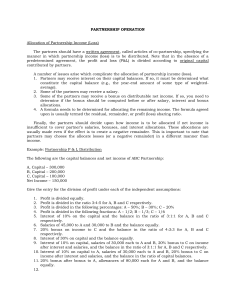

Burauen Community College Poblacion District 9, Burauen, Leyte College of Business and Public Administration Handout 3 - CONFRAS PARTNERSHIP OPERATIONS – PART 1 The accounting for partnership operation is primarily concerned with the following activities: 1. Accounting treatment of profits and losses; 2. Division of profits and losses; 3. Preparation of the partnership’s financial statements Accounting Treatment of Profits and Losses The partnership’s net income or loss for the period is computed in the same manner as it is computed under a sole proprietorship. The income or loss for the period is then reflected in the income and expense summary account after all income and expense accounts are closed to such special account. To recall, there is a net income if the income and expense summary has a credit balance. On the other hand, there is a net loss if the income and expense summary account have a debit balance. The profit or loss is subsequently distributed to the partners by closing the income summary account to the respective partner’s drawing accounts. The balances of the drawing accounts, whether debits or credits are not closed to capital accounts because to close such balances to capital will mean a change in capitalization which has been agreed upon. If the balance in the drawing account is a credit, such balance is available for withdrawal by the partner; however, if it is a debit, such debit is to be reimbursed by the partner in order not to impair the capital contribution per agreement. Division of Profits and Losses The following rules shall be observed in the division of profits and losses according to the provisions of the Civil Code: 1. Profits a. The profits will be divided according to the partners’ agreement b. If there is no agreement: ▪ As to the capitalist partners, the profits shall be divided according to their capital contributions (according to the ratio of original capital credit or in its absence, the ration of capital balances at the beginning of the year); ▪ As to industrial partners (if any), such share as may be just and equitable under the circumstances, provided that the industrial partner shall receive such share before the capitalist partners divide the profits. 2. Losses a. The losses will be divided according to partners’ agreement; b. If there is no agreement as to distribution of losses but there is an agreement as to profits, the losses shall be distributed according to the profit-sharing ratio; c. In the absence of any agreement: ▪ As to capitalist partners, the losses shall be divided according to their capital contributions ▪ As to purely industrial partners, they shall not be liable for any losses. Page | 1 ILLUSTRATIVE PROBLEMS: Problem 1: DIVISION OF PROFITS Joshua, James and Kath have the following result of operations for the month of January: Merchandise Inventory, January 1 Sales Purchases Rent Expense Office Supplies Expense Transportation Expense Representation Expense Repairs Expense Salaries Expense Depreciation Expense Debit P 300,000 Credit P 8,100,000 6,800,000 200,000 30,000 100,000 50,000 20,000 600,000 100,000 The merchandise inventory on January 31, 2021 is P200,000. In addition, James and Kath, capitalist partners, have capital balances of 65,000 and 35,000, respectively. Joshua, on the other hand, is an industrial partner. Requirements: 1. Compute for the partnership’s net income for the period. 2. Divide the net income assuming the profit-sharing agreement for James, Kath, and Joshua is 50%, 40%, and 10%, respectively 3. Divide the net income assuming: a. The capitalist partners have no profit-sharing agreement, but the partners agreed that Joshua, the industrial partner, will receive a profit share equivalent to 10% of net income. b. No profit-sharing agreement for all partners c. Assuming Joshua is a capitalist-industrial partner and he contributed a capital of P25,000 and per partnership agreement, he would receive a 10% share in the partnership as an industrial partner. Problem 2: DIVISION OF LOSSES Sean and Andrew, capitalist partners, have capital balances of 60,000 and 40,000 respectively. Partnership affairs are managed solely by Marino, the industrial partner. During the first month of its operations, the partnership suffered a net loss of 30,000. Requirements: 1. Divide the net loss assuming Sean, Andrew, and Marino agreed to share profits at 50%, 40% and 10%, respectively, but losses shall be divided by all partners equally. 