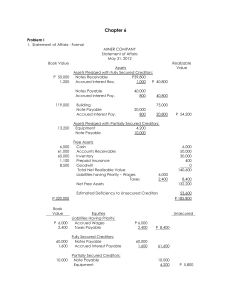

Corporation Liquidation P1 The following information is available on June 1, 2018 to Samsung Company, which is having fifficulty in paying its liabilities as they become due: Carrying Amount Cash 8,960 Accounts receivable, net, fair value equal to carrying amount 103,040 Inventories, current fair value, 40,320 pledged on 47,040of notes payable 87,360 Machinery and Equipment, net, current fair value of 150,976 pledged on mortgage on note payable 239,680 Office Supplies, current fair value of 5,600 4,480 Wages payable 12,992 Taxes payable 2,688 Accounts payable 134,400 Notes payable, 47,040 of which is secured by inventories 89,600 Mortgage note payable 112,896 Common stock, 5 par 224,000 Retained earnings, deficit 133,056 Additional information: 1. Estimated liability to the trustee is 58,240. 2. A delivery van previously given to the supervisor was returned to the company, fair market value, 56,000. Compute the estimated recoverable amounts to the different types of creditors in the event of liquidation. P2 SMDC Corp. a closely held corporation was undergoing liquidation. The total cash value of SMDC’s bankruptcy estate after the sale of all assets and payment of administrative expenses is 100,000. SMDC has the following creditors: BDO Bank is owed 75,000 on a mortgage loan secured by SMDC’s real property. The property was valued at and sold, in bankruptcy, for 70,000. The BIR has a 12,000 recorded judgement for unpaid corporate income tax. National Office Supplies has an unsecured claim of 3,000 that was timely filed. ACE Electric Company has an unsecured claim of 10,000 that was timely filed. REH Publications has a claim of 16,000, which is secured by SMDC’s inventory that was valued and sold, in bankruptcy, for 2,000. The claim was timely filed. Required: a. Calculate b. Calculate c. Calculate d. Calculate the the the the total total total total amount amount amount amount recoverable recoverable recoverable recoverable by by by by partially secured creditors. unsecured creditors with priority. fully secured creditors. unsecured creditors without priority. P3 A company that was to be liquidated had the following liabilities: Income taxes Note payable secured by land Accounts payable Salaries payable Administrative expenses for liquidation The company had the following assets: Current assets Land Building Required: a. Total free assets: b. Total liabilities with priority: c. Net free assets: d. Total unsecured liabilities: 10,000 100,000 251,050 12,950 20,000 Book value 100,000 50,000 150,000 Fair value 95,000 75,000 200,000 P4 The following data were taken from the statement of realization and liquidation of CRASHED CO. Assets to be realized 1,375,000 Assets acquired 750,000 Supplementary credits 2,800,000 Assets realized 1,200,000 Liabilities to be liquidated 2,250,000 Liabilities assumed 1,625,000 Supplementary charges 3,125,000 Assets not realized 1,375,000 Liabilities liquidated 1,875,000 Liabilities not liquidated 1,700,000 The ending balances of capital stock and retained earnings are 1,500,000 and 238,000, respectively. A net loss of 738,000 was reported for the period. What is the net gain/(loss) for the three-month period? How much is the ending balance of cash? P5 On December 31, 2019 the statement of affairs of BANKRUPTCY COMPANY, which is in bankruptcy liquidation, included the following: Assets pledged for fully secured liabilities 100,000 Assets pledged for partially secured liabilities 40,000 Free assets 120,000 Fully secured liabilities 80,000 Partially secured liabilities 50,000 Unsecured liabilities with priority 60,000 Unsecured liabilities without priority 90,000 Required: a. Calculate b. Calculate c. Calculate d. Calculate the the the the total total total total amount amount amount amount recoverable recoverable recoverable recoverable by by by by partially secured creditors. unsecured creditors with priority. fully secured creditors. unsecured creditors without priority. P6 When SPENCER Company filed for liquidation with the Securities and Exchange Commission, it prepared the following balance sheet. Current assets, net realizable value, 50,000 80,000 Land and buildings, fair value, 240,000 200,000 Goodwill, fair value, 0 40,000 Total assets 320,000 Accounts payable 160,000 Mortgage payable, secured by land and building 200,000 Common stock 100,000 Retained earnings, deficit (140,000) Total liabilities and equities 320,0000 What is the estimated deficiency to unsecured creditors? What percentage of their claims are the unsecured creditors likely to get?