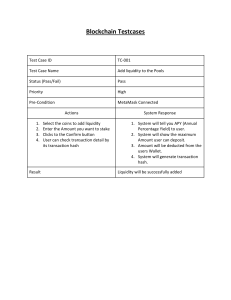

Content 2 3 4 5 6 7 9 10 11 14 16 17 19 20 21 22 23 24 24 25 26 27 29 29 29 30 31 32 33 34 35 36 37 38 38 39 40 40 41 42 44 45 46 What is an NFT: How do NFTs work: What Is a Cryptocurrency Public Ledger: What is the meaning of this new “Trend”: But I can make a screenshot of these pixelated drawings… Is the BOOM of NFTs over: What does it mean to Mint an NFT: How do you mint an NFT? NFT Royalties: What Are They and How Do They Work: How do NFT royalties work: Who gains from a NFT royalty: Why use NFT royalties: How to buy NFTs: Where to buy NFTs: What is a crypto wallet? How to make an NFT How to sell NFTs How to sell an NFT you bought How to sell an NFT you minted What are gas fees: Why Are Ethereum Gas Prices So Expensive: There are two types of fees: How do I store an NFT I own: What is an NFT Wallet and why do you need it: Best crypto wallets of 2021 according to Yahoo money: Making money from NFTs: What is Staking NFTs: Invest in NFT startups: NFT gaming: Ask a friend: What Are Some Examples of High-Profile NFT Sales: Can you buy digital assets like land and space + how: How does Decentraland work: The content layer Marketplace and Builder: Can you buy weird digital creatures and make a living: What is Axie Infinity: How to earn money in Axie Infinity: How to earn Smooth Love Potions (SLP)?: How to start playing Axie Infinity: Where to find an Axie Infinity scholarship What Is the Future of NFTs: Sources: What is an NFT: NFT stands for: Non-fungible token. “Non-fungible” means that it’s unique and can’t be replaced with something else. For example, a Bitcoin or an Ethereum are fungible — trade one for another Bitcoin or Ethereum, and you’ll have exactly the same thing. A one-of-a-kind trading card, however, is non-fungible. If you traded it for a different card, you’d have something completely different. It’s a digital asset that can represent real-world objects, such as art, domain names, virtual experiences, videos, music, or any type of digital file that can be traded online. 2 How do NFTs work: At a very high level, most NFTs are part of the Ethereum blockchain. Ethereum is a cryptocurrency, like bitcoin or dogecoin, but its blockchain also supports these NFTs, which store extra information that makes them work differently from, say, an ETH coin. It is worth noting that other blockchains can implement their own versions of NFTs. The Ethereum blockchain is a decentralised public ledger that stores and verifies details regarding a transaction. When you purchase an NFT you can keep track of who has owned it through the blockchain. When you create an NFT the blockchain provides a certificate of uniqueness specifically for that NFT and non-transferability. Which maintains creator originality and value of uniqueness. 3 What Is a Cryptocurrency Public Ledger: A public ledger derives its name from the age-old record-keeping system used to record information, such as agricultural commodity prices, news, and analysis. The public ledger was available for general public viewing as well as for verification. As cryptocurrency-based blockchain systems emerged, which rely on a similar record-keeping and public verification mechanism, the use of the public ledger gained popularity in the world of cryptocurrency. 4 What is the meaning of this new “Trend”: NFTs can really be anything digital, but a lot of the current excitement is around using the tech to sell digital art. But let us remind you that CSGO skins were basically the first NFTs long before we knew about the term NFT. The “new” hype is just evolution of the digital assets, we use more and more every single day. The meaning behind this is like owning an expensive physical art, but in the digital world. One word: significance. 5 But I can make a screenshot of these pixelated drawings… You can copy a digital file as many times as you want, including the art that’s included with an NFT. But NFTs are designed to give you something that can’t be copied: ownership of the work (though the artist can still retain the copyright and reproduction rights, just like with physical artwork). To put it in terms of physical art collecting: anyone can buy a Mona Lisa print. But only one person can own the original. 6 Is the BOOM of NFTs over: The NFT space is booming like never before, but experts say there are 5 challenges the digital collectibles space still needs to overcome: 1. Authenticity: There are currently limited tools to determine the authenticity of NFTs despite the difficulty in altering one, said Anthony Georgiades, president and COO of Pastel, an NFT marketplace. His company uses tools that authenticate NFTs by scouring not only its own marketplace but others as well. Further guarantees of authenticity are important for collectors, especially in crypto markets where scams are common. 