2. Divide the net loss assuming Sean, Andrew, and Marino agreed to share profits at 50%, 40% and 10%, respectively, but did not arrive at an agreement as to division of losses. 4. Divide the net income assuming: a. The capitalist partners have no profit-sharing and loss-sharing agreement. b. Assuming Joshua is a capitalist-industrial partner and he contributed a capital of P25,000 and per partnership agreement, he would receive a 10% share in the partnership as an industrial partner. Income summary: 6900. 8100 1100. ___________ 100,000. sh.josh capital Sh. Of James sh.of kath Joshua. 10,000 (35) 25,925. James ( 65) kath total (35) 100,000 58,000 58,000 31,000 31,000 /135 Page | 2 ARBITRARY AGREEMENTS IN COMPUTING PROFITS AND LOSSES In general, profits or losses shall be divided in accordance with the agreement of the partners. The ration in which the profits or losses from partnership operations are distributed is recognized as the profit and loss ratio. The partners may agree on any of the following scheme in distributing profits or losses: 1. Equally 2. Specified ratio or percentage 3. Based on capital ratio a. Ratio of original capital investments b. Ratio of capital balances at the beginning of the year c. Ratio of capital balances at the end of the year d. Ratio of average capital balances 4. By allowing interest on partners’ capital and the balance in an agreed ratio (Interest may be based on beginning capital, ending capital, or average capital) 5. By allowing salaries to partners and the balance in an agreed ratio 6. By allowing bonus to the managing partner based on profit and the balance in an agreed ratio 7. By allowing salaries, interest on partners’ capital, bonus and the remainder in agreed ratio Allowance of Interest on Partners’ Capital To give recognition to the differences in partners’ capital contribution, the partners may agree that an interest be allowed on their capital balances which may either be the beginning, ending, or average capital balances. Such agreement, including the rate of interest must be stipulated in the contract. It is important to note that the interest given to partners is not an expense of the partnership but as part of the distribution of profits or losses. Salaries or Bonus Allowed for Partner’s Service An equitable division of profits and losses frequently requires that financial consideration be given to the skills, talents, efforts and work hours that active partners devote to the partnership business in addition to their capital investment. Consequently, salaries and/or bonuses may be given to a partner before the agreed profit-sharing ratio distribution is made. Salaries. To recognize personal contribution by the partner to the business, they may agree to receive salary, and divide the remaining profit among themselves by the agreed specified ratio. Except when stated otherwise, salary allowances are part of the net income/loss allocation to the partners. Also, salary distribution must be made even though the result of operation is loss, except when agreement states otherwise. Bonus. A partnership agreement may provide that a managing partner be allowed a bonus on earnings of the business to encourage profit maximization. The bonus may be computed as follows: Bonus = Bonus Rate x Base Net Income The bonus may be based on the following net income: 1. Net income before deducting salaries, interest, and bonus 2. Net income after deducting salaries and interest, but before bonus 3. Net income after deducting salaries, interest and bonus Page | 3 MULTIPLE BASES AND PRIORITY ALLOCATION This procedure depends on the partners’ agreement regarding priority in allocating the multiple basis of profit or loss. To divide equitably, the partners may agree that their salaries be first given priority over interest on capital and bonus, and if there is a remainder, it shall be divided in an agreed ratio. ILLUSTRATIVE PROBLEM: A, B, and C are capitalist partners of ABC Partnership which was established on January 10, 2021. The