Interpreting Financial Statements

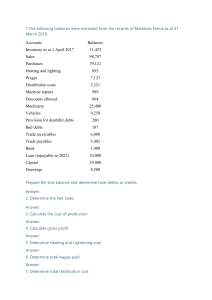

advertisement

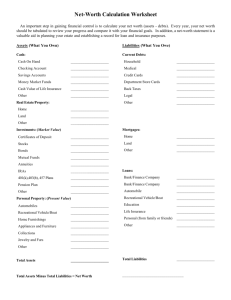

Interpreting Financial Statements What the Income Statement Says… •business name and accounting period •sources of revenue realized during the period •expenses (expired costs) incurred during the period •net income (or net loss) What the Income Statement DOESN’T Say… •prediction of future income •precise net income Why? It’s difficult to know exactly what revenues resulted from this month’s advertising expense, etc. •“true profit” Why? We would have to include the liquidated value of the business assets (minus capital contributions) to figure out the “true profit” generated by the business over it’s lifetime. •net income does NOT indicate cash What the Balance Sheet Says… •business name (entity concept) – not the owner’s assets or debts •assets (items of value owned by the business) •liabilities (legal claims against the assets held by outside parties) •owner’s equity (owner’s claim in the assets of the business) •ability of the business to pay its short-term and long-term debts For example, current assets versus short-term liabilities What the Balance Sheet DOESN’T Say… •how net income was earned (look to the Income Statement for this) •specific claims of creditors against specific assets •capital does not equal cash – just a general claim in the assets •actual “market-value” or “current worth” of the business Why? The real value of many assets lies in their ability to generate income. A $2,000.00 computer in the hands of a skilled graphic artist is worth more than just $2,000.00