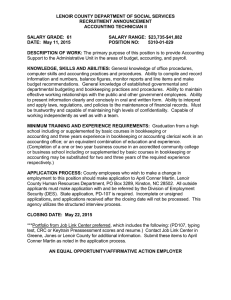

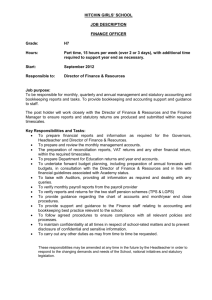

Accounting Technician II Social Services

advertisement

Accounting Technician II Social Services GENERAL STATEMENT OF DUTIES Employees in this class usually report to an accountant and are responsible for independently performing a major portion of the bookkeeping activities such as accounts payable and receivable, maintenance and control of general ledger and accounts, and report preparation for one or more complex budget codes in a large accounting office. Employees may report to an administrative official and are responsible for carrying out all accounting and budget activities for a small department or unit. The employee performs a variety of bookkeeping activities and participates in budget preparation and inventory control. Work requires the exercise of considerable judgment to insure that transactions are in accordance with correct accounting and budget procedures and statutory requirements. EXAMPLES OF DUTIES PERFORMED Maintaining Agency Donated Funds through Quicken Meeting deadlines for Accounts Payable for Travel / Training, Emergency Assistance, and Work First Invoices Maintaining Agency Vehicles including fuel and schedule maintenance Purchasing of Supplies Maintain County Purchase orders Schedule Agency Vehicles and Agency conference rooms Key forms 5022 and 8128 to State System Create and track Work Requests for Building Maintenance Prepare and maintain Vendor Agreements Prepare payroll for Part I entry and enter Part I payroll and time effort Assist Director, Program Administrators and Business Manager with budget preparation and tracking of revenues and expenses RECRUITMENT STANDARDS Knowledge of General Accepted Accounting Principles Knowledge and skill in accounting software applications Possess good math skills Possess good communication skills including the ability to write legibly and accurately. Ability to organize work, follows instructions, makes good decisions, achieve unit goals. Proficiency in use of computers, calculator, copy machines, telephones and other office equipment. Ability to abide by rules of confidentiality and be respectful of clients and coworkers. Ability to understand, interpret and apply laws and regulations to the maintenance of financial records MINIMUM EDUCATION AND EXPERIENCE Graduation from high school including or supplemented by basic courses in bookkeeping or accounting and three years experience in bookkeeping or accounting clerical work in an accounting office; or an equivalent combination of education and experience. (Completion of a one or two year business course in an accredited community college or business school including or supplemented by basic courses in bookkeeping or accounting may be substituted for two and three years of the required experience respectively.)