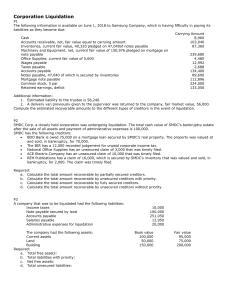

Chapter 6 Problem I 1. Statement of Affairs - Formal MINER COMPANY Statement of Affairs May 31, 2012 Book Value P 50,000 1,200 119,000 13,200 6,000 61,000 60,000 1,100 8,500 Assets Assets Pledged with Fully Secured Creditors: Notes Receivable P39,800 Accrued Interest Rec. 1,000 P 40,800 Notes Payable Accrued Interest Pay. 40,000 800 Building Note Payable Accrued Interest Pay. 20,000 800 40,800 75,000 20,800 Free Assets Cash Accounts Receivable Inventory Prepaid Insurance Goodwill Total Net Realizable Value Liabilities having Priority – Wages Taxes Net Free Assets 6,000 50,000 30,000 400 0 140,600 6,000 2,400 Estimated Deficiency to Unsecured Creditors P 6,000 2,400 60,000 1,600 10,000 P 54,200 Assets Pledged with Partially Secured Creditors: Equipment 4,200 Note Payable 10,000 Equities Liabilities Having Priority: Accrued Wages Taxes Payable Fully Secured Creditors: Notes Payable Accrued Interest Payable Partially Secured Creditors: Note Payable Equipment 8,400 132,200 53,600 P 185,800 P 320,000 Book Value Realizable Value Unsecured P 6,000 2,400 P 8,400 60,000 1,600 61,600 10,000 4,200 P 5,800 170,000 10,000 110,000 ( 50,000) P 320,000 Unsecured Creditors: Accounts Payable Notes Payable 170,000 10,000 Stockholders’ Equity Common Stock Retained Earnings (Deficit) P 185,800 2. Deficiency Statement to determine estimated deficiency to unsecured creditors: Deficiency Account May 31, 2012 Estimated Losses: Estimated Gains: Accounts Receivable P 11,000 Common Stock P 110,000 Notes Receivable 10,400 Retained Earnings (50,000) Inventory 30,000 Estimated Deficiency to Buildings 44,000 Unsecured Creditors 53,600 Equipment 9,000 Prepaid Insurance 700 Goodwill 8,500 P113,600 P 113,600 Estimated final dividend rate to unsecured creditors is: P132,200/P185,800 = 71.15% Problem II 1. Formal Down Dog Corporation Statement of Affairs June 30, 2014 Book Value Assets Pledged with partially secured creditors P165,000 Equipment-net Less: Note payable and accrued interest Unsecured amount (See below) Free Assets 3,000 Cash 72,000 Accounts receivable-net 60,000 Inventories Total net realizable value Less: Priority liabilities – wages payable Total available for unsecured creditors ______ Estimated deficiency to unsecured creditors P300,000 Realizable Value P87,000 (96,000) (9,000) 3,000 48,000 72,000 123,000 (45,000) 78,000 30,000 P108,000 Deficiency Account (Loss/Gain) (78,000) P 0 (24,000) 12,000 ______ (90,000) Unsecured Equities Book Value Priority liabilities P 45,000 Wages payable (assumed under P4,650 per employee) Partially secured creditors 96,000 Note payable and accrued interest Less: Equipment pledged as security Liabilities P 45,000 P 96,000 (87,000) P 9,000 Unsecured creditors 72,000 Accounts payable 27,000 Rent payable Stockholders’ equity 180,000 Capital stock (120,000) (120,000) P300,000 Estimated Deficiency 72,000 27,000 180,000 ______ Retained earnings (deficit) P108,000 2. Estimated payments per dollar for unsecured creditors Cash available Distribution to partially secured and unsecured priority creditors: Note payable and interest Administrative expenses Wages payable Available to unsecured nonpriority creditors P 60,000 P(30,000) P210,000 P87,000 24,000 45,000 Note payable and interest (unsecured portion) Accounts payable Rent payable Unsecured nonpriority claims (156,000) P 54,000 P 9,000 72,000 27,000 P108,000 (P54,000 / P108,000 = P0.50 per peso) Expected recovery for each class of claims Partially secured Note payable and interest Secured portion Unsecured portion (P9,000 × 0.50) P87,000 4,500 P91,500 Unsecured priority Administrative expenses Wages payable P24,000 