2. Scalability: The majority of NFT marketplaces are currently powered by general Layer-1 blockchains, like ethereum. In order to support NFT-specific features in a highly scalable manner, a purpose-built network is preferred, said Georgiades. Scalability, he said, is among the biggest drawbacks in the mainstream adoption of NFTs. 3. Interoperability: While most NFTs are on the ethereum blockchain, others can host them as well, such as binance smart chain and flow. This could be a problem 7 because NFTs being in different cities" won't allow them to share scalability, security, and messaging, '' said Hugo McDonaugh, co-founder of Cryptograph, an NFT auction platform. He says this is why he is helping develop the polkadot network, which he referred to as the "road between all these cities." 4. Storage: Acquiring an NFT is one thing, but storage of the underlying data is not so trivial. Most NFTs simply have external hyperlinks pointing at centralized cloud storage solutions such as Google Cloud and Amazon Web Services. Doing so poses a lot of risks, said Georgiades, and leaves any creator or owner highly vulnerable to the loss of assets, which could just vanish, change, or go offline without the owners' control. IPFS, a peer-to-peer storage system, he said is gaining traction but may be unwieldy as it requires individual holders to maintain nodes across the world. 5. Accessibility: More and more investors may be gaining awareness of what NFTs are but the barrier to participate is still relatively high, said McDonaugh. What will lower the barrier, he said, is a secondary marketplace where all currencies and all assets from all "cities" are accepted when buying and selling. 8 What does it mean to Mint an NFT: Minting an NFT is how your digital art becomes a part of the Ethereum blockchain–a public ledger that is unchangeable and tamper-proof. Similar to the way that metal coins are minted and added into circulation, NFTs are also tokens that get “minted” once they are created. Your digital artwork is represented as an NFT so it can then be purchased and traded in the market and digitally tracked as it is resold or collected again in the future. 9 How do you mint an NFT? It is quite easy to create an NFT on Ethereum. All you need is an Ethereum wallet that supports NFTs and an account on an Ethereum-focused NFT marketplace. Some examples of wallets that are compatible with NFTs are Metamask, Trust Wallet, and Coinbase. 10 NFT Royalties: What Are They and How Do They Work: With NFTs in the limelight, artists and content creators are finding that these tokens can be very beneficial for them, even after they have sold their NFT. This aspect is particularly interesting, they’re called NFT royalties. If you are new to non-fungible tokens, you may be wondering exactly what NFT royalties are. After minting multiple NFTs, I’ve developed a good sense of what NFT royalties are and how they work. NFT royalties give you a percentage of the sale price each time your NFT creation is sold on a marketplace. NFT royalty payments are perpetual and are executed by smart contracts automatically. With most marketplaces you can choose your royalty percentage. 5-10% is considered a standard royalty. There are many differences between NFTs and other traditional royalty payments. The NFT royalties are automatic payouts to the author made on secondary sales. These are coded into the smart contract on the blockchain. Each time a secondary sale happens, the smart contract ensures that the terms of the NFT are fulfilled. 11 If a royalty is specified, a cut of the profits goes to the artist who created them. There are no intermediaries needed nor does this depend upon the wishes of whoever is transacting them. Please do note that, not all NFTs yield royalties. It has to be specifically written into the terms. Once the smart contract terms are clearly written into the blockchain, the rest is taken care off automatically. This works equally well for digital content, gaming accessories, physical items etc. NFT royalties are a never-before-opportunity to maximize the earnings of artists and content creators. Artists have the benefit of getting returns for something they produced once on a recurring basis. Also as their popularity grows they end up getting increasing returns on their work. This is an unbeatable proposition that NFT offers. A lot of digital artists and content creators are motivated by this and hence are rushing to join the NFT bandwagon. The royalty systems can differ from marketplace to marketplace. Newer marketplaces like Bluebox are coming up with alternate ways in which content creators can further benefit. Traditionally after the first sale, the artist or creator did not have a way to track the subsequent transactions of their work. Once they had sold their work that’s all their earning would be from that piece of work. 12 Regardless of how their fame has increased over the years, they do not stand to gain anything from the works previously sold. That was simply not how the system worked! The buyers of their work on the other hand can turn around and sell the same work at enormously high prices if they wait for the right time. This led to the artists not benefitting even a penny from subsequent sales no matter how high a price it commands. Hence the common concept of artists as impoverished or starving artists. NFTs have brought in the opportunities to change this completely. Artists can have their fair share of the sales from their creations for perpetuity. 