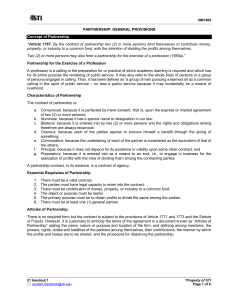

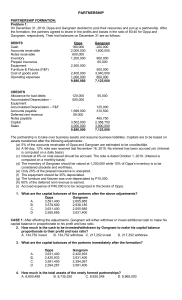

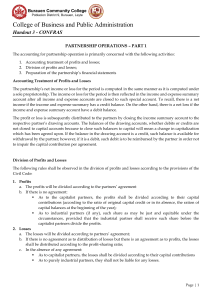

ACCOUNTING FOR SPECIAL TRANSACTIONS (Advanced Accounting 1) A partnership is an unincorporated association of two or more individuals to carry on, as co-owners, a business, with the intention of dividing the profits among themselves. Characteristics of a partnership 1. Ease of formation 2. Separate legal personality 3. Mutual agency 4. Co-ownership of property 5. Co-ownership of profits 6. Limited life 7. Transfer of ownership 8. Unlimited liability (this is applicable to a general partnership) Accounting for partnerships The following are the major considerations in the accounting for the equity of a partnership: Formation – accounting for initial investments to the partnership Operation – division of profits or losses Dissolution – admission of a new partner and withdrawal, retirement or death of a partner Liquidation – winding-up of affairs Valuation of contributions of partners All assets contributed to (and related liabilities assumed by) the partnership shall be measured at fair value. Partners’ ledger accounts 1. Capital accounts 2. Drawing accounts 3. Receivable from/ Payable to a partner Bonus on initial investments A bonus exists when the capital account of a partner is credited for an amount greater than or less than the fair value of his contributions. The bonus is treated as adjustment to the capital accounts of the other partners.