45,000 69,000 Unsecured nonpriority Accounts payable (P72,000 × 0.50 Rent payable (P27,000 × 0.50) Total payments P36,000 13,500 49,500 P210,000 Problem III Realizable value of all assets (P635,000 + P300,000 + P340,000) Allocated to: Fully secured creditors Partially secured creditors Unsecured creditors with priority Remainder available to general unsecured creditors Payment rate to general unsecured creditors (Including balance due to partially secured creditors) P559,000 / (P1,165,000 + (P400,000 - P300,000)) P1,275,000 (316,000) (300,000) (100,000) P559,000 44.2% Realizable value of assets: Assets pledged to fully secured creditors Assets pledged to partially secured creditors Free assets Total realizable value P635,000 300,000 340,000 P1,275,000 Amounts to be paid to: Fully secured creditors Partially secured creditors [P300,000 + (0.442 × P100,000)] Unsecured creditors with priority General unsecured creditors (0.442 × P1,165,000) Total P316,000 344,200 100,000 514,800* P1,275,000 *Rounded P130 Problem IV Free Assets: Current Assets ................................................................................. Buildings and Equipment .............................................................. Total ........................................................................................ P 35,000 110,000 P145,000 Liabilities with Priority: Administrative Expenses ................................................................ Salaries Payable (only P3,000 per employee) ........................... Income Taxes ................................................................................. Total ........................................................................................ P 20,000 6,000 8,000 P 34,000 Free Assets After Payment of Liabilities with Priority (P145,000 – P34,000) ...................................................................... P111,000 Unsecured Liabilities Notes Payable (in excess of value of security) ......................... Accounts Payable .......................................................................... Bonds Payable ................................................................................ Total ........................................................................................ P 30,000 85,000 70,000 P185,000 Percentage of Unsecured Liabilities To Be Paid: P111,000/P185,000 = 60 % Payment On Notes Payable: Value of Security (land) ................................................................. P 90,000 60% of Remaining P30,000 ............................................................ 18,000 Total Collected by holders ............................................................ P108,000 Problem V Free Assets: Cash ........................................................................................ Receivables (30 percent collectible) .......................................... Inventory ........................................................................................ Land (value in excess of secured note: P120,000 – P110,000) ................................................................. Total ........................................................................................ P30,000 15,000 39,000 10,000 P94,000 Less: Liabilities with priority Salary payable (below maximum) ........................................ Free assets available ................................................................ (10,000) P84,000 Unsecured Liabilities: Accounts payable .......................................................................... Bonds payable (less secured interest in building: P300,000 – P180,000) ................................................ Unsecured liabilities .................................................................. P90,000 120,000 P210,000 Percentage of unsecured liabilities to be paid: P84,000/P210,000 = 40% Amounts to be paid for: Salary payable (liability with priority to be paid in full) ........................................................................................ Accounts payable (unsecured—will collect 40% of debts of P90,000) .................................................................. Note payable (fully secured by land—will collect entire balance) ........................................................................ Bonds payable (partially secured—will collect P180,000 from building and 40 percent of the remaining P120,000) ................................................................. P10,000 P36,000 P110,000 P228,000 Problem VI Class of Creditors Fully secured liabilities Partially secured liabilities Unsecured liabilities with priority Unsecured liabilities without priority Total Creditor’s Claims 183,600 54,600 30,810 182,500 Problem VII 1. Total estimated proceeds Less asset proceeds claimed by secured creditors: Notes payable and interest (from proceeds of receivables and inventory) Mortgage payable and interest (from proceeds of land and building) Total available to unsecured claimants. Total Amounts Expected to be Recovered 183,600 51,720 30,810 116,800 % of Total Claims Expected to be Recovered 100.0 94.7 100.0 64.0 P910,000 P150,000 320,000 470,000 P440,000 Less distributions to unsecured claims with priority: Wages payable Taxes payable Amount available for unsecured claims 2. 3. P 10,000 20,000 Unsecured portion of notes payable and interest (P500,000 + P30,000 – P150,000) Accounts payable Total claims ofunsecured creditors Dividend to Unsecured Creditors P410,000 ÷ P640,000 = 64.1% 30,000 P410,000 P380,000 260,000 P640,000 Unsecured portion of notes payable and Interest Dividend on unsecured amount Amount received on unsecured portion Proceeds from receivables and inventory Total Received P380,000 64.1% P243,580 150,000 P393,580 Dividend to note holders: P393,580 ÷ P530,000 = 74.3% Problem VIII 1. WILBUR CORPORATION STATEMENT OF AFFAIRS DECEMBER 31, 20x4 Assets Estimated Current Values Book Value P 40,000 50,000 110,000 (1) Assets pledged with fully secured creditors: Accounts receivable (net) Less: 10% note payable and interest Land Plant and equipment (net) Less: Mortgages payable and interest 20,000 35,000 (2) Assets pledged with partially secured creditors: Marketable securities Less: 10% note payable and interest Inventory Less: Accounts payable Estimated Amount Available to Unsecured Claims Estimated Gain (Loss) on Realization P 40,000 38,500 P 1,500 P 65,000 100,000 P165,000 (157,500) P 16,000 P 15,000 (10,000) 7,500 (4,000) (20,800) P 32,000 (60,000) (3,000) 4,000 35,000 55,000 6,000 140,000 48,000 (3) Free assets: Cash Accounts receivable (net) Inventory Prepaid insurance Plant and equipment (net) Franchises P 4,000 35,000 50,000 1,000 60,000 15,000 4,000 35,000 50,000 1,000 60,000 15,000 Estimated amount available Less: Creditors with priority Net available to unsecured creditors Estimated deficiency P 174,000 (43,000) P 131,000 45,000 Total unsecured debt P 176,000 P 543,000 (5,000) (5,000) (80,000) (33,000) (P 125,000) 2. Percentage to unsecured creditors: P131,000/P176,000 = 74.43% Problem IX Assets to be realized Old Receivebles, net Marketable Securities Old Inventory Depreciable Assets, net Smith Company Statement of Realization and Liquidation Assets Assets Realized P 50,000 20,000 72,000 120,000 Assets Acquired New Receivables Old Receivbles