13 How do NFT royalties work: A percentage of the secondary sales amount can be allotted as royalty and the creator can determine this amount at the time of minting the work. Once minted, your NFT will earn you the percentage you chose, on all future sales of your non-fungible token. While not all marketplaces are geared towards offering royalties, ones like Rarible let you enter royalties when minting your NFT. Imagine that you have created an NFT artwork on Rarible. A fan of your art, buys the artwork for say 8 ETH. So you have made 8 ETH (Ether). You also have coded into the NFT the term that anytime a sale occurs you will get 10% of the proceeds. Now your buyer auctions your art for an even higher price in the marketplace. Presumably, your reputation has grown and hence the value of your work has gone up as well. Imagine that your buyer sells it for 200ETH. Since you have already precoded a 10% royalty into the NFT, you will receive 20 ETH from this sale. Again the new owner might sell it at an even higher price and you get a 10% out of the new sale price again. Thus you will receive a recurring income from your 14 creations. So with NFT royalty you stand to gain from every sale of your work for as long as it keeps selling. It is certainly an awesome system! No more impoverished artists or content creators. No more fakes and replicas flooding the market. Even if there are fakes it becomes easy to identify the original. All this is possible because of the blockchain technology. It is also sometimes referred to as the Distributed Ledger Technology or DLT. Blockchain technology is basically an unalterable and transparent ledger that is decentralized. This type of ledger preserves the integrity and the authenticity of the work. It also has automated protocols to ensure that whenever conditions specified in the smart contract are fulfilled it takes the necessary action. It can complete its action without the need of an external agent or any intermediary. The blockchain technology and smart contract work together to ensure that the author is identified and the royalty payments are made immediately after the transaction is over. This removes any chance of the artist or author being cheated out of their royalties. There is no risk of fraud or fake work being circulated. People who create can have complete trust that they will be getting their rewards. These rewards are not from any person or a patron, but directly from the action of the blockchain. 15 Who gains from a NFT royalty: Musicians creators, content creators and artists of all kinds stand to gain from NFTs royalties. The buyer also stands to gain as they are able to verify the authenticity of what they are buying. This enables them to proudly display their assets as well as resell them at an assured price. It’s a win-win! Electronic musician Jaques Green had his track from 2011 netting around $27,000 in royalties. Mike Winkelmann, who made news by selling his artwork for a huge sum of money; has programmed his NFT to issue 10% royalty from each subsequent sale. Steve Aoki, Ozuna, Kings of Leon etc. are artists who are actively taking advantage of the new technology to generate sales and subsequent royalties. As you can see, it can be a substantial source of revenue for the creator and buyer alike. 16 Why use NFT royalties: NFT royalties are an easy and hassle free way to keep earning from your hard work. NFT royalties are an excellent opportunity that artists, game developers and content creators are able to tap into profits from secondary sales, which was never available to them previously in such a manner. NFTs are a way of democratizing the payments made. Now an artist can get paid as easily as a sports superstar based on their popularity. It is only fair that they also benefit from secondary sales of their work. Another cool thing about NFTs is that the token can be sold but the underlying copyrights remain with the creators. The creators can now even sell a percentage of their rights to others as well. The new owners can also tap into the royalties earned for the NFTs due to the rights they now own. Not all marketplaces allow this but recently launched platform Bluebox is an example. Some aspects of caution do exist as potential cases of intellectual property are yet to be clearly formulated on such transactions. The tax consequences also have to be considered as those royalties and proceeds that come in will have to be handled as capital gains in most cases. It is 17 increasingly likely that NFTs would become estate assets and transfer of these assets