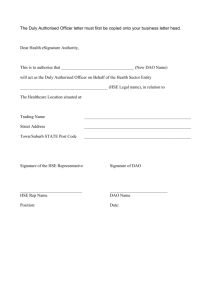

MINERVA An NFT Marketplace for Appreciating Assets. Draft - Sep 2021 Abstract Minerva is a DAO platform which will bring real-world utility to the NFT marketplace, built on the Terra blockchain. The DAO will select, verify and insure providers of appreciating assets, who will be authorised to mint NFTs as proof of sale. Minerva will allow users to use their NFTs as collateral, earning yield on wine, watches, vintage cars and more. When users wish to collect their assets in physical form, the NFT will be burned after proof of delivery and yield will be retained by users. From the outset Minerva will have charitable giving at its core, with membership in the Terra Charity Alliance and a proactive giving strategy. 1. Platform Overview This document will refer to two central parties who utilise the Minerva platform. A ‘provider’ refers to any individual or company who is able to sell appreciating assets. A ‘User’ refers to any individual purchasing assets. The primary purpose of the Minerva DAO is to facilitate the sale of appreciating assets in a safe, reliable and transparent manner. The first step in achieving this is by utilising trustworthy agents who will instigate the initial sale of assets and hold them in safekeeping until NFTs are burned and redeemed in their non-digital form. Providers All providers for assets on Minerva will apply for verification to the DAO. A model application will include videos of storage facilities, proof of assets, interview / Q&A opportunity and consent for routine inspections from DAO members if necessary. Providers may be working within already-established companies (e.g. wine merchants) or be independent bodies seeking to support the DAO. Providers may also apply for verification with certain guarantees in place, for example time-stamped photos/videos of assets to users on a monthly basis. Users Users who purchase NFTs as proof of sale on Minerva should expect regular updates on their asset, including dated proof of security. Assets as collateral Users will be able to use their assets as collateral on Talis Protocol, borrowing UST on the established value of their asset. This UST could then be invested in any means, enabling an appreciating asset to have another way to provide financial opportunities. Redeeming of assets in physical form Users who choose to collect their asset in physical form must commit to burning the NFT in order to do so. Some users may be concerned about reliability of providers post-sale. Here the smart-contract vault system will ensure that both providers and users are incentivised to complete the process (See below). Delivery costs will be covered by Users, and agreed through a dated fee information sheet by providers. Delivery costs will be broken down by continent, with local sales preferential for environmental considerations. Local (in-country) sales may be incentivised by providers through additional NFT allocations. Guarantee of Delivery When an NFT asset sale occurs, 40% of UST will immediately be available to the provider. The remaining 60% will be converted to aUST and locked in a Minerva vault. On completion of the sale and confirmation of delivery by user, this 60% will be released to providers. The 60% of sale fee will accrue yield in the time between minting and burning of the asset NFT. This yield will be split into four avenues: 1. 40% to the Terra Charity Alliance. 2. 25% to provider. 3. 25% to user. 4. 10% to TORCH token buybacks. The Minerva Vault system will incentivise both providers and users to complete sales, while facilitating a system of charitable giving within the central sale process. Community Pages The intention is for Minerva to become a place of knowledge and insight on appreciating assets. Users will be encouraged to contribute research and thoughts on wines, watches, cars, antiques and more. These insights will be incentivised and rewarded through community bounty programmes, as initiated and selected by DAO governance. The TORCH token will be a means of incentivising this. 2. TORCH Token The TORCH token will hold four functions on the Minerva DAO: 1. Governance. Including verification of all providers on the platform 2. Liquidity Provision. TORCH-UST Pools in place prior to initial NFT sales 3. Contingency Fund. Insurance option available utilising TORCH against damage to assets while held by DAO providers. 4. Community Incentives. TORCH bounties rewarded by DAO to users who produce insightful content. Token Plan ● Token plan is to be developed and confirmed further. ● There is no plan to seek investors, but rather to gain funding for development through an initial Phase 1 public token sale. ● Each individual drawing team tokens will require approval from the DAO every 2 years DAO Structure Minerva will be a decentralised platform from the outset, guided by the following principles: ● No central authority. All team members must seek DAO approval on a bi-annual basis ● No Investor pre-sale. Token sale will be launched on concept. Initial developement will be conducted with DAO oversight. ● No provider pre-selection. All providers must be selected and approved by community vote. ● Transparency throughout. Clear transparency with named team members, labeled and accessible team/community wallets from outset. 3. Minerva Roadmap (Draft) Q4 2021 Q1 2022 ● ● ● ● ● Initial token sale. Platform development. Initial provider verification - Wines. Bootstrapped liquidity pools ● Platform Launch for NFT sales, limited to Wines only. Limited launch with 10 providers. Begin provider verification - Watches, in anticipation of Q2 sales. Q2 2022 and beyond ● ● Launch of vintage watch NFT marketplace. Begin provider verification - Vintage Cars, in anticipation of Q3 sales.