New Receivbles Marketable Securities Sales of Inventory Assets Not Realized 100,000 Old Receivables, net New Receivables, net Depreciable Assets Supplementary Charges Supplementary Items Supplementary Credits Old Current Payables P 31,000 Liabilities Liquidated Old Current Payables Net Loss 22,000 35,000 96,000 P 7,000 Liabilities Liabilities to be Liquidated P 31,000 Liabilities Not Liquidated Old Current Payables P 28,000 65,000 15,000 100,000 Old Current Payables P 65,000 Liabilities Incurred P 34,000 P433,000 ________ P 433,000 Problem X Mallory Corporation Statement of Realization and Liquidation For the Three Months Ended July 31, 20x5 Assets Cash Non-Cash P 4,000 P720,000 Assets Beginning balances assigned 5/1/x5 Cash Receipts: Collection of Accounts Receivable Sale of inventory Sale of land and building Sale of machinery Cash Disbursements: Payment of salaries payable Partial payment of accounts pay. Partial payment of bank loan Ending balance Assets Beginning balances assigned 5/1/X5Receipts: Cash Collection of Accounts Receivable Sale of inventory Sale of land and building Sale of machinery Cash Disbursements: Payment of salaries payable Partial payment of accounts pay Partial payment of bank loan Ending balance Fully Secured P240,000 Partially Secured P270,000 60,000 170,000 20,000 70,000 (70,000) (200,000) (340,000) (100,000) (60,000) (170,000) (70,000) P24,000 P10,000 Liabilities Unsecured With Without Priority Priority P94,000 P0 (10,000) (30,000) (80,000) (30,000) (240,000) (60,000) (180,000) ________ (90,000) ________ P 0 P 0 P34,000 P 0 Owner's Equity P120,000 10,000 20,000 P30,000 ________ P (30,000) Multiple Choice Problems 1. d – since there is parent and subsidiary relationship, any intercompany accounts are eliminated from consolidated point of view. 2. a - [P90,000 + P36,000 + P10,000 – P45,000 = P91,000 total estimated amount available; P91,000 – (P4,500 + P10,000) = P76,500 estimated amount available for unsecured, non-priority creditors; P76,500 P90,000 = 0.85] 3. c – it is a partially secured liability 4. d – [(P1,110,000 – P780,000) + P960,000] – P210,000 = P1,080,000 5. b – P25,000 + [.30 x (P75,000 – P25,000)] = P40,000 6. d – (P555,000 – P390,000) + P480,000 = P645,000 – P105,000 = P540,000 7. b – P30,000 + [.30 x (P90,000 – P30,000)] = P48,000 8. c – [ P110,000 + (P150,000 – P110,000) x 40%] = P128,000 9. d 10. c – P60,000 + [(P120,000 + P6,000) – (P30,000 + P35,000) = P121,000 11. b - P20,000 + P80,000 + [P170,000 – (P150,000 + P7,000)] = P113,000 – (P10,000 + P10,000) = P93,000 12. c – P93,000/P121,000 = 77% rounded. 13. a Net Free Assets: (P700,000 – P300,000) + P70,000 + P230,000 = P700,000 – P140,000 = P560,000 Total Unsecured Creditors without priority: (P400,000 – P300,000) + P600,000 = P700,000 14. c - Pension P10,000 + Salaries P35,000 (= P10,600 + P10,950 + P10,950 + P2,500) + Taxes P80,000 + Liq. expenses P40,000 = P165,000. 15. c Statement of Realization and Liquidation Assets to be Realized…………. Assets Acquired……………….. Liabilities Liquidated…………. Liabilities Not Liquidated……. Supplementary charges/ debits……………………… P 1,375,000 750,000 1,875,000 1,700,000 Assets Realized…………………..P 1,200,000 Assets Not Realized…………… 1,375,000 Liabilities to be Liquidated…. 2,250,000 Liabilities Assumed………….. 1,625,000 Supplementary credits……… 2,800,000 3,125,000 P 8,825,000 P 9,250,000 Net Gain……………………….. P 425,000 16. No requirement 17. c Total Liabilities (refer to Liabilities not liquidated–No. 14)…………………… P1,700,000 +: Stockholders’ Equity (P1,500,000 – P500,000)………………………………… 1,000,000 Total LSHE = Total Assets…………………………………………………………… P 2,700,000 -: Noncash assets (refer to Assets not realized-No. 14)……….