including royalty through wills, trusts and legal instruments have to be carefully sorted out. Tapping into NFT royalties is an excellent way for artists and creators to have their work yield substantial profit, even into the future when they are no longer in possession of their token. Tokenizing assets allow for earning in secondary sales and also share the royalties with those wanting to invest in the rights. The age-old practice which allows intermediaries and businesses to profit while the artist remains impoverished has been eradicated. The freedom and the opportunity offered by NFTs can be applied to physical goods as well so that all artists and creators (not just digital ones) can benefit from their work. This makes it possible for artists and creators in general to sustain and continue producing quality work and getting what they deserve, as long as their NFT is being sold. 18 How to buy NFTs: If you’ve ever used eBay, then you will have an idea of how buying NFTs works. Most NFT marketplaces function like an auction house. You place a bid, and wait to see if you win your chosen NFT. Like eBay, some sites also have ‘Buy Now’ options, where NFTs are sold for a fixed price. Another major thing to note about NFT marketplaces is that prices are usually listed in decimals of ether (though are often accompanied by the dollar value as well). This dollar value can change frequently due to the volatility of the cryptocurrency trading price at any given time. This is because almost all NFT marketplaces require you to purchase their non-fungible tokens using ether, the currency of the Ethereum blockchain that most NFTs are a part of. You do this by using a cryptocurrency wallet that contains ether you have previously purchased. Each transaction is subject to a fluctuating ‘gas fee’. This is money that goes to the ‘miners’ providing the computing power for the Ethereum blockchain. 19 Where to buy NFTs: There are a number of different NFT marketplaces catering to different needs. Some list a variety of tokens, from art and music to trading cards and domain names, while others only sell niche branded collectibles, like the one for North American basketball league, NBA Top Shot or Pokemon-inspired online video game, Axie Infinity. Common NFT marketplaces include OpenSea.io, SuperRare, Foundation.app, Rarible and Mintable. What you should be aware of is that each marketplace has specific crypto wallet requirements. At present, there is no one wallet that is usable on all the sites. The most regularly accepted crypto wallet is MetaMask, while others include Formatic, Coinbase Wallet, Torus and Portis. 20 What is a crypto wallet? A cryptocurrency wallet allows you to send, receive and store digital assets, like NFTs, and cryptocurrencies, including ether. There are many different types of wallet and they all have different features. The wallet could be built into your web browser, a browser extension itself, or an app on your phone. Crypto wallets can even be a piece of hardware plugged into your computer. 21 How to make an NFT If you want to make, or ‘mint’, an NFT, then all you really need is the image, video or music file you want to upload, and a pre-funded crypto wallet usable with your chosen blockchain (likely Ethereum). Then you can pick from many of the same sites you would buy an NFT from, like OpenSea.io or Mintable.com, and go create your own. These marketplaces each have a slightly different way of doing things, but it tends to be as simple as clicking the ‘Create’ button on the site and following the instructions. This will include uploading the file, choosing whether you want to mint single or multiple NFTs, and selecting the sale price and type. You may also be subject to gas fees when minting your NFT, but these can differ from platform to platform. 22 How to sell NFTs There are two ways of selling NFTs - trading an NFT you have already bought, and selling an NFT you have minted. And again, like with minting an NFT, there will be fees attached to selling your non-fungible token. This will not only include gas fees, but final sale service fees dictated by the marketplace 23 How to sell NFTs There are two ways of selling NFTs - trading an NFT you have already bought, and selling an NFT you have minted. And again, like with minting an NFT, there will be fees attached to selling your non-fungible token. This will not only include gas fees, but final sale service fees dictated by the marketplace. How to sell an NFT you bought You can resell NFTs on the secondary market, just like anything else you would own. To do so, make sure the NFT in question is in the crypto wallet paired with your marketplace of choice, and put it up for sale. While your NFT could sell for more money than you originally bought it for, the long-term or even short-term value of NFTs is not guaranteed. How to sell an NFT you minted This will likely be the end point of the creation, or minting, process on whatever platform you are using, as explained above. Depending on the service, you will either set the ‘Buy Now’ price, or dictate the terms of the auction, namely the reserve price. In some cases you can even receive royalties every time your NFT is sold in the future. 