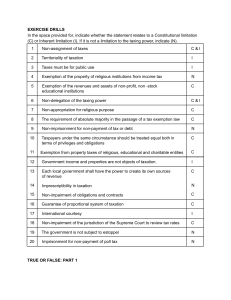

Exercise Drill No. 1 In the space provided for, indicate whether the statement relates to Constitutional limitation (C) or Inherent limitation (I). If it is not a limitation to the taxing power, indicate (N). 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. Non-imprisonment for non-payment of tax or debt. Non-delegation of taxing power. Taxes must be for public use. Exemption of the property of religious institutions from income tax. Exemption of the revenues and assets of non-profit, non-stock educational institutions. Territoriality of taxation. Non-appropriation for religious purpose. The requirement of absolute majority in the passage of a tax exemption law. Non-assignment of taxes. Imprisonment for non-payment of poll tax. Exemption from property taxes of religious, educational and charitable entities. Non-impairment of the jurisdiction of the Supreme Court to review tax cases. Each local government shall have the power to create its own sources of revenue. Imprescriptibility in taxation. Non-impairment of obligation and contracts. Guarantee of proportional system of taxation International courtesy Government income and properties are not objects of taxation. The government is not subject to estoppel. Taxpayers under the same circumstance should be treated equal both in terms of privileges and obligations. C I I C C I C C N N C C C N C C I I N C