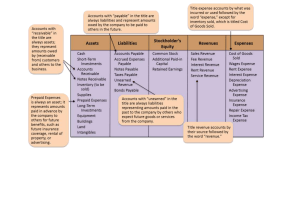

Chapter 3 Study online at quizlet.com/_21y9eu 1. 10 column worksheet - Provides an orderly format for the accumulation of information necessary for the preparation of financial statements - Does not replace any financial statements nor does it alter any of the steps in the accounting cycle 2. The accounting information system Collects and processes transaction data and then disseminates the financial information to interested parties 3. Accrual basis of accounting Revenue is recognized when it is earned and expenses when incurred without regard to the time of receipt or payment of cash. 4. Accruals Accrued revenues, accrued expenses - Rev/exp. first, cash later - Recognized in the current period for which the corresponding payment or receipt of cash is to occur in a future period - Estimated items are expenses such as bad debts and depreciation whose amounts are a function of unknown future events or developments reversal entries are only for accrued AJEs 5. Accrued expenses - Expenses incurred but not yet paid in cash or recorded - i.e. interest, rent, taxes, and salaries - Adjusting entry: debit expense, credit liability 6. Accrued revenues - Revenue for services performed, but not yet received in cash or recorded - Adjusting entry: debit asset, credit revenue 7. Adjusted trial balance Shows the balance of all accounts at the end of the accounting period to prove the equality of the total debit balances and the total credit balances in the ledger after all adjustments Adjusting entries - Made at the end of the accounting period to bring all accounts up to date on an accrual basis so that correct financial statements can be prepared - Necessary to achieve a proper matching of revenues an expenses in the determination of NI for the current period and to achieve an accurate statement of assets and equities existing at the end of the period - Affect one real account (asset, liability, or equity) and one nominal account (revenue or expense) 8. 9. Basic accounting equation Assets = Liabilities + Stockholders' Equity 10. Cash basis of accounting Revenue is recognized only when cash is received and expenses are recorded only when cash is paid. 11. Closing process - Nominal (revenues and expenses) accounts should be reduced to zero in preparation for recording the transactions of the next period - Requires recording and posting of closing entries - All nominal accounts are reduced to zero by closing them through the Income Summary account - The net balance in the Income Summary account is equal to the NI or NL for the period - The NI or NL is transferred to stockholders' equity by closing the Income Summary account to Retained Earnings 12. A company can directly prepare its financial statements from the adjusted trial balance 13. Debits and credits Assets and expenses are increased by debits and decreased by credits. Liabilities, owners' equity, and revenues are decreased by debits and increased by credits. 14. Deferrals Prepaid expenses, unearned revenues - Cash first, rev/exp. later - Recognized at a later date than the point when cash was originally exchanged 15. Double-entry accounting Refers to the process used in recording transactions 16. General journal A chronological listing of transactions expressed in terms of debits and credits to particular accounts; no distinction made concerning the type of transaction involved 17. General ledger A book that usually contains a separate page for each account 18. IFRS insights - Since the passage of SOX, companies that trade on U.S. exchanges are required to place renewed focus on their accounting systems to ensure accurate reporting - Converting to IFRS requires retrospective application (recasting prior financial statements on the basis of IFRS) to provide financial statement users with comparable information 19. Journalizing Transactions are initially recorded in a journal, sometimes referred to as the book of original entry 20. Post-closing trial balance Third trial balance; shows that equal debits and credits have been posted properly to the Income Summary account 21. Posting Transferring amounts from a journal to the ledger 22. Prepaid expenses - Deferral; expenses paid in cash before they are used - i.e. insurance, supplies, advertising, and rent - Adjusting entry: debit expense, credit asset 23. Reversing entries - Made at beginning of next accounting period - Exact opposite of the adjusting entry made in previous period - Optional - The entries subject to reversal are the adjusting entries for accrued revenues and accrued expenses. 24. Specialized journal Used to accumulate transactions possessing common characteristics 25. Summarized steps of accounting cycle 1. Enter transactions of period in appropriate journals 2. Posting 3. Unadjusted trial balance 4. Prepare adjusting journal entries and post them to ledger(s) 5. Adjusted trial balance 6. Prepare financial statements from adjusted trial balance 7. Prepare closing entries and post them to ledger(s) 8. Post-closing trial balance 9. Optional: Prepare reversing entries and post them to the ledger(s) 26. Trial balance A list of all open accounts in the general ledger and their balances 27. Unearned revenues - Deferral; cash received before services are performed - Adjusting entry: debit liability, credit revenue