24 What are gas fees: “Gas fees'' are the transaction fees that users pay to miners on a blockchain protocol to have their transaction included in the block. The system works on a standard supply and demand mechanism. If there is more demand for transactions, miners can choose to include the transactions that pay more, compelling users to pay more to have their transactions processed quickly and efficiently. Users of Ethereum can also choose to pay more for faster transactions, as seen in the diagram below. Wallets like MetaMask enable users to interact directly with the Ethereum network, choosing which amount of gas they wish to pay. There are several websites where you can track gas prices, like ethgastation.info or ethereumprice.org. 25 Why are Ethereum Gas Prices so expensive: Gas fees can be high because Ethereum is one of most used blockchains — there is so much movement in the Ethereum chain that the blocks are full and transaction fees shoot up with each rise in demand. Ethereum gas fees are not always astronomical, but they have spiked to incredibly high levels during peak periods in the past such as the 2017 ICO boom and the DeFi summer of 2020, both times where the value of Ethereum and the number of projects in the space skyrocketed, bringing congestion to the Ethereum network. In many instances, Ethereum gas fees can be outrageous for most use cases. However, rising gas fees does demonstrate that there are real use cases for Ethereum and the decentralized applications (DApps) are built on top of it. If we manage to scale Ethereum, making it process more transactions and at a lower cost, new business models will emerge. One of the most successful use cases of a blockchain network so far is the aforementioned decentralized finance (DeFi) ecosystem. 26 There are two types of fees: One-time fees: The first time you trade on a platform like OpenSea you’ll have to pay an account registration fee or an account initialisation fee before you can begin listing on Ethereum. After you pay this fee you be allowed to trade between your wallet and OpenSea as well as transfer NFTs when a sale occurs - The first time you use any cryptocurrency for the first time, you’ll need to pay an approval fee - The first time you list an auction you’ll also need to pay a one-time fee to approve WETH for trading - Contract approval, if the NFT you’re listing was minted through a custom NFT contract you’ll need to pay an approval fee that authorised transactions. Recurring fees: This fee occurs on Ethereum every time you: 1. 2. 3. 4. 5. 6. 7. 27 Accept an offer; Transfer an NFT; Purchase an NFT; Delete a listed NFT; Cancel a bid; Convert cryptocurrencies; Freezing your metadata, means your item will be safely stored forever. This is where you permanently lock and store it on decentralised file storage allowing data such as item name, media, description, properties, levels, and stats to be accessible for others to view Gas-free - Minting a new NFT, due to the “collection manager” you are able to create NFTs for free! - Opening a collection - Listing an NFT as fixed price & auction - Reduce the price of an NFT you’ve listed. 28 How do I store an NFT I own: NFTs should be stored in a secure location such as your software crypto-wallet which is generally protected by your 12-word seed phrase, a password and touch authentication. For the best security, consider storing your NFTs in a cold storage hardware wallet. What is an NFT Wallet and why do you need it: NFT wallets are digital wallets that help you store NFTs and cryptocurrencies in one place. The wallets help you in receiving additional assets alongside purchasing things with the assets in your ownership. Best crypto wallets of 2021 according to Yahoo money: 1. 2. 3. 4. 5. 29 Electrum – Best for Bitcoin Coinbase – Best for Beginners Mycelium – Best for Mobile Ledger Nano X – Best Offline Crypto Wallet Exodus – Best for Desktop Making money from What is Staking NFTs: In crypto, staking refers to storing digital assets in the form of a ‘stake’ and assigning them to those willing to maintain their upkeep. In return, they give you a share of the reward. You can stake your NFTs to earn rewards and incentives on various sites — one of them being Rplanet. 31 Invest in NFT startups: A good way to indirectly make money with non-fungible tokens is through investing in startups. If there’s one thing that NFTs have proven is that they’re not a quick-passing crypto trend. They’ve numerous applications in various industries that can change the world. There’re so many promising NFTs startups that are showcasing great innovations in the crypto world. It’d be impressive if you can invest in them as they make their first steps into a revolutionary future. As the big fish continue pouring more money into NFTs, they’re becoming more mainstream. At the moment, gaming, trading collectibles, and creating NFTs might be setting the pace but there’ll be more ways in which you can make money through them. Just like in any other investments, there are some risks. Remember to research widely and invest wisely. 