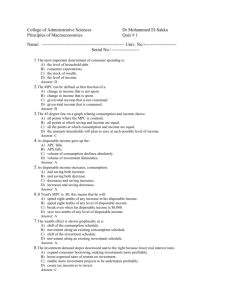

Fun!!! With the MPC, MPS, and Multipliers Special thanks to Mr. David Mayer & Mr. Ken Norman from whom I adapted this power point Marginal Propensity to Consume (MPC) • The fraction of any change in disposable income that is consumed. • MPC= Change in Consumption Change in Disposable Income • MPC = ΔC/ΔDI Marginal Propensity to Save (MPS) • The fraction of any change in disposable income that is saved. • MPS= Change in Savings Change in Disposable Income • MPS = ΔS/ΔDI Marginal Propensities • MPC + MPS = 1 –.: MPC = 1 – MPS –.: MPS = 1 – MPC • Remember, people do two things with their disposable income, consume it or save it! The Spending Multiplier Effect • An initial change in spending (C, I, G, NX) causes a larger change in aggregate spending, or Aggregate Demand (AD). The Spending Multiplier Effect • Why does this happen? –Expenditures and income flow continuously which sets off a spending increase in the economy. The Spending Multiplier Effect –Ex. If the government increases highway spending by $200 billion, then highway contractors will hire and pay more workers, which will increase aggregate spending by more than the original $200 billion. The First Round of Government Spending Causes The Biggest Splash MPC of 75% G spends $200 billion on the highways. Highway workers save 25% of $200 billion [$50 billion] & spend 75% or $150 billion on boats. Boat makers save 25% of $150 bil. [$37.50 bil.] & spend 75% or $112.50 bil. on iPod Minis, etc. Calculating the Spending Multiplier • The Spending Multiplier can be calculated from the MPC or the MPS. • Multiplier = 1/1-MPC or 1/MPS • Multipliers are (+) when there is an increase in spending and (–) when there is a decrease Expenditure Multiplier ME [Change in G, I, or NX] = 1/MPS MPC .90 .80 .75 .60 .50 1/MPS 1/.10 1/.20 1/.25 1/.40 1/.50 = M = 10 = 5 = 4 = 2.5 = 2 Calculating the Tax Multiplier • When the government taxes, the multiplier works in reverse • Why? – Disposable income is decreased, meaning we spend less • Tax Multiplier = MPC/ 1-MPC or MPC/ MPS – Its negative if taxes are increasing – Its positive if taxes are decreasing Tax Multiplier MT [Change in Taxes] = -MPC/MPS MPC .90 .80 .75 .60 .50 = M -MPC/.10= -9 -MPC/.20= -4 -MPC/.25= -3 -MPC/.40= -1.5 -MPC/.50= -1 MPC/MPS MT = MPC/MPS MT -9 ME = 1/MPS ME MPC .9 10 .8 5 .75 4 -3 -4 .60 2.5 -1.5 .5 2 -1 The larger the MPC, the smaller the MPS, and the greater the multiplier. The tax multiplier is always one less than the spending multiplier. The Balanced Budget Multiplier in G = in T • When Government Spending increases are matched with an equal size increase in taxes, that change ends up being = to the change in Government spending • Why? Mathematically - 1/MPS + -MPC/MPS = 1- MPC/MPS = MPS/MPS = 1 Economically - Part of any tax change effects savings, meaning the change in spending due to the tax change is always less • The balanced budget multiplier always = 1 Multiplier Practice • Assume US citizens spend $.90 for every extra $1 they earn. • Further assume that the real interest rate (i) decreases, causing a $50 billion increase in Investment (I). • Calculate the effect of this increase in spending on AD. Step 1: Calculate the MPC and MPS MPC = C / DI MPS = 1- MPC = Step 2: Determine which multiplier to use, and whether its + or – The problem mentions an increase in I, use a (+) spending multiplier Step 3: Calculate the Spending and/or Tax Multiplier Step 4: Calculate the Change in AD ( C, I, G or NX) * Spending or Tax Multiplier More Practice • Assume Germany raises taxes on its citizens by 200b. • Assume that Germans save 25% of the change in their disposable income. • Calculate the effect of these taxes on the German economy. More Practice • Assume the Japanese spend 4/5 of their disposable income. • Assume that the Japanese government increases its spending by 50 trillion and in order to maintain a balanced budget simultaneously increase taxes by 50t. • Calculate the effect of these changes on the Japanese Aggregate Demand.