……………… 1,375,000 Cash balance, ending………………………………………………………………P1,325,000 18. P440,000 Total Free Assets: Fully secured: Land and building: P650,000 – (P300,000 + P20,000) = P 330,000 Free assets: Cash 10,000 Equipment 100,000 Or, Total estimated proceeds Less asset proceeds claimed by secured creditors: P 440,000 P910,000 Notes payable and interest (from proceeds of receivables and inventory) Mortgage payable and interest (from proceeds of land and building) Total available to unsecured claimants/total free 19. P410,000 Total available to unsecured claimants/total free Less distributions to unsecured claims with priority: Wages payable Taxes payable Amount available for unsecured claims/net free assets P150,000 320,000 470,000 P440,000 P440,000 P 10,000 20,000 30,000 P410,000 20. P640,000 = P260,000 + [(P50,000 + P100,000) – (P500,000 + 30,000), or Unsecured portion of notes payable and interest (P500,000 + P30,000 – P150,000) Accounts payable Total claims of unsecured creditors P380,000 260,000 P640,000 21. 64.1% Dividend to unsecured creditors P410,000 ÷ P640,000 = 64.1% 22. P320,000 = P300,000 + P20,000 23. P393,580 Unsecured portion of notes payable and interest Dividend on unsecured amount Amount received on unsecured portion Proceeds from receivables and inventory Total Received x P380,000 64.1% P243,580 150,000 P393,580 Dividend to note holders: P393,580 ÷ P530,000 = 74.3% 24. P30,000 25. P166,666 = P260,000 x 64.1 26. P910,247 = P320,000 + P393,580 + P30,000 + P166,666 (discrepancy of P247 due to roundingoff) 27. P230,000 Net free assets (No. 19) P410,000 Less: Unsecured creditors without priority (No. 20) 640,000 P230,000 28. P340,000 = P910,000 – P1,250,000 29. P340,000, same with No. 28, since there are no unrecorded expenses liabilities) 30. P60,675 – you may the same procedure in Nos. 18 to 29 to solve this problem, the following is the formal presentation of statement of affairs Estimated Net Realizable Value Book Value Assets Assets pledged with fully secured creditors: 98,500 Land and Bldg 92,800 5,800 Investment in Calandir 15,000 Total 107,800 Assets pledged with partially secured creditors: 41,000 Inventory 20,000 43,000 Equipment 8,000 Free Assets: 1,850 Cash 1,850 21,200 Accounts Rec 17,000 15,000 Note Rec 15,000 Estimated Amount Avail for unsecured creditors with and without priority Less unsecured creditors with priority Estimated amounts for unsecured creditors without priority (Net Free Assets): Net Realizable Amount Avail _______ Deficiency _______ 226,350 169,650 Book Liabilities Value and Owners Equity Fully Secured Creditors: 600 Accrued Mtg Interest 70,000 Mortgage Payable 375 Accrued N/P Interest 10,000 Note Payable Total Partially Secured Creditors: 50,000 Accounts Payable Unsecured Creditors with Priority: 3,775 Accrued Payroll Unsecured creditors without Priority: 40,625 Accounts Payable 10,000 Other Accrued Liabilities 185,375 Totals 40,975 Owner Equity 226,350 31. 32. 33. 34. 35. 36. 37. Estimated Secured Amount Estimated Amt Avail for Unsecured Creditors Estimated Gain or (Loss)on Liquidation 22,200 4,625 (5,700) 9,200 (21,000) (35,000) 1,850 17,000 15,000 0 (4,200) 0 60,675 (3,775) 56,900 15,725 72,625 _______ (56,700) Estimated Unsecured Amount With Without Priority Priority 600 70,000 375 10,000 80,975 28,000 22,000 3,775 _______ 108,975 3,775 P56,900 – refer to No. 30 for computation P72,625 – refer to No. for computation Dividend - P56,900/P72,625 = P.78 – refer to No. 30 for further computation P80,975 – refer to No. 30 for computation P45,160 = P28,000 + (P22,000 x 78%) P3,775 P39,487.50 = 78% x (P40,625 + P10,000) 40,625 10,000 72,625 38. P169,397.50 No. 34……………..P 80.975 No. 35…………….. 