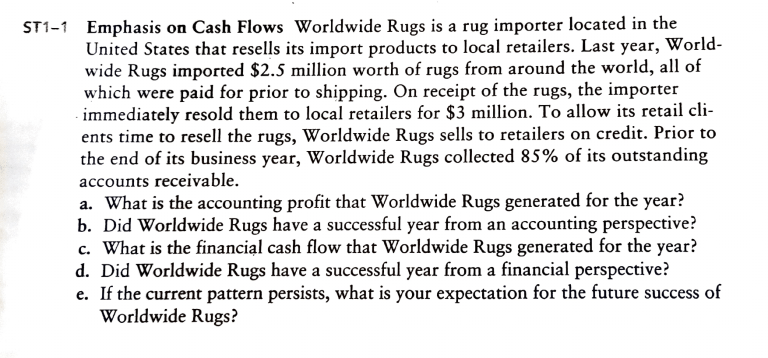

ST1-1 Enmphasis on Cash Flows Worldwide Rugs is a rug importer located in the United States that resells its import products to local retailers. Last year, Worldwide Rugs imported $2.5 million worth of rugs from around the world, all of which were paid for prior to shipping. On receipt of the rugs, the importer immediately resold them to local retailers for $3 million. To allow its retail clients time to resell the rugs, Worldwide Rugs sells to retailers on credit. Prior to the end of its business year, Worldwide Rugs collected 85% of its outstanding accounts receivable. a. b. C. d. What is the accounting profit that Worldwide Rugs generated for the year? Did Worldwide Rugs have a successful year from an accounting perspective? What is the financial cash flow that Worldwide Rugs generated for the year? Did Worldwide Rugs have a successful year from a financial perspective? e. If the current pattern persists, what is your expectation for the future success of Worldwide Rugs? E1-1 Ann and Jack have been partners for several years. Their firm, A & J Tax Prepara- tion, has been very successful, as the pair agree business-related questions. One disagreement, however, concerns the legal form of their business. For the past 2 years, Ann has tried to convince Jack to incorporate. She believes there is no to and sees only benefits. Jack strongly disagrees; he thinks incorporating the business should remain a partnership forever. First, take Ann's side, and explain the positive side to incorporating the business. Next, take Jack's side, and state the advantages to remaining a partnership. Last, what information would you want it you were asked to make the decision for downside Ann and Jack? on most E1-3 The end-of-year parties at Yearling, Inc., are known for their extravagance. thank the employees for their hard work, management provides the best food and entertainment. During the planning for this year's bash, a disagreement broke Out between the treasurer's staff and the controller's staff. The treasurer's staff con that the firm was running low cash and might have trouble paying its bills tended Over the coming months; they requested that cuts be made to the budget for the on party. The controller's staff believed that any cuts were unwarranted, as the firm continued to be very profitable. Can both sides be correct? Explain your E1-4 You have been made video conferencing. answer. fora day at AlIMCO, which develops technology for A manager of the satellite division has asked you to authorize a treasurer capital expenditure in the amount of $100,000. The manager states that this expenditure is necessary to continue a long-running project designed to use satellites to allow video conferencing anywhere on the planet. The manager admits that the satellite concept has been surpassed by recent technological advances in telephony, but he believes that AIMCO should continue the project because $2.5 million has already been spent over the past 15 years on this project. Although you believe the project will generate future cash outflows that exceed its inflows, the manager believes it would be a shame to waste the money and time already spent. Use marginal cost-benefit analysis to make your decision regarding whether you should authorize the $100,000 expenditure to continue the project. Persc7a: inance Problem P1-3 Cash flows It is typical using cash flows over for Jane to plan, monitor, a given period, typically and assess her financial position has a savings account, month. Jane 6% per year while it offers short-term investment and her bank loans money at of 5%. Jane's cash flows during August were a as follows: rates Item Cash inflow -$1,000 Clothes Interest received Cash outflow $ 450 -500 Dining out -800 Groceries Salary 4,500 Auto payment -355 Utilities -280 Mortgage -1,200 Gas a. b. Determine Jane's total cash inflows and cash Determine the If there is d. If there is C. P1-4 -222 a a outflows. cash flow for the month of August. shortage, what are a few options open to Jane? surplus, what would be a prudent strategy for her net to follow? Marginal cost-benefit analysis and the goal of the firm Ken analyst for Bally Gears, Inc., has been asked to evaluate a Allen, capital budgeting The manager of the automotive division believes that replacing the roboticsproposal. used on the heavy truck gear line will produce total benefits of $560,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $400,000 (also in dollars) over that same period. An initial cash today's investment of $220,000 would be manager estimates that the existing Show how Ken will required to install the new equipment. "The robotics can be sold for $70,000. apply marginal cost-benefit analysis techniques to determine the following: a. The marginal benefits of the proposed new robotics. b. The marginal costs of the proposed new robotics. C. The net benefit of the proposed new robotics. d. What should Ken recommend that the company do? Why? e. What factors besides the costs and benefits should be considered decision is made? before the final P1-7 Marginal and average tax rates Using the tax rate schedule given in Table 1.2, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the fol- lowing levels of partnership earnings before taxes: $10,000; $80,000; $300,000; $500,000; $1 million; $1.5 million; and $2 million. b. Plot the average tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). What generalization can be made concerning the relationship between these variables? P1-8 Marginal tax rates Using the tax rate schedule given in Table 1.2, perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $15,000; S60,000; $90,000; $150,000; $250,000; $450,000; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). Explain the relationship berween these variables.