partnership earned a net income of P300,000 for the year ended December 31,2023. Moreover, the capital accounts in the ledger shows the following information: May 1 A, Capital 300,000 500,000 100,000 300,000 Jan. 1 June 30 Balance August 1 B, Capital 250,000 700,000 50,000 500,000 Jan. 1 Oct. 1 Balance Sept. 1 C, Capital 200,000 300,000 300,000 400,000 Jan. 1 Oct. 1 Balance Requirements: Compute the share of each partner in the net income using the following independent cases: 1. Net income is divided equally 2. Profit is divided using 2:1:1 ratio for A, B, and C, respectively 3. Net income is divided using the original capital investment ratio assuming the partners originally contributed a capital of P500,000, P300,000 and P200,000, respectively. 4. Net income is divided based on the beginning capital ratio 5. Net income is divided based on the ending capital ratio 6. Net income is divided based on the average capital ratio 7. Partners A, B, and C agreed to distribute net income or loss by allowing 12% interest on beginning capital balances, with the remainder to be apportioned 1:1:1 to A, B, and C, respectively. 8. Partners A, B, and C agreed to distribute net income or loss by allowing 12% interest on ending capital balances, with the remainder to be divided 50%, 30%, 20% to A, B, and C, respectively. 9. Partners A, B, and C agreed to distribute net income or loss by allowing 12% interest on average capital balances, with the remainder to be divided 3:2:1 to A, B, and C, respectively. 10. The partners agreed to allow an annual salary of P120,000 to Partner A, the managing partner. Any remainder is to be divided equally among partners A, B, and C. 11. The partners allowed a bonus to Partner A to be computed as 10% of net income before salary, interest, and bonus; and the remainder to be divided equally. 12. The partners allowed a bonus to Partner A to be computed as 10% of net income after salary and interest, but before bonus; and the remainder to be divided equally. 13. The partners allowed a bonus to Partner A to be computed as 10% of net income after salary, interest, and bonus; and the remainder to be divided equally. 14. The partners agreed that the net income will be divided through the following manner: Each of them would have a salary of 5,000 per month; a 6% interest on their respective average capital balances will be provided; a 10% bonus based on net income after deducting salary, interest, and bonus shall be granted to Partner A; and the balance shall be divided on the basis of 30%, 30% and 40% to A, B, and C, respectively. DISTRIBUTION OF INSUFFICIENT NET INCOME The agreement of the partners may provide for distribution of net income by allowing salary, and interest to partners. However, there may be instances when the result of operations may not be enough to meet these Page | 4 allowances. As a rule, the prescribed allocation for salaries should still be given in spite of the insufficiency of the partnership’s net income to cover them. The earnings deficiency produced as a result of giving salaries and/or interest shall be allocated among the partners based on their profit and loss sharing ratio. ILLUSTRATIVE PROBLEM: Raymund, Jason, and Kit formed a partnership. The partners agreed on the following mode of distribution of net income: 1. Interest on beginning capital balances computed as follows: Raymund – P10,000; Jason – P20,000; Kit – P30,000 2. Salary to Raymund of 120,000 3. Remainder to be distributed to Raymund, Jason, and Kit at 50%, 30% and 20%, respectively. Case 1: The net income is P200,000 Case 2: The net income is P170,000 Case 3: The net income is P50,000 Case 4: The net loss is P50,000 PROBLEM 1: DIVISION OF PROFITS A, B and C formed a partnership with the following information: A, a capitalist partner, contributed P600,000 cash. B, a capitalist-industrial partner, contributed P200,000 C, an industrial partner, contributed his skills and expertise. ABC Partnership has a P600,000 credit balance in its income and expense summary account during the first year of its operation. Required: Compute the profit share of each partner and make journal entries using the following independent cases: Case 1: A, B and C’s profit and loss sharing is 60%, 30% and 10%, respectively. Case 