed, showing the analysis by the two relevant factors: turnover and percentage return on sales. A key measure of this management is return on shareholders’ equity—the trend as well as the entity’s performance versus competitors. 9 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S ROLE OF THE CONTROLLER IN THE STRATEGIC PLANNING Accordingly, the responsibilities of the controller might be grouped into supportive facilitating functions, and exercise of the primarily financial functions in consolidating and testing the plan from a financial standpoint. To provide financial-type data, together with requested analyses, to the other executives involved in developing the plan, including: Provision of analytical data Assistance in organizing financial data, as needed, for the use of the other executives in their plan presentations Assistance in goal setting Consolidate all plans in financial terms, by year or other appropriate time segment (two years, or quarters, in some instances) for the planning period. Evaluate or appraise the strategic plans as an overall management device against such standards. Judge the planned financial condition including that of any segments against such requirements as credit agreements, merger or acquisition contracts, or indentures, or against selected ratios: debt to equity, current ratio, working capital, and the like. These calculations can be made to test yearly operating results or year-end condition. Measure dividend policy, stock purchase plans, or other financial policies against perceived needs and market requirements, as related to future capital requirements. Evaluate the plan, or any segments, as to reasonableness, weaknesses, attainability, undue optimism, and so forth. Finally, assuming the plan will be met each year, evaluate it in the context of market expectation (analysts), P/E ratio, and so forth. 10 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S TAXATION PLANNING OBJECTIVE OF TAX PLANNING Minimize the amount of cash paid out for taxes. FIVE (5) PRIMARY GOALS TO INCLUDE IN THE TAX PLANNING All of which involve increasing the number of differences between the book and tax records. 1. Accelerate deductions. By recognizing expenses sooner, one can force expenses into the current reporting year that would otherwise be deferred. The primary deduction acceleration involves depreciation, for which a company typically uses MACRS (an accelerated depreciation methodology acceptable for tax reporting purposes), and straight-line depreciation, which results in a higher level of reported earnings for other purposes. 2. Take all available tax credits. A credit results in a permanent reduction in taxes, and so is highly desirable. Unfortunately, credits are increasingly difficult to find, though one might qualify for the research and experimental tax credit, which is available to those companies that have increased their research activities over the previous year. Example: Tax credit certificate as a result of VAT overpayment, BIR Form No. 2307 certificates, etc. 3. Avoid nonallowable expenses. There are a few expenses, most notably meals and entertainment, that are completely or at least partially not allowed for purposes of computing taxable income. A key company strategy is to reduce these types of expenses to the bare minimum, thereby avoiding any lost benefits from nonallowable expenses. 4. Increase tax deferrals. There are a number of situations in which taxes can be shifted into the future, such as payments in stock for acquisitions, or the deferral of revenue received until all related services have been performed. This can shift a large part of the tax liability into the future, where the time value of money results in a smaller present value of the tax liability than otherwise would be the case. 5. Obtain tax-exempt income. The controller should consider investing excess funds in municipal bonds, which are exempt from both federal income taxes and the income taxes of the state in which they were issued. The downside of this approach is that the return on municipal bonds is less than the return on other forms of investment, due to their inherent tax savings. 11 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S OTHER TAXATION AREAS Cash Method of Accounting The normal method for reporting a company’s financial results is the accrual basis of accounting, under which expenses are matched to revenues within a reporting period. However, for tax purposes, it is sometimes possible to report income under the cash method of accounting. Under this approach, revenue is not recognized until payment for invoices is received, while expenses are not recognized until paid. Inventory Valuation It is allowable to value a company’s inventory using one method for book purposes and another for tax purposes, except in the case of the last-in-first-out (LIFO) inventory valuation method. Mergers and Acquisitions A key factor to consider in corporate acquisitions is the determination of what size taxable gain will be incurred by the seller (if any), as well as how the buyer can reduce the tax impact of the transaction in the current and future years. Two (2) ways in which an acquisition can be made: A. Stock acquisition B. Asset acquisition Net Operating Loss Carryforwards Pursuant to Section 4 (bbbb) of Bayanihan II