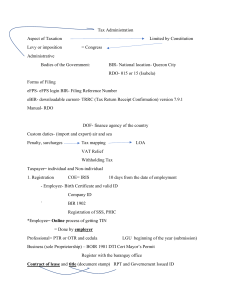

Taxation Law: any law that arises from the exercise of the taxation power of the state. Types of Taxation laws: 1. Tax Laws: for assessment and collection of taxes. Examples: National Internal Revenue Code. Tariff and Customs Code. Local Tax Code. 2. Tax Exemption Laws: grant certain immunity from taxation power. Example: Minimum Wage Law, BMBE Law, Cooperative Development Act. III. Revenue Memorandum rulings Rulings and interpretations of the CIR to the provisions of the Tax Code and other tax laws as applied to specific set of facts, with or w/o precedents The CIR may issue this rulings to provide taxpayers guidance on the tax consequences in specific situations. Note: BIR Rulings cannot contravene duly issued RMRS. IV. Revenue Memorandum circulars issuances that publish pertinent and applicable portions, as well as amplifications, of laws, rules, regulations and precedents issued by the BIR and other agencies/offices Revenue bulletins Periodic issuances, notices and announcements of the CIR that consolidate the BIR’s position on certain specific issues of law in relation to the provision of the tax code, relevant tax laws, and other issuances for the guidance of the public. Sources of Taxation Law I. Constitution II. Statutes and Presidential Decrees III. Judicial Decisions or case laws IV. Executive Orders and Batas Pambansa V. Administrative Issuances VI. Local Ordinances VII. Tax Treaties and Conventions with Foreign Countries VIII. Revenue Regulations Types of Administrative Issuances I. Revenue Regulations Issuances signed by the Secretary of Finance upon recommendation of the Commissioner of Internal Revenue. Specify and define the rules and regulations for the effective enforcement of the provisions of the NIRC and related statutes. Formal pronouncements to clarify the law and carry into effect its general provisions by providing details of administration and procedure. It has the force and effect of a law, but not intended to expand or limit the application of the law. II. Revenue Memorandum orders Provide directives and instructions, guidelines and outline processes, operations and procedures necessary in the implementation of stated policies, goals, objectives, plans and program of Bureau in all areas of operations except auditing. V. VI. BIR Rulings BIR Rulings are the official position of the Bureau to queries raised by taxpayers and other stakeholders relative to clarification and interpretation of tax laws. Note: Rulings are merely advisory or information service to the taxpayers, none of them is binding except to the addressee and may be reversed by the BIR at any time. Types of Rulings a. VAT rulings b. International