2: There was no agreement made regarding partnership profit distribution. Case 3: Each industrial partner will get a 10% of the partnership’s net income and the balance to be distributed to the capitalists according to their capital contribution. PROBLEM 2: DIVISION OF LOSSES X, Y and Z formed a partnership with the following information: X, a capitalist partner, contributed P300,000 Y, a capitalist-industrial partner, contributed P100,000 Z, an industrial partner, contributed his skills and expertise. XYZ Partnership has a P600,000 credit balance in its income and expense summary account during the first year of its operation. Required: Compute the share of each partner and make journal entries using the following independent cases: Case 1: X, Y and Z’s profit and loss sharing is 60%, 30% and 10%, respectively. Case 2: There was no agreement made regarding partnership profit distribution. Page | 5 PROBLEM 3: DISTRIBUTION OF PARTNERSHIP’S NET INCOME At December 31, 2021, the partnership’s income statement showed a net income amounting to P420,000. During the period, the partners’ capital accounts showed the following: Ann June 30 July 1 September 1 September 30 October 31 Gie P 50,000 P 100,000 (50,000) Lee (100,000) 50,000 200,000 150,000 Required: Show the distribution of partnership’s net income based on the following independent assumptions: 1. 2. 3. 4. 5. 6. 7. Equally Beginning Capital Ending Capital Average Capital Interest on Average capital, 12% per annum; The balance is to be divided based on ending capital Salaries of P10,000 per month to Ann; The balance is to be divided based on average capital Interest on average capital, 12% per annum; Annual salaries of P60,000 to Ann; The balance is to be divided based on average capital 8. Bonus of 10% of net income to Ann; The balance is to be divided based on average capital 9. Bonus of 10% of net income after bonus to Ann; Salaries of P5,000 per month to Ann; 6% annual interest on beginning capital balances to all partners; The balance is to be divided based on ending capital. 10. Bonus of 10% net income after salary, interest, and bonus to Ann; Salaries of P5,000 per month to Ann; 6% annual interest on average capital balances; The balance is to be divided based on average capital. PROBLEM 4: DISTRIBUTION OF PARTNERSHIP’S NET INCOME Labasan, Gabayan, and Villanueva are manufacturers' representatives in the architecture business. Their capital accounts were as follows: 09/ 1 A, Capital 80,000 300,000 60,000 01/01 05/ 01 3/1 90,000 B, Capital 400,000 50,000 40,000 1/ 1 7/ 1 9/1 8/ 1 C, Capital 120,000 500,000 70,000 30,000 1/ 1 4/ 1 6/1 Required: For each of the following independent profit and loss agreement, prepare the profit distribution schedule: 1. Salaries are P150,000 to Labasan, P200,000 to Gabayan, and P180,000 to Villanueva. Labasan receives a bonus of 5% of profit after bonus. Interest is 10% of ending capital balances. Labasan, Gabayan, and Villanueva divide any remainder in a 3:3:4 ratio. Profit was P789,600. 2. Interest is 10% of average capital balances. Salaries are P240,000 to Labasan, P210,000 to Gabayan, and P250,000 to Villanueva. Gabayan receives a bonus of 10% of profit after bonus and salary. Any remainder is divided equally. Profit was P680,800. Page | 6 3. Villanueva receives a bonus of 20% of profit after bonus and salaries. Salaries are P210,000 to Labasan, P180,000 to Gabayan, and P150,000 to Villanueva. Interest is 10% of beginning capital balances. Labasan, Gabayan, and Villanueva divide any remainder in an 8:7:5 ratio. Profit was P929,400. PROBLEM 5: DISTRIBUTION OF INSUFFICIENT NET INCOME On Jan. 1, 2020, the Quezonistas Partnership was formed with initial investments by the partners as follows: Jean Zaira Vanessa 2,000,000 1,000,000 1,000,000 According to the partnership agreement, profit or loss is to be divided among the partners as follows: 1. Salaries of P120,000 for Jean, P60,000 for Zaira and P60,000 for Vanessa. 2. Interest at 5% on the original capital balances. 3. The remainder to be divided among Jean, Zaira, and Vanessa in a ratio of 4:1:1, respectively. Required: Determine the partners' share in the profit assuming the partnership reported profit of P350,000 for the year ended Dec. 31, 2020. Page | 7