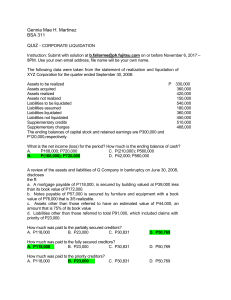

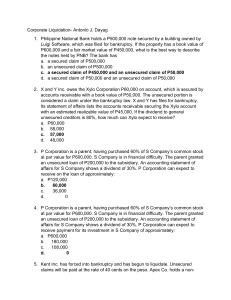

Partnership FORMATION Recognition of Non-Cash Asset 1. Agreed Value 2. Fair Market Value 3. Book Value Formation Prepare journal entries to adjust to agreed value Debit investments; Credit capital account For those accounts with contra-accounts, use the contra-account title. Methods of Equating Capital 1. Bonus method – mere transfer of capital 2. Goodwill method - recognize asset OPERATIONS Rules for Dividing Profit 1. In accordance with the agreement 2. Capital interest 3. Book value Rules for Dividing Losses 1. In accordance with the agreement 2. Division of profits 3. Capital interest Types of Withdrawal 1. Personal/Temporary a. In anticipation of salary profits or allowances b. Charged to drawing 2. Capital/Permanent a. Charged to capital DISSOLUTION Admission of a New Partner Admission by purchase Mere transfer of capital Revaluation to old partners Admission by investment Bonus: Total Agreed Capital (TAC) = Total Contributed Capital (TCC) Revaluation: recognize other assets Retirement/Withdrawal Sale to a new partner (refer to ABP) Sale to continuing partners (refer to ABP) Sale to partnership Bonus Method: Cash Settlement xx Interest of ret partner (xx) Bonus to remaining partner (xx) Revaluation method Cash Settlement xx Interest to ret partner (xx) Share of ret partner xx Interest of ret partner x% Total Asset Revaluation xx LUMP-SUM LIQUIDATION 1. Realization of non-cash asset and distribution of gain/loss. 2. Payment of liquidation expense 3. Payment of liabilities to outsiders 4. Elimination of capital deficiency (check solvency) 5. Payment to partners a. Loan balances b. Capital balances INSTALLMENT LIQUIDATION 1. Realization of non-cash asset on a piece-meal basis 2. Gain/loss on realization 3. Cash priority program or safety payments 4. Distribution of available cash Cash, beginning xx Cash realization of NCA xx Liquidation expense (xx) Liabilities (xx) Cash withheld (xx) Available Cash xx Corporate Liquidation STATEMENT OF REALIZATION & LIQUIDATION - Periodic report of trustee (e.g. monthly) intended to show progress toward the liquidation. - Quitting concern not going concern STATEMENT OF AFFAIRS - Preliminary report of trustee - Financial statement designed for insolvent corporation - Summary of estimated results of liquidation CLASSIFICATION Assets 1. Assets pledged with fully secured creditors 2. Assets pledged with partially secured creditors 3. Free assets Liabilities 1. Unsecured creditors with priority a. Administrative or liquidation expenses b. Wages payable c. Taxes 2. Fully secured creditors 3. Partially secured creditors 4. Unsecured creditors without priority RECOVERY PERCENTAGE - Claims of unsecured creditors without priority - Recovery percentage: NFA / US CRs without priority Net Free Assets FS Assets xx FS Liabilities (xx) Other Financial Assets xx US CRs without priority xx NET FREE ASSETS xx Unsecured Creditors without priority PS Liabilities xx PS Assets (xx) US CRs without Priority xx Est Deficiency to Unsecured Creditors Net Free Assets – US CRs without Priority PAYMENTS TO CREDITORS 1. Fully secured creditors = 100% 2. Partially secured creditors a. Secured part = 100% b. Unsecured part = Unsecured part x Recovery Percentage 3. Unsecured creditors with priority = 100% 4. Unsecured creditors without priority = Unsecured Liab. w/o priority x Recovery Percentage (Note: 2b and 4, the result if Net Free Assets) Long-Term Construction Contracts OVERVIEW - Issued on May 28, 2014, it supersedes: 1. IAS 18 – Revenue 2. IAS 11 – Construction Contracts 3. IFRIC 13 – Customer Loyalty Program 4. IFRIC 15 – Agreements for Construction of Real Estate 5. IFRIC 18 – Transfers of Assets from Customers 6. SIC 31 – Revenue Barter Trans Involving Advertising Services - Improve comparability of reported revenue - Establish principles about the nature, timing, and uncertainty OBJECTIVE of revenue and cash flows arising from a contract with customer SCOPE - Applies to all contract with customers EXCEPT: 1. Leases 2. Insurance contracts 3. Financial instruments 4. Guarantees 5. Certain non-monetary exchanges - Sale of non-monetary financial assets, such as PPE, real estate or intangible assets will also be subject to some of the requirements of the new model - Contract with customer may be partially within the scope of another standard DEFINED TERMS Contract - An agreement between 2 or more parties that creates enforceable rights and obligations Customer - A party that has contracted with an entity to obtain goods or services in exchange for consideration Income - Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in an increase in equity, other than those relating to contributions from equity participants Performance Obligation - A promise in a contract with a customer to transfer to the customer either; 1. A good or service (or bundle) that is distinct 2. Series of distinct goods or services that are substantially the same and that have the same pattern of transfer with customer Revenue