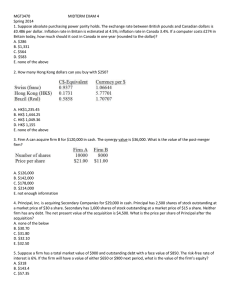

ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term Final Exam Review Sheet 1. You are comparing stock A to stock B. Given the following information, which one of these two stocks should you prefer and why? State of Economy Boom Recession Probability of State of Economy 70% 30% Returns if State Occurs Stock A Stock B 11% 7% 19% -12% A. Stock A; Stock A has a slightly lower expected return but appears to be significantly less risky than stock B. B. Stock A; Stock A has an expected return of 10.2% and appears to be less risky. C. Stock A; Stock A has a higher expected return and appears to be less risky than stock B. D. Stock B; Stock B has a higher expected return and appears to be just slightly more risky than stock A. E. Stock B; Stock B has a much higher return which compensates for the additional risk. 2. The common stock of Cross Country Homes has an expected return of 15.18%. The return on the market is 11.6% and the risk-free rate of return is 4.3%. What is the beta of Cross Country Homes stock? A. 1.37 B. 1.42 C. 1.49 D. 1.51 E. 1.56 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 3. What is the standard deviation of a portfolio with weights of 60% in security A and the remainder in security B? A. 0.5% B. 0.9% C. 1.5% D. 2.3% E. 6.4% 4. Your portfolio has a beta of 1.08. The portfolio consists of 20% Treasury bills, 45% in stock A, and 35% in stock B. Stock A has a risk-level equivalent to that of the overall market. What is the beta of stock B? A. .79 B. 1.25 C. 1.54 D. 1.61 E. 1.80 5. Which one of the following portfolios should have the most systematic risk? A. 50% invested in Treasury bills and 50% in a market index fund. B. 20% invested in Treasury bills and 80% invested in a stock with a beta of.80. C. 10% invested in a stock with a beta of 1.0 and 90% invested in a stock with a beta of 1.40. D. 100% invested in a mutual fund which mimics the overall market. E. 100% invested in Treasury bills. 6. Security A B Risk-free asset Return 15% 12% 5% Standard Deviation 8% 14% ??? Beta 1.2 0.9 ??? ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term What is the portfolio expected return and the portfolio beta if you invest 30% in A, 30% in B and 40% in the risk-free asset? A. 9.6%; 1.32 B. 9.6%; 1.00 C. 10.1%; 0.95 D. 10.1%; 0.72 E. 10.1%; 0.63 7. You own 189 shares of Hi-Tek, Inc. stock. The company has stated that it plans on issuing a dividend of $.30 per share at the end of this year and then issuing a final liquidating dividend of $1.05 per share at the end of next year. Your required rate of return is 15 percent. Ignoring taxes, what is the value of one share of Hi-Tek stock today? A. $1.01 B. $1.05 C. $1.17 D. $1.21 E. $1.35 8. BDJ, Inc. has 31,000 shares of stock outstanding with a market price of $15 per share. If net income for the year is $155,000 and the retention ratio is 80%, what is the dividend per share on BDJ Inc.'s stock? A. $0.68 B. $1.00 C. $1.25 D. $1.55 E. $1.89 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 9. The spot rate of the U.S. dollar is C$1 = $.94US while the forward rate for one year is C$1 = $.92US. The nominal risk-free rate is 3% in the U.S. and 2% in Canada. How much profit can you make given this situation using covered interest arbitrage? A. -$.04 B. -$.01 C. $.01 D. $.03 E. $.05 10. The current spot rate is C$1.1578 and the one-year forward rate is C$1.1397. The nominal risk-free rate in Canada is 7 % while it is 6.5 % in the U.S. Using covered interest arbitrage you can earn an extra profit over that which you would earn if you invested $1 in the U.S. A. $.0022 B. $.0025 C. $.0220 D. $.0239 E. $.0250 11. Suppose the indirect exchange rate for the Canadian dollar is 0.93. Based on this, you know you can buy: A. $1 U.S. for $0.93 Canadian. B. $1.93 U.S. for $1 Canadian. C. $1 U.S. for $1.08 Canadian. D. $1.08 U.S. for $1 Canadian. E. $1 U.S. for $1.93 Canadian. 12. You are considering a project in Poland, which has an initial cost of 250,000PLN. The project is expected to return a one-time payment of 400,000PLN 5 years from now. The risk-free rate of return is 3 % in Canada and 4 % in Poland. The inflation rate is 2 % in Canada and 5 % in Poland. Currently, you can buy 375PLN for $100. How much will the payment 5 years from now be worth in dollars? A. $101,490 B. $142,060 C. $1,462,350 D. $1,489,025 E. $1,576,515 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 13. Suppose that the nominal risk-free rate of interest in Canada is 5%. The nominal risk-free rate in Germany is 8% with inflation of 6%. What is the approximate inflation rate in Canada? A. 2.0% B. 3.0% C. 4.0% D. 5.0% E. 6.8% 14. Which of the following is the best definition of cross-rate. A. Money deposited in a financial centre outside of the country whose currency is involved. B. International bonds issued in multiple countries but denominated in a single currency (usually the issuer's currency). C. Banks that make loans and accept deposits in foreign currencies. D. The implicit exchange rate between two currencies (usually non-U.S.) quoted in some third currency (usually the U.S. dollar). E. Second borrower in currency swap. Counterparty borrows funds in currency desired by principal. 