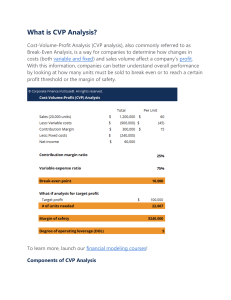

COST-VOLUME-PROFIT (CVP) ANALYSIS Traditional Income Statement Sales Less: COGS Gross Profit Less: OpEx Operating Income xx (xx) xx (xx) xx Profit = ∆ in units above BEP x CM/u Targeted Income as a Percent of Sales Revenue Contribution Margin Income Statement Sales Less: Variable expenses Contribution Margin Less: Fixed expenses Operating Income xx (xx) xx (xx) xx When expressed in net income, add back the income taxes to get operating income Cost-Volume-Profit (CVP) Analysis - examines the behavior of total revenues, total costs, and operating income as changes occur in the output level, selling price, variable cost per unit, or fixed costs of a product Break-even point - that point of activity level where total revenues equal total costs, thus, there is neither profit nor loss Variable cost ratio - Contribution margin ratio - Operating Income Approach Set OI = 0 proportion of each sales used to cover variable costs proportion of each sales dollar available to cover fixed costs and provide for profit BEP in Sales OI = Sales – Variable expenses – Fixed expenses Target Profit Sales = 𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡𝑠 + 𝑇𝑎𝑟𝑔𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝐶𝑀 𝑟𝑎𝑡𝑖𝑜 Contribution Margin Approach Total CM = Fixed expenses 𝐵𝐸𝑢𝑛𝑖𝑡𝑠 𝐹𝑖𝑥𝑒𝑑 𝑐𝑜𝑠𝑡𝑠 = 𝐶𝑀/𝑢 Multiple-Product Analysis Direct fixed costs - fixed costs which can be traced to each segment and would be avoided if the segment did not exist Common fixed costs Target Profit Set OI = Target profit fixed costs that are not traceable to the segments and that would remain even if one of the segments was eliminated Sales Mix - relative combination of products being sold by a firm; the percentage of each product included in total sales Degree of Operating Leverage - a measure of the sensitivity of profit changes to change in sales volume. The greater the degree of operating leverage, the more the changes in sales activity will affect profits. Degree of Operating Leverage = CM / Operating Income Graphical Representation of CVP Relationship Sensitivity Analysis - The point where the total revenue line and the total cost line intersect is the break-even point. Assumptions of CVP Analysis 1. When represented graphically, the behavior of total revenues and total costs are linear in relation to the output level within a relevant range and time period. 2. The selling price, total fixed costs, and variable costs per unit are known and remain constant over the relevant range. 3. What is produced is sold. 4. The sales mix, when multiple products are sold, is assumed to be known and will remain constant as the level of total units sold changes. Risk and Uncertainty Margin of Safety - units expected to be sold or revenue expected to be earned above the break-even volume; indicates the amount by which actual or planned sales may be reduced without incurring a loss Operating Leverage - the use of fixed costs to extract higher percentage changes in profits as sales activity changes. The greater the fixed costs in relation to variable cost, the greater is the operating leverage available. a what-if technique that examines the impact of changes in underlying assumptions on an answer. The data can be varied as desired to see what impact changes have on the expected profit.