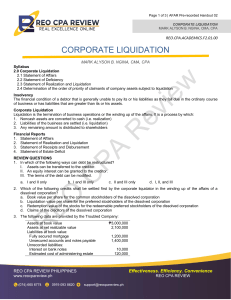

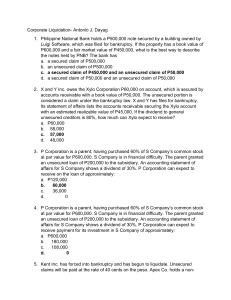

lOMoARcPSD|5917258 Corporate Liquidation-Discussion Guide Accountancy (Mariano Marcos State University) StuDocu is not sponsored or endorsed by any college or university Downloaded by Heyzz Up (heyzzup23@gmail.com) lOMoARcPSD|5917258 Corporate Liquidation Liquidation: Termination of business operations. It is a process by which: 1. The assets of the business are converted into cash 2. The liabilities of the business are settled 3. Any remaining amount is distributed to Owners Common Cause of Corporate Liquidation - Insolvency Accounting and Reporting for Liquidation - Quitting Concern rather than Going Concern - Statement of Affairs: a statement which shows the liquidation value of the corporation. a. Assets are measured at net realizable values and classified on the basis of availability b. Liabilities are measured at settlement value and classified on the basis of priority Asset: 1. Assets pledged to fully secured creditors 2. Assets pledged to partially secured creditors 3. Free assets Liability: 1. Fully secured creditors 2. Partially secured creditors 3. Unsecured creditors with priority 4. Unsecured creditors without priority Frequently Asked Questions 1. Percentage of recovery for unsecured creditors 2. Estimated deficiency to unsecured creditors Downloaded by Heyzz Up (heyzzup23@gmail.com) lOMoARcPSD|5917258 B Company has decided to seek liquidation after facing financial setbacks. The company’s statement of financial position on this date is as follows: Assets Cash 100,000 Accounts Receivable 300,000 Inventory 450,000 Prepaid Expenses 10,000 Equipment-net 750,000 Land 1,500,000 Total Assets 3,110,000 Liabilities Accounts Payable Notes Payable Bonds Payable Total Liabilities 350,000 700,000 1,500,000 2,550,000 Shareholder's Equity Ordinary Share Capital 450,000 Ordinary share Premium 500,000 Retained Earnings (390,000) Total Shareholder's Equity 560,000 Additional Information: 1. The assets had the following net realizable values: Accounts Receivable 120,000 Inventory 300,000 Equipment 400,000 Land 1,750,000 2. The inventories are used as collateral for the notes while the land is used as collateral for the bonds. Interest accrued on the notes amounts to 150,000 while the interest accrued on the bonds is 200,000. 3. Unrecorded claims against the company are as follows: o Accrued salaries of 50,000 o Accrued taxes of 40,000 Determine the following: 1. Estimated recovery percentage for unsecured creditors 2. Estimated deficiency to unsecured creditors 3. How much would the creditor holding the notes payable receive upon settlement? Downloaded by Heyzz Up (heyzzup23@gmail.com)