Bookkeeping Training Sydney Brisbane Perth Canberra Melbourne Adelaide Parramatta Geelong

advertisement

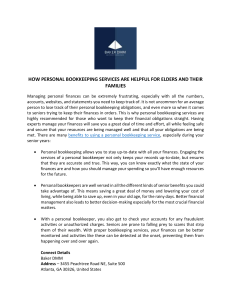

BOOKKEEPING TRAINING Professional Development WHAT IS BOOKKEEPING We all deal with numbers at some point in our lives. This includes budgeting, taxes, and managing personal finances. A foundational knowledge of bookkeeping is helpful. These courses vary in the amount of time required and the level of detail they cover, but they should all help you get started in your bookkeeping career. You will need to have a good understanding of math and tech-savvy to be able to bookkeeper effectively. Employers are generally looking for someone who can manage their finances, keep track of key transactions, handle invoices and enter data. WHY BOOKKEEPING? • Bookkeeping training classes will provide a comprehensive overview of the main functions and concepts of bookkeeping. Many will cover the use of popular bookkeeping software, and some may offer certifications after completion. The course's length and detail will vary depending on whether it is designed to help someone start a new career or keep track of their small business finances. • A certified bookkeeper is not required. A certified bookkeeper is able to effectively manage the accounts of clients. It also adds credential to your professional achievements. • Some people learn bookkeeping skills while working. It is always a good idea to continue your education to be a professional bookkeeper. • You are responsible for maintaining accurate financial records and managing all accounting processes of a business. • For entry-level positions in bookkeeping, some employers might require that you have a high school diploma. Employers expect you to have some work experience and additional education. IS BOOKKEEPING A GOOD CAREER • A bookkeeper is essential for every business. A bookkeeper is a rewarding career choice if you are a detail-oriented individual who enjoys solving problems. • If you are an entrepreneur looking to manage your finances, or if bookkeeping is something you want to do professionally, you might think about enrolling in an online class. THE DIFFERENCE IN BOOKKEEPING • What are the Different Types Of Bookkeeping? • There are two types of bookkeeping: the cash basis and accrual basis. Cash basis accounting is the simpler type of accounting. This allows revenue and expenses to be recorded when cash changes hands. This is usually only applicable to very small businesses. • Small businesses must ensure that they are keeping accurate financial records, regardless of what type of bookkeeping is used. This can be achieved by small businesses learning how to use bookkeeping software, hiring an accountant or professional bookkeeper, or outsourcing accounting tasks to a virtual service. • All financial transactions are recorded by bookkeepers. The types of transactions that a company makes will depend on the industry it is operating in, but they generally include vendor invoices and customer invoices as well as payroll processing checks, payment receipts and bank transactions. The company's accounting software tracks and reports on the transactions. This position requires familiarity with accounting software or bookkeeping. It is important to accurately record all financial transactions that occur every day. To make long-term business decisions, management relies on accurate and current information. Attention to detail and accuracy are essential in this role. You will need to have some accounting and financial knowledge. This can be acquired through training on the job or classes. THANK YOU We are going to have a great year learning together!