Accounting Concepts to Midterm

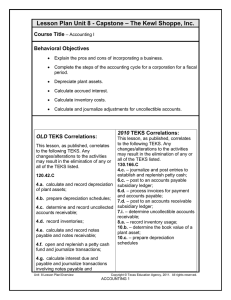

advertisement

define the following concepts: o account, o debit, o credit, o account balance, and o ledger Understand the nature of accounts that would typically be placed within a Balance Sheet, such as: o cash, o accounts receivable, o furniture, o equipment, o supplies, o bank loan payable, o account payable, o mortgage payable, and o capital. Explain the functions of, and work with, the following types of owner's equity accounts: o revenue o expense o drawings o capital Understand and utilize the following new GAAPs associated with these new accounts: o the revenue recognition principle, o the matching principle. Understand the following concepts related to the above principles: Income Statement net income net loss fiscal period, and the Chart of Accounts Prepare an Income Statement Prepare a Balance Sheet which includes an expanded Owner's Equity section o o o o o understand and explain the following concepts: o HST Payable, o HST Recoverable, o "Contra" account, o journalizing, o posting, o post reference journalize the "opening entry" within a General Journal. journalize transactions within a General Journal. correctly journalize sales and purchase transactions involving HST; distinguish between an adjusting entry and a transaction entry; understand the function of adjusting entries; know and understand the concept of prepaid expenses; understand how to adjust for the following prepaid expenses: o prepaid insurance o prepaid rent o supplies on hand know and understand the concept of depreciation; be able to calculate depreciation on a fixed asset using either the: o straight line method, or the o declining balance method be able to properly use the following accounts related to depreciation: o any fixed asset account (ie. computer, building, automobile) o accumulated depreciation account (contra-asset account) o depreciation expense Eight-Column Worksheet understand and explain the process involved in closing the revenue, expense, and drawings accounts in order to update the owner's capital account. demonstrate these closing entries within either a General Journal or a General Ledger. differentiate between: o real accounts and nominal accounts, o the Trial Balance and the Post-Closing Trial Balance, as well as o the Income Summary (or Revenue and Expense Summary) account and other Owner's Equity accounts. prepare a post-closing trial balance.