and as implemented under RR No. 252020, the net operating loss of a business or enterprise incurred for the taxable years 2020 and 2021 can be carried over as a deduction from gross income for the next five (5) consecutive taxable years following the year of such loss. Ordinarily, NOLCO can be carried over as deduction from gross income for the next three (3) consecutive years only. Excerpt from BIR Form No. 1702-RT 12 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S Project Costing A company that regularly develops large infrastructure systems such as enterprise resource planning (ERP) systems for its own use MAY separate the various components of each project into different accounts, and expense those that more closely relate to ongoing operational activities. Another approach is to charge subsidiaries for the cost of a development project, especially if the charging entity is in a low-tax region and the subsidiaries are in hightax regions. However, these cost-shifting strategies must be carefully documented with proof that the systems are really being used by subsidiaries, and that the fees charged are reasonable. Property Taxes Local governments use property tax assessments as one of their primary forms of tax receipt. Personal property taxes are assessed based on a company’s level of reported fixed assets in the preceding year, and typically paid once a year. In order to minimize this tax, the accounting department should regularly review the fixed asset list to see which items can be disposed of, thereby shrinking the taxable base of assets. Transfer Pricing The basic concept behind the use of transfer pricing to reduce one’s overall taxes is that a company transfers its products to a division in another country at the lowest possible price if the income tax rate is lower in the other country, or at the highest possible price if the tax rate is higher. By selling to the division at a low price, the company will report a very high profit on the final sale of products in the other country, which is where that income will be taxed at a presumably lower income tax rate. In the Philippine setting, the Bureau of Internal Revenue (BIR) issued Revenue Regulations (RR) No. 34-20201 (the Regulations) providing guidelines and procedures for the submission of a new and simplified BIR Form No. 1709 (the Related Party Transactions (RPT) Form), transfer pricing (TP) documentation and other supporting documents. Safe harbors and materiality thresholds have also been provided. The Regulations became effective on 23 December 2020. The information disclosed in the RPT Form will be used by the BIR for transfer pricing risk assessments, audits and the exchange of information. Consequently, Philippine companies with RPTs should review their transfer pricing positions to ensure that their RPTs are: (i) within the arm’s-length range; (ii) supported by contemporaneously prepared TP documentation and relevan documents; and (iii) properly disclosed in the annual RPT Form and in the Notes to the Financial Statements. 13 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S MANAGEMENT OF THE TAXATION FUNCTION A company with multiple locations will undoubtedly have taxation issues with a variety of government entities, each of which collects taxes under a separate set of rules, forms, and timetables. A better approach is to assign tax liaison responsibility to several members of the accounting staff (or tax staff, if this is a separate group). Example: Outsourcing of tax team, tax compliance review / due diligence review performed by an accounting/law firm- 14 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S UPDATED ARTICLE/S IN RELATION TO TAXATION PLANNING BIR: Better, innovative and revolutionary TOP OF MIND - Zhyrr Andrei A. Barredo - The Philippine Star November 23, 2021 | 12:00am Republic Act 11032 or the “Ease of Doing Business and Efficient Government Service Delivery Act of 2018” was enacted with the goal of improving the efficiency of Philippine government offices and reducing the processing time of transactions. The law essentially mandates the streamlining of systems and procedures of government services in order to build confidence among local and foreign investors to do business in the Philippines. But three years since the law came into existence, it makes one wonder how much government services have actually improved, especially now that everyone has been forced to adapt to a so-called ‘new normal’ because of COVID-19. The pandemic upended normal office routines and caused many of the core notions of work to change. While the concepts of work-from-home arrangements and remote transactions are not new, the focus they have been receiving nowadays is unparalleled. As businesses emerge from the crisis and shift to a hybrid work arrangement, companies are now reconsidering the size, location, and design of their offices. For example, some companies opted not to renew their leases on office spaces as more and more of their employees have been working from the comfort of their homes, rendering the upkeep of extra office spaces cost inefficient. While the idea of transferring offices appears to be a simple process of packing up and moving to a new location, there is more to it than meets the eye. Updating a company’s registered principal office address