View PowerPoint

advertisement

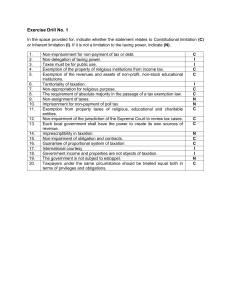

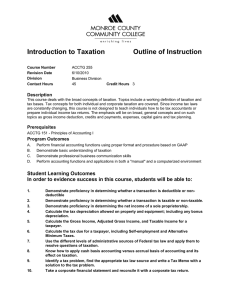

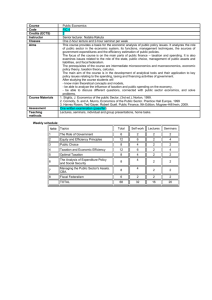

National Tax Association September 29, 2006 Five Key Things Non-Lawyers Should Know About Tax Law and Its Policy Implications Walter Hellerstein Francis Shackelford Professor of Taxation University of Georgia Law School Overview “No Taxation Without Representation” Is Not a Rule of Law Every Tax That Is Unfair Is Not Unconstitutional A Tax Is Not an Assessment of Benefits One Person’s State Tax Incentive Is Another Person’s Discriminatory Tax You Owe a Tax on Things You Buy Regardless of Where You Buy Them “No Taxation Without Representation” Is Not A Rule of Law Residence and Source Bases for Taxation Residence-based Taxation Without Representation Political Principle Source-based Taxation Without Representation Discrimination concerns Administrative concerns Every Tax That Is Unfair Is Not Unconstitutional Federal Constitutional Restraints Are Limited Limitations on Federal Taxing Power Limitations on State and Local Taxing Power Exports, “Direct” Taxes, Geographical Uniformity, Due Process Equality and Uniformity Extraterritoriality Burdens on Commerce Interference with Federal Supremacy Finer Tuning Must Come From Legislative Branch A Tax Is Not An Assessment of Benefits Any Other View Would Undermine View That Government Exists to Provide for Common Good A Tax Is the Means of Distributing the Burden of the Cost of Government Taxpayers Generally Have No Right to Any Specific Quid Pro Quo for Taxes Paid Whether a Tax Should Be Designed as an Assessment of Benefits Is a Different Question One Person’s State Tax Incentive Is Another Person’s Discriminatory Tax Reduced tax on stock transfers to encourage trading on New York exchanges Tax exemption for pineapple wine to encourage fledgling Hawaii wine industry Boston Stock Exchange v. State Tax Commission, 429 U.S. 318 (1984) Bacchus Imports, Ltd. v. Dias, 468 U.S. 263 (1984) Income tax credit for machinery and equipment to encourage new investment in Ohio Cuno v. DaimlerChrysler, Inc 126 S. Ct. 1854 (2006 ) ., 386 F.3d 738 (6th Cir. 2004), reversed on other grounds, Key Policy Questions: Who should draw the line: courts or Congress? Where should the line be drawn? You Owe a Tax on Things You Buy Regardless of Where You Buy Them Consumption Should Be Taxed Where Consumption Occurs Value Added Taxes and Retail Sales/Use Taxes Levy Tax on Goods on Destination Basis Legal Liability at Destination Is Indisputable Key Practical Question Is Enforceability Key Policy Issues: Fairness and Efficiency versus Administrability OECD, EU, and U.S. Subnational Initiatives