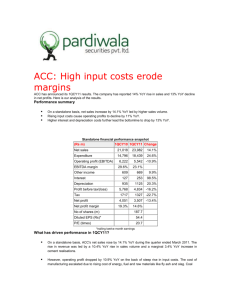

Vedanta Income Statement Analysis Despite its varying trend in Operating Income, during the year (2021-22), the Operating Income increased by 69% on a year-on-year (YoY) basis and a 6.81% increase cumulatively. The Company’s Operating Profit Margin increased by 14.17% on YoY Basis, however, there is a fall of 0.85% cumulatively. VEDANTA’s Depreciation and Amortisation Expenses increased by 21.74% on YoY Basis and 0.71% cumulatively. Other Income increased by 23.75% on YoY Basis and 16.64% cumulatively despite its varying trend. Net Profit increased by 64.19% on YoY Basis and 18.90% cumulatively despite its varying trend. Net Profit Margin increased by 24.07% on YoY Basis and 10.38% cumulatively. Vedanta Balance Sheet Analysis The Current Liabilities increased by 8.15% on YoY Basis from Rs.137,731 crores to Rs.148,959 crores and 0.24% cumulatively. Long-Term Debt stood at Rs. 27,693 Crores as compared to Rs. 24,740 crores during FY21, a growth of 11.93% on YoY Basis and 8.47% cumulatively. The Current Assets increased by 44.50% on YoY Basis and 5.13% cumulatively, while the Fixed Assets decreased by 2.61% on YoY Basis and 1.99% cumulatively. Overall, the Total Assets and Liabilities stood at Rs. 148,959 crores in 2022 as against Rs. 137,731 crores in 2021 showing an 8.15% increase on YoY Basis and a 0.24% growth cumulatively. Vedanta Cash Flow Statement Analysis Vedanta’s Cashflow from Operating Activities stands at Rs.12,564 crores in 2022 as compared to Rs. 13,664 Crores in 2021, seeing a decrease of 8.05%. The Cash Flow from Investing Activities reduced by 26.9% on YoY Basis. The Cash Flow from Financing Activities stands at Rs. –16,135 crores in 2022 as compared to Rs. 13,800 in 2021. Vedanta Ratio Analysis Profitability Analysis: o Profit Margin in FY 2021-22 is 27.93 and Gross Profit Margin is 23.28. o Asset Turnover Ratio is 0.55. o Return on Assets or Return on Investment is 208.73. Liquidity Analysis: o Current Ratio in FY 2021-22 is 0.61. o Quick Ratio is 0.80. o Inventory Turnover Ratio is 7.39. Solvency Analysis: o Debt to Equity Ratio in FY 2021-22 is 0.47. o Long Term Debt to Equity Ratio is 0.30. Hindustan Zinc Income Statement Analysis Operating Income, during the year (2021-22), the Operating Income increased by 30.09% on a yearon-year (YoY) basis and a 5.92% increase cumulatively. The Company’s Operating Profit Margin increased by 3.76% on YoY Basis, however, there is a fall of 0.72% cumulatively. Depreciation and Amortisation Expenses increased by 15.25% on YoY Basis and 14.49% cumulatively. Other Income decreased by 33.15% on YoY Basis and 7.03% cumulatively. Net Profit increased by 20.67% on YoY Basis and 0.75% cumulatively. Hindustan Zinc Balance Sheet Analysis The Current Liabilities decreased by 22.62% on YoY Basis from Rs. 6,094 crores to Rs. 7,,876 crores and 0.29% cumulatively. Long-Term Debt stands at Rs. 4295 Crores as compared to Rs. 5,538 crores during FY21, a decline of 22.44% on YoY Basis and 33.98% cumulatively. The Current Assets decreased by 2.38% on YoY Basis and 0.13% cumulatively, while the Fixed Assets increased by 3.95% on YoY Basis and 6.04% cumulatively. Overall, the Total Assets and Liabilities stood at Rs. 23,983 crores in 2022 as against Rs. 24,568 crores in 2021 showing an 2.38 % decrement on YoY Basis and a 0.16% decrement cumulatively. Hindustan Zinc Cash Flow Statement Analysis Hindustan Zinc’s Cashflow from Operating Activities stands out Rs.12,691 crores in 2022 as compared to Rs. 10,574 Crores in 2021, seeing a increase of 20.02%. The Cash Flow from Investing Activities stands out Rs. 846 crores in 2022 as compared to Rs. 2,435 Crores in 2021. The Cash Flow from Financing Activities stood at Rs. –12,258 crores in 2022 as compared to Rs. – 9,797 in 2021. Hindustan Zinc Ratio Analysis Profitability Analysis: o Profit Margin in FY 2021-22 is 55.11 and Gross Profit Margin is 45.20. o Asset Turnover Ratio is 0.78. o Return on Assets or Return on Investment is 81.13. Liquidity Analysis: o Current Ratio in FY 2021-22 is 1.23 o Quick Ratio is 1.80. o Inventory Turnover Ratio is 15.07. Solvency Analysis: o Debt to Equity Ratio in FY 2021-22 is 0.08. o Long Term Debt to Equity Ratio is 0.06.