Chapter 16 PARTNERSHIP LIQUIDATION – INSTALLMENT LIQUIDATION C

advertisement

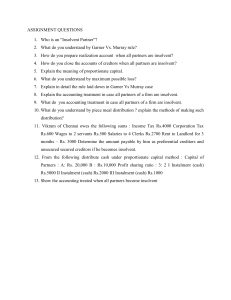

Chapter 16 PARTNERSHIP LIQUIDATION – INSTALLMENT LIQUIDATION Comprehensive Chapter Outline C Installment liquidations involve the distribution of cash to partners as it becomes available during the liquidation period and before all liquidation gains and losses have been realized. 1 No cash is distributed to partners until all nonpartner liabilities have been paid. 2 Payments to partners can be determined by a safe payment schedule for each installment distribution. 3 When the partners’ capital accounts are aligned in the profit and loss sharing ratios, safe payment schedules will not be necessary. 4 Once all the partners are included in an installment distribution, future installment payments to the partners will be in the profit sharing ratios. Thus, additional safe payment schedules are not necessary. CASH DISTRIBUTION PLANS INVOLVE RANKING PARTNERS IN TERMS OF THEIR VULNERABILITY TO POSSIBLE LOSSES, PREPARING A SCHEDULE OF ASSUMED LOSS ABSORPTION, AND PREPARING A CASH DISTRIBUTION PLAN. A Vulnerability rankings to possible losses are determined by dividing each partner’s equity by his or her profit sharing ratio. This amount is the maximum loss that the partner could absorb without reducing his or her equity below zero. B A schedule of assumed loss absorption is prepared using the vulnerability rankings. C 1 The schedule begins with preliquidation equities and charges each partner’s equity with its share of the partnership loss that would exactly eliminate the equity of the most vulnerable partner. 2 Each remaining partner’s equity is charged with its share of the loss that would exactly eliminate the equity of the next most vulnerable partner. 3 This process is repeated until the equities of all but the least vulnerable partner have been reduced to zero. A cash distribution plan is prepared from the schedule of assumed loss absorption. D 1 Under the plan, the first cash available for distribution goes to pay nonpartner liabilities. 2 Next, the least vulnerable partner will receive an amount of cash that will align that partner’s equity in the relative profit and loss sharing ratio with the next least vulnerable partner. 3 This process is repeated until all partners’ capital balances are aligned. 4 Remaining distributions are in the profit and loss sharing ratio. A cash distribution schedule can be prepared from the cash distribution plan. The schedule shows how cash is distributed as it becomes available. INSOLVENT PARTNERS AND PARTNERSHIPS A The Uniform Partnership Act gives the following priority ranks for claims against the separate property of a bankrupt partner: 1 Amounts owed to separate creditors 2 Amounts owed to partnership creditors 3 Amounts owed to partners by way of contribution B Partnership creditors must first seek recovery of their claims from partnership property. Creditors of individual partners must first seek recovery of their claims from individual property. C Solvent partnership, but insolvent partner: 1 Partnership creditors recover their claims from partnership property. 2 An insolvent partner’s personal creditors have a claim against partnership assets to the extent of the insolvent partner’s equity in such assets. 3 Creditors of an insolvent partner with a credit capital balance may have a claim against the personal assets of a solvent partner with a debit capital balance to the extent of the debit capital balance. 4 Partners with debit capital balances are obligated to the partnership for the amount of the debit balance; however, if the partner with the debit balance is insolvent, that partner’s personal assets will go to his personal creditors. 5 In states that have not adopted the Uniform Partnership Act, partners may be able to share in the personal assets of an insolvent partner with a debit capital balance.