entails reporting the transfer to various government agencies such as the Securities and Exchange Commission (SEC), the Local Government Unit (LGU), the Bureau of Internal Revenue (BIR), the Social Security System (SSS), the Philippine Health Insurance (PhilHealth), and the Home Development Mutual Fund (HDMF), among others. Unfortunately, government offices and agencies in the Philippines do not share a single database of information on the thousands of businesses set up in the country. Hence, companies must prepare different sets of documentary requirements for each government office. This, of course, entails physically appearing before each of the offices – from SEC in Pasay City to the various Revenue District Offices (RDO) of the BIR throughout the country. Our generation is inundated with information technology and advancements that allow us to communicate and transact beyond borders and remotely even. And now, more than ever, we are witnessing the unprecedented development and emergence of various online tools and platforms that make communication and interaction possible regardless of physical distance. Despite the advancements in technology, the government sector still finds itself lagging behind the private sector when it comes to providing efficient digital services. 15 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S Although a number of government agencies, in compliance with the Ease of Doing Business Act, have implemented the use of electronic tools and systems to ensure new and easy ways of doing business amidst the pandemic, such as the SEC, which has finally implemented online registration and online submission of reportorial requirements via the Electronic Simplified Processing of Application for Registration of Company (SEC – ESPARC) and the Online Submission Tool (OST), it bears stressing that the status quo remains – most government offices still conduct business manually. Transferring from one BIR RDO to another, for example, still requires physical submission of the same set of documents required for initial registration (i.e., SEC documents); not to mention, the original BIR documents, including, but not limited to the old Certificate of Registration and unused invoices and receipts, still have to be surrendered to the previous RDO unless the company requests permission from the BIR to retain the use of old booklets of invoices and/or receipts until a new Authority to Print (ATP) is issued by the new RDO. The company will also need to manually fill out BIR Form No. 1905 and comply with open cases, which more often than not, are filed returns that did not show up in the BIR’s system. The company will then need to provide hard copies of those filed returns to show proof of compliance. From de-registration with the old RDO to registration with the new RDO, the whole transfer takes a month or so to complete. If only the BIR, within its organization, had a single database of all taxpayers’ registration information regardless of location, perhaps most processes would be less burdensome for taxpayers. But such is not the case. At least for now. With the SEC recently implementing the use of electronic platforms, one cannot help but wonder – ”When will other government offices and agencies follow suit?” The BIR issued Revenue Memorandum Order (RMO) 27-2020, otherwise known as the “BIR Digital Transformation (DX) Roadmap 2020-2030” in 2020. Under this RMO, business-related transactions with the BIR shall be automated through the development of accessible, webbased software and technology-neutral platforms in collaboration with the Department of Information and Communications Technology (DICT). While promising, we have yet to fully experience the BIR’s digital transformation. While the 2020 Doing Business Report of the World Bank shows that the Philippines now ranks 95th out of 190 economies, from 124th in 2019, we still have so much more to improve on to catch up with neighboring countries such as Singapore. It is about time for us to use technology to our advantage and to up our game. Otherwise, companies might pack up and switch addresses, not just from one Philippine city to another, but out of the country. Companies put in money in the Philippine economy, the least we can do is to put in place a better, innovative, and revolutionary mechanism that ensures them of smooth and efficient registration, reportorial, and compliance measures to foster their confidence in doing business in the Philippines. Zhyrr Andrei A. Barredo is a tax analyst from the tax group of KPMG R.G. Manabat & Co. (KPMG RGM&Co.), the Philippine member firm of KPMG International. KPMG RGM&Co. has been recognized as a Tier 1 tax practice and Tier 1 transfer pricing practice by the International Tax Review. This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity. 16 lOMoARcPSD|14255897 P O LY T E C H N I C U N I V E R S I T Y O F T H E P H I L I P P I N E S The views and opinions expressed herein are those of the author and do not necessarily represent the views and opinions of KPMG International or KPMG RGM&Co. For comments or inquiries, please email ph-fmmarkets@kpmg.com Source: Barredo, Z. A. (2021, November 23). Philstar Global. Retrieved from Philstar: https://www.philstar.com/business/2021/11/23/2143105/bir-better-innovative-andrevolutionary 17