32 NFT gaming: We’re living in fun times where you can play to earn. Blockchain-based games allow you to purchase in-game items as NFTs and trade them. Already, they’re some highly valued collectibles in the market today such as in the game CryptoKitties. A single crypto kitty has fetched more than $300,000. More games are recently launching with more affordable NFTs. Some are even giving out their collectibles for free for its first couple of players. 33 Ask a friend: A quick way to make money from NFTs without having artworks. Just ask a friend of yours if he/she has some design works and start selling them on websites like Opensea. Then set a deal to split the profit. Find many artists and create an empire. This is the same model like production companies use to multiply their effort. Many artists create content under the big name of company X. 34 What are some examples of High-Profile NFT Sales: One of the first NFT sales to make the news was Twitter CEO Jack Dorsey selling his first ever tweet as an NFT. With the proceeds going towards charity, it ended up going for $2,500,000. The most expensive NFT sale happened at Christie’s auction house. It was the famed house’s dive into blockchain auctions. The image was a large JPEG file with 5,000 unique pictures the graphic designer had taken. Though he wasn’t particularly famous, it sold for just shy of $70,000,000. Part of the reason it sold so well was because it was also the first-ever public auction of an NFT. However, NFTs are still novel enough that “unicorn” sales like this still happen. NFT 35 Can you buy digital assets like land and space + how: You can buy digital assets like land, space and so on on platforms like Decentraland. Decentraland is a software running on Ethereum that seeks to incentivize a global network of users to operate a shared virtual world. Decentraland users can buy and sell digital real estate, while exploring, interacting and playing games within this virtual world. Over time, the platform has evolved to implement interactive apps, in-world payments and peer-to-peer communication for users. Two different types of tokens govern operations in Decentraland. These are: LAND – A non-fungible token (NFT) used to define the ownership of land parcels representing digital real estate. MANA – A cryptocurrency that facilitates purchases of LAND, as well as virtual goods and services used in Decentraland. Changes to the Decentraland software are enacted through a collection of blockchain-based smart contracts, which allow participants who own MANA to vote on policy updates, land auctions and subsidies for new developments. 36 How does Decentraland work: The Decentraland application is built to track real estate parcels defined by LAND tokens. The software leverages the Ethereum blockchain to track ownership of this digital land, and it requires users to hold its MANA token within an Ethereum wallet to engage with its ecosystem. Further, developers are free to innovate within Decentraland’s platform by designing the animation and interactions experienced on their virtual real estate. Architecture: Decentraland has many layered components built using Ethereum smart contracts. The consensus layer maintains a ledger that tracks the ownership of land parcels. Each parcel of LAND has a unique coordinate in the virtual world, an owner and a reference to a description file representing the content within the parcel. 37 The content layer controls what happens within each parcel, and includes various files required to render them: 1. Content Files – referencing all static audio and visuals 2. Script Files – defining the placement and behavior of the referenced content 3. Interaction Definition – peer-to-peer interactions such as gesturing, voice chat, and messaging. Finally, the real-time layer facilitates social interactions within Decentraland through user avatars, including voice chat and messaging. Marketplace and Builder: Outside of the gaming environment, the Decentraland team has released a marketplace along with a drag-and-drop editor users can access to build scenes. The marketplace enables participants to manage and exchange LAND tokens, priced in MANA. Owners can use the marketplace to transact or transfer parcels and other in-game items such as wearables and unique names. Of note, all transactions are settled between Ethereum wallets, and therefore are verified by Ethereum’s network and logged on its blockchain. 