15. Uncovered interest parity is defined as the condition which states that the: A. Current forward rate is an unbiased predictor of the future spot exchange rate. B. Exchange rate adjusts to maintain purchasing power parity among currencies. C. Expected percentage change in the exchange rate is equal to the difference in the interest rates. D. Exchange rates adjust such that the real rate of interest is constant across currencies. E. Interest rate differential between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate. 16. Suppose you have the following information concerning an acquiring firm (A) and a target firm (B). Neither firm has any debt. The incremental value of the acquisition is estimated to be $250,000. Firm B is willing to be acquired for $540,000 worth of Firm A's stock. Number of Shares Price per Share Firm A 50,000 $50.00 Firm B 18,000 $22.50 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term What is the NPV of acquiring Firm B? A. The NPV is negative B. $94,588 C. $102,120 D. $118,156 E. $162,015 17. Calipers, Inc. is acquiring Johnson Warehouse for $47,000 in cash. Calipers has 2,700 shares of stock outstanding at a market value of $32 a share. Johnson Warehouse has 3,200 shares of stock outstanding at a market price of $14 a share. Neither firm has any debt. The net present value of the acquisition is $1,800. What is the value of Caliper's after the acquisition? A. $84,600 B. $86,000 C. $110,000 D. $124,800 E. $133,000 18. Tuesday's and Thursday's are all-equity firms. Tuesday's has 5,600 shares outstanding at a market price of $28 a share. Thursday's has 4,500 shares outstanding at a price of $42 a share. Thursday's is acquiring Tuesday's. The incremental value of the acquisition is $4,200. What is the value of Tuesday's to Thursday's? A. $130,200 B. $152,600 C. $156,800 D. $161,000 E. $165,400 19. The Sandwich Shoppe has 1,600 shares outstanding at a market price per share of $11. Joe's Slop Hut has 1,800 shares outstanding at a market price of $14 a share. Neither firm has any debt. Joe's Slop Hut is acquiring The Sandwich Shoppe. The incremental value of the acquisition is $1,600. What is the value of The Sandwich Shoppe to Joe's Slop Hut? A. $1,600 B. $2,200 C. $17,600 D. $19,200 E. $22,500 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 20. You buy 15 wheat futures contracts when the futures price is $2.61 per bushel (each contract is for 5,000 bushels). The price on the maturity date is $2.21. What is your payoff? A. -$30,000 B. -$2,000 C. $0 D. $2,000 E. $30,000 21. Raoul purchased both a call and a put on 125,000 bushels of soybeans. Both options have a strike price of 510 and a common expiration date. Soybean contracts are based on 5,000 bushels. The price of soybeans on the expiration date is 530. Ignore the costs of the options and all transaction costs. What is Raoul's profit or loss on these two option contracts? A. -$25,000 B. -$12,500 C. $0 D. $12,500 E. $25,000 22. Given the following information, what is the price per troy ounce that will be used for today's marking-to-market for the September silver contract? Silver - 5,000 troy oz.; $ per troy oz. Jul Sep A. $.10428 B. $.10511 C. $10.428 D. $10.511 E. $10.553 Open High Low 10.451 10.529 10.502 10.553 10.397 10.474 Settle Change Lifetime Lifetime Open High Low Interest 10.428 -0.016 10.509 10.378 7,980 10.511 -0.013 10.557 10.468 4,609 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 23. You are a jewelry maker and purchase four June 540 calls on gold. What is the total price you will pay to acquire this gold? Ignore transaction costs. Gold - 100 troy oz.; $ per troy oz. Price 540 550 Call Apr 16.70 9.10 Call May 17.40 9.90 Call Jun 17.70 10.20 Put Apr .80 5.10 Put May .80 5.30 Put Jun .90 5.40 A. $208,920 B. $212,000 C. $212,360 D. $220,080 E. $223,080 24. DogChew Products needs to replace its rawhide tanning and molding equipment. It can be used for five years and will have no salvage value. The equipment costs $930,000. The firm can lease it for $245,000 a year, or it can borrow the money to purchase the equipment at 9%. The firm's tax rate is 39%. The CCA rate is 20% (Class 8). What is the net advantage to leasing? A. -$88,132 B. -$20,592 C. $1,269 D. $13,706 E. $15,062 25. Knight Motors is considering either leasing or buying some new equipment. The lease payments would be $14,500 a year for 3 years. The purchase price is $52,000. The equipment has a 3-year life and then is expected to have a resale value of $12,000. Knight Motors uses straight-line depreciation, borrows money at 9 percent, and has a 35 percent tax rate. What is the net advantage to leasing? A. -$2,742 B. -$2,212 C. -$1,611 D. $3,529 E. $3,898 ACCT3004 FINAL EXAM REVIEW – 2021 Winter Term 26. Daily Enterprises is contemplating the acquisition of some new equipment. The purchase price is $47,000. The company expects to sell the equipment at the end of year 4 for $5,000. The firm uses MACRS depreciation which allows for 33.33 percent, 44.44 percent, 14.82 percent, and 7.41 percent depreciation over years 1 to 4, respectively. The equipment can be leased for $12,500 a year for 4 years. The firm can borrow money at 7.5 percent and has a 34 percent tax rate. What is the incremental annual cash flow for year 4 if the company decides to lease the equipment rather than purchase it? A. -$14,434 B. -$12,734 C. -$10,266 D. -$9,434 E. -$8,766