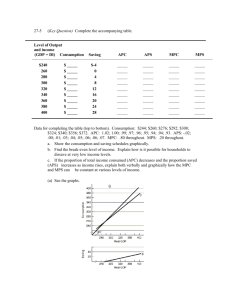

MULTIPLIER EFFECT Friday, 19 February 2021 The Multiplier Effect ◦ The multiplier shows how an increase in spending (injection) produces a more than proportional increase in national income. ◦ Properties: 1. Must be > 1 (because you divide by a number 0 < x < 1) 2. It works in opposite directions ◦ The multiplier is derived from the mpc → The Marginal Propensity to Consume (mpc) = how much of every extra Rand of national income will be used for consumption as opposed to saving →The Marginal Propensity to Save (mps) = how much of every extra Rand of national income will be saved The multiplier in a 2-sector model ◦ The size of the multiplier depends on the proportion of any increase in income that is spent. ◦ The larger the mpc, the bigger the multiplier (positive relationship) ◦ The smaller the mpc, the smaller the multiplier ◦ It is the money that stays in the economy ◦ For every R1 injected, some percentage will be spent and some will be saved, e.g. ◦ Y = R 100 000 ◦ C = R 60 000 (60% is consumed) → mpc = 0,6 ◦ S = R 40 000 (40% is saved) → mps = 0,4 mpc and mps relationship and formulas ◦ mpc + mps = 1 ◦ The money can only be used in these two ways, so the propensities will add up to one. ◦ This implies: ◦ mps = 1 – mpc ◦ mpc = 1 – mps ◦α= 1 1 −𝑚𝑝𝑐 = 1 𝑚𝑝𝑠 ◦ E.g. mpc = 0,6 and mps = 0,4, then ◦α= 1 1 −𝑚𝑝𝑐 = 1 𝑚𝑝𝑠 = 1 1−0,6 = 1 0,4 = 2,5 Aggregate Spending in billions (AE) Y = Income E = Equilibrium • Scale line where AE = Y • AE = C + I + G (Aggregate Expenditure) AE1 = C + I + G • • E at AE = R40, Y = R100 AE = Y E1 ∆E R 50 ∆I/∆G ∆Y AE = C + I + G E R 40 ∆Y ∆I or ∆G → Total expenditure changes with same amount as ∆I or ∆G • AE shifts to AE1 with ∆ • The multiplier causes Y → Y1 (R100 → R125) • E1 at AE = R50, Y = R250 • ∆Y K = multiplier = ∆E = gradient of AE = 45° R 100 R 125 Total Income (Y) R125−R100 R25 = = 2,5 R10 R50−R40