38 Decentraland’s builder tools authorize owners to curate a unique experience within their LAND parcels. Interactive scenes are designed through its editing tool, where developers can access customization libraries and payment implementations. Can you buy weird digital creatures and make a living: Yes, you can do this too. The platform/game is called Axie Infinity. Play-To-Earn Is The New Economy Of Video Gaming. Axie Infinity is currently the number one blockchain game where players earn rewards in a form of cryptocurrency tokens, which can then be exchanged for real money. This is also known as "play-to-earn" in the gaming industry. This sounds too good to be true and you must be wondering how is it possible that I can earn money by playing a game? 39 What is Axie Infinity: Axie Infinity was created by Vietnamese gaming startup Sky Mavis. It uses two Ethereum-based cryptocurrencies which are Axie Infinity Shards (AXS) and Smooth Love Potion (SLP). It is inspired by Pokemon where players collect digital pets known as Axies, which can be bred, raised, battled, and traded in the Axie ecosystem. The game is designed to provide a fun, accessible, and educational way to learn about blockchain technology. How to earn money in Axie Infinity: There are few ways you can earn from Axie Infinity: 1. Farming SLP and selling them for real money 2. Breeding and selling Axies 3. Starting your own scholarship 4. Investing in Lunacia Land 5. Trading SLP and AXS The game is still in the alpha stage and there will be more features added to it. 40 How to earn Smooth Love Potions (SLP)?: Most players are earning in Axie Infinity by farming Smooth Love Potion (SLP). SLP is important in the Axie ecosystem. It is high in demand because they are required to breed new Axies. SLPs can also be traded or sold on exchanges according to the current market price of SLP. Currently, there are three ways to earn SLP in Axie Infinity: 1. Battle monsters in Adventure Mode (PvE) 2. Battle other players in the Arena (PvP) 3. Complete daily quests by checking in once a day and completing tasks 41 How to start playing Axie Infinity: Step 1: Buy Ethereum (ETH) First, you need some Ethereum to buy Axies. You can get it from cryptocurrency exchanges offering Ethereum such as Huobi, Coinbase, Crypto.com and Binance. Set up an account with the preferred exchange and verify your identity. You will need to provide your address, identification number and a photo of your driver's license or passport. Once your account is verified, you can fund your account with fiat currency or any other cryptocurrency supported by the exchange. Look for a trading pair with Ethereum and the asset you funded the account with and complete your order. Step 2: Send ETH to MetaMask Next, you will need a MetaMask wallet to interact with the Axie Infinity marketplace. MetaMask is available on iOS, Android and as a browser extension on Google Chrome. 42 Step 3: Send ETH to Ronin The Ronin Wallet was built by Sky Mavis to speed up transactions and reduce fees for Axie Infinity. Ensure you download the Ronin Wallet from Sky Mavis's official website as there are many fake wallets floating around. Once you have it installed, go to the Ronin-to-Ethereum bridge and connect your MetaMask wallet. Enter your Ronin address and the amount of ETH you want to send and complete the deposit. Step 4: Buy Axies from the marketplace Head over to the marketplace and look for three Axies. You will need to consider the number of times the Axie has been bred and its purity. You will also need to build a strong team. One of Axies need to have high health and other needs to be able to withstand high damage. Once you buy your Axies, you are ready to play your first game. 43 Where to find an Axie Infinity scholarship: If you find the upfront cost too high, you can always opt for a scholarship and earn a decent income. Scholarships are managed by an individual or a group of people who rent out their Axie team. In a scholarship, there is an agreement where the manager takes a cut of the SLPs farmed by the scholar. You can look for a scholarship in Axie community groups on Reddit, Discord and Facebook. 44 What Is the Future of NFTs: Like most blockchain experiments, the future is relatively unknown. However, prominent publications indicate that NFTs aren’t going away any time soon. Now that wealthy investors are pouring money into them, it’s likely they will become more and more mainstream. With an ability to sell the right to use assets without giving up ownership, this may even become the new way to sell music to consumers. To jump into the market with the least risk, anything creative that you own is potentially valuable. Game sprites, music you’ve recorded, pictures you’ve taken, prominent accounts on various sites and forums, and pretty much anything else you can think of could be an NFT. 45 Sources: www.forbes.com www.axieinfinity.com www.kraken.com www.binance.com www.medium.com www.money.yahoo.com www.theverge.com www.coinmarketcap.com www.help.foundation.app www.nerdwallet.com www.builtin.com www.cyberscrilla.com www.startuptalky.com www.decrypt.co Pictures and Images: www.freepik.com 46