Ch 8 Presentation 1 (Macro Chapter 8

advertisement

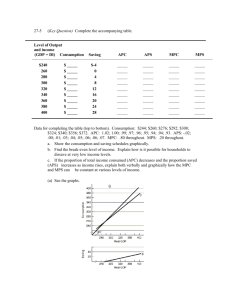

Macro Chapter 8 Presentation 1- Marginal Propensities and the Multiplier Income, Consumption, and Savings • In general, as income goes up, people spend more--- Direct relationship • People also tend to save more as income increases • Savings = Disposable Income - Consumption 45-Degree Line • A reference line used to compare consumption and savings • Consumption = DI • If you assume that the reference line is DI, then the vertical distance between the 45 degree line and a given consumption line will tell you the amount of savings Income and Consumption Consumption and Disposable Income, 1983-2005 10000 Consumption (billions of dollars) 9000 05 45° Reference Line C=DI 8000 04 03 01 7000 02 00 C 99 6000 Saving In 1992 5000 98 97 96 95 94 93 92 4000 3000 83 2000 84 88 87 86 85 91 90 89 Consumption In 1992 1000 45° 0 0 2000 4000 6000 8000 Disposable Income (billions of dollars) 10000 Dissaving • Spending more on consumption than your aftertax income Break-Even Income • The level of disposable income at which households will spend all DI and have zero savings Average Propensity to Consume (APC) • the fraction or % of income that is consumed Consumption APC = Income Average Propensity to Save (APS) • The fraction or % of income that is saved Saving APS = Income Average Propensities Contd. • Since DI is either consumed or saved…. • APC + APS = 1 • Ex- if APS is .04, APC must be .96 Marginal Propensity to Consume (MPC) MPC = Change in Consumption Change in Income • The fraction that is spent from a change in DI • Ex- If income increases from 470B to 490B, and consumption increases from 435B to 450B • MPC = (450-435)/490-470= 15/20 = .75 Marginal Propensity to Save (MPS) MPS = Change in Saving Change in Income • Ex. If income increases from 470 B to 490B and Savings increases from 20B to 25B calculate MPS and MPC • MPS = (25-20)/(490-470) = 5/20 = .25 • *** MPS + MPC = 1 so MPC = 1-.25 = .75 The Multiplier Effect • There is a direct relationship between changes in spending and real GDP • ***A change in total spending leads to a larger change in GDP (multiplies) • The money initially spent goes to profits, wages, rents etc. which are then spent in a chain reaction down the line The Multiplier Effect Change in Real GDP Multiplier = Initial Change in Spending • Or • Change in Real GDP = multiplier x initial change in spending Multiplier Effect and Marginal Propensities Multiplier = 1 1 - MPC -orMultiplier = 1 MPS Sample Problem • The MPC is .8 and a business increases investment by $5 Billion. What is the multiplier? How much increase in GDP? • Multiplier = 1/MPS or 1/1-MPC = 1/(1-.8) = 5 GDP = 5 x 5 = 25 Billion increase The Multiplier Effect Increase in investment of $5 Second Round Third Round Fourth Round Fifth Round All other rounds Total $20.00 (1) Change in Income $ 5.00 3.75 2.81 2.11 1.58 4.75 $ 20.00 $4.75 15.25 13.67 11.56 8.75 5.00 (2) (3) Change in Change in Consumption Saving (MPC = .75) (MPS = .25) $ 3.75 $ 1.25 2.81 .94 2.11 .70 1.58 .53 1.19 .39 3.56 1.19 $ 15.00 $ 5.00 $1.58 $2.11 $2.81 ΔI= $5 billion $3.75 $5.00 1 2 3 4 Rounds of Spending 5 All The MPC and the Multiplier MPC Multiplier .9 10 .8 5 .75 4 .67 .5 3 2