45,160 No. 36…………….. 3,775 No. 37…………….. 39,487.50 P169,397.50 (discrepancy around P250 plus due to rounding-off) 39. P15,725 – refer to No. 30 or P56,700, estimated net loss – P40,975, owners’ equity 40. P56,700 – refer to No. 30 or P169,650 – P226,350 41. P56,700 (same with No. 40 since there are no unrecorded expenses liabilities) 42. P22,475 Liabilities Unsecured Assets Fully Partial With Without Cash Noncash Secured Secured Priority Priority 6/1/x5 Balances: 1,850 224,500 80,975 50,000 3,775 50,625 Cash Receipts: Securities Sale 16,000 N/R Collected 15,000 Equipment 7,000 Sale Inventory Sale 22,000 Cash Disbursements: Bank Loan (10,375) Part Pyt-A/P (29,000) 6/30 Balance 22,475 Owners' Equity 40,975 (5,800) (15,000) (43,000) 10,200 0 (36,000) (41,000) (19,000) ---------119,700 (10,375) --------70,600 (50,000) 0 ------3,775 21,000 71,625 ---------(3,825) 43. P119,700 – refer to No. 42 44. P70,600 – refer to No. 42 45. None – refer to No. 42 46. P3,775 – refer to No. 42 47. P71,625 – refer to No. 42 48. (P3,825) deficit – refer to No. 42 49. P150,900 Book Value 57,000 174,000 6,000 900 90,000 Estimated Net Realizable Assets Value Assets pledged with fully secured creditors: Accounts receivable (net) 45,000 Land, plant and equipment (net) 150,000 Total 195,000 Free assets: Notes receivable 6,000 Accrued interest receivable 900 Inventories (90,000 x 60%) 54,000 Estimated Amount Available for Unsecured Creditor Estimated Gain or (Loss) on Liquidation 12,600 77,400 (12,000) (24,000) 6,000 900 54,000 0 0 (36,000) Estimated amount available for unsecured creditors with and without priority Less unsecured creditors with priority Estimated amounts for unsecured creditors without priority: Net realizable amount available Deficiency 327,900 Book Value 3,600 69,000 2,400 30,000 24,900 0 150,900 (26,900) 124,000 26,000 Totals 255,900 150,000 Estimated Secured Amount Liabilities and Owners' Equity Fully secured creditors: Accrued interest Note payable Accrued interest Note payable Total Unsecured creditors with priority: Wages payable Administration fees – accountant’s fee Unsecured creditors without priority: Accrued interest Cash overdraft Notes payable Accounts payable Totals Owners' equity--see Note A 0 18,000 6,000 126,000 279,900 48,000 327,900 Note A: Includes the effect of the P2,000 professional fee. (72,000) Estimated Unsecured Amount With Priority Without Priority 3,600 69,000 2,400 30,000 105,000 24,900 2,000 -------105,000 -------26,900 50. P124,000 – refer to No. 49 51. P150,000– 52. 82.67% = P124,000/P150,000 53. P105,000 54. None 55. P26,900 56. P124,005 = P150,000 x 82.67% 57. P255,900 = P72,000 + P26,900 + P124,005 (discrepancy of P5) 58. P26,000 = (P72,000 + P2,000 unrecorded ) – P48,000 or P150,000 – P124,000 59. P72,000 – refer to No. 49 60. P74,000 = P72,000, loss of realization of assets + P2,000 unrecorded expenses THEORIES 1. debtor 2. P5,000 3. inability to pay debts as they mature 4. a. administrative costs b. certain postfiling “gap” claims in involuntary filings c. wages, salaries, and commissions d. employee benefit plans 0 18,000 6,000 126,000 150,000 5. 6. 7. 8. 9. 10. 11. 12. 13. 44. 45. 46. 47. 48. e. deposits by individuals f. taxes infrequent two-thirds, more than one-half fraudulent, preferential realization and liquidation False False False True False a c c a b 14. 15. 16. 17. 18. False True True True True c 50. d 51. a 52. d 53. b 49. 19. False False 20. 21. 22. 23. 54. 55. 56. 57. 58. c a a d c d b a 24. 25. 26. 27. 28. c a d c e 59. a 60. c 29. 30. 31. 32. 33. b b b a c 34. 35. 36. 37. 38. b d b c a 39. 40. 41. 42. 43. b c b a c