LAWS 2203 SEMESTER 1 2000 QUESTION 3 MARK: 76 (A) Dakota

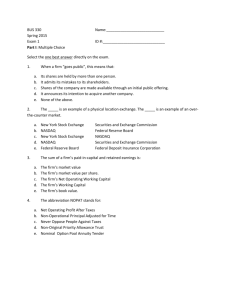

advertisement

LAWS 2203 SEMESTER 1 2000 QUESTION 3 MARK: 76 (A) Dakota (D) wants to do two different things. Firstly, he wants to invalidate AV's share reduction. Secondly, he wants payment of his debt. Share Reduction D can attempt to argue the share reduction itself does not comply with the Corporations Law. S256B(1) sets out 3 requirements a reduction must meet: (i) Fair and reasonable to shareholders as a whole. (i) Does not materially prejudice ability to pay back creditors. (i) Approved by shareholders under s256C. (i) Fair and Reasonable D can argue the expulsion of minority shareholders was not fair and reasonable. In Nicron V Catts, the court did hold payment of market price was reasonable. Here, market value is nil - 5 cents is above this. However, the facts are closer to Catts V Ampol - an attempt to circumvent takeover provision as in Ampol and unlike Nicron, there has been no offer made from the Ontario group for the shares. This raises issues of separate legal entity - AV will be owned by 3 subsidiaries of O. Cases attempting to pierce the corporate veil and consider corporate groups as a single entity have been unsuccessful in Australia (Pioneer Concrete V Yelnah, Qintese V Schrodern). However, this case may be successful. It is clear O is treating the companies as one if it wishes to acquire a new entity to write off losses to and increase the profitability of others. This suggests profits were treated as one corp. Furthermore, the arrangement was approved by O, not O's shareholding subsidiaries suggesting it is the head and brains of the trading venture - required by Smith, Stone & Knight. [This is a good argument but a SSK argument could succeed] It is possible the SS&K criteria may succeed here, but more evidence is needed on issues such as whether O appointed mangers, whether O was in constant control, whether O governed the venture and whether profits were made by O's skill and direction. [Presence of the intermediate shareholders and minority shareholders of AV reputes the argument] The fact O approved the decision is indicative of all of this. D may succeed in arguing an exception to separate legal entity, and if so will succeed in showing the deal unfair to shareholders as a whole by analogy to Catts V Ampol. (i) Prejudice ability to repay creditors This is probably satisfied. D could attempt to argue the payment of 5 cents a share did prejudice creditors, but the sum is probably insufficient to be considered material. (i) Approval The reduction is selective, and so must be approved under s256C(2). This requires a unanimous vote of ordinary shareholders (clearly not the case if D voted against) or a special resolution where no one being given consideration for their shares can support the resolution. It is not clear on the evidence whether this vote was supported by some selling shares, but the fact no one abstained and O group only represented 70% of the is (assuming all shareholders were present) when 75% was needed suggests they did. The reduction is invalid under s256B. Consequences This does not invalidate the reduction (s256D(2)). It only allows action against any individual involved in the contravention. As such, D cannot reverse the reduction on these grounds. He can only use this to take action against the directors for breach of the Corporations Law under a s1324 injunction. S1324(1a) allows a member to bring an action if s256B(1)(b) creditors or (a) (fair to shareholders) is breached. As this is not exclusive, it is arguable D can also bring an action for the breach of s256C(2), if s1324(10) will allow D to claim damages. Note D is no longer a member. However, as he has lost his shares, his interests are certainly affected for standing under s1324. As the breach occurred while he was a member, it is likely that the court will also look to standards similar to s1324(1A). Breach of Director's Duties D could attempt to argue that Bullwrinkle (B), as a director appointed by Yukon (Y), has breached his fiduciary duty to act for the benefit of the whole company (s181, Hospital Product) by arguably considering the interests of Y when acting in his capacity as a director in AV. However, as the general meeting has passed a resolution, B has not performed any acts himself unless misled that meeting, of which there is no evidence. This may also be insolvent trading of share capital under s588G, but even if this were so, D could not reverse the decision. He would also struggle to show he was "affected" for s1324. (2) The Debt D is best advised to make a statutory demand, under s459E. The debt is quantified and greater than $2K, and not damages. It is unlikely AV could challenge this disputing the existence of the debt or that it is a substantial injustice. The effect of a statutory demand is that if it is not paid or challenged within 21 days, the company is deemed insolvent (s459C). As a creditor, D could then bring an action for compulsory winding up (ss461, 462). If AV is wound up, D will only see a fraction of the money given their high debts and low value. However, it appears AV does not want to be wound up, particularly now that O is in control and wishes to write off its losses. AV will therefore pay D in order not to be declared insolvent. QUESTION 3B AV's best option at this point is to go into voluntary administration. This is assuming it has not reached some sort of deal for O to cover it. The directors can put a company into voluntary administration if it is likely to become insolvent (s436A). Given AV's high debts, this is likely to be the case. This will result in the appointment of an administrator to control the business (s437A). The administrator will then meet with the creditors, who will decide whether to accept administration or wind the company up. After this, the administrator will have 21 days to report on the best course of action for the company before the creditors meet to decide whether to accept the recommendation. At this point, the creditors could also choose to wind the company up. The risk of this strategy is that the creditors may wind AV up. There are, however, several advantages: (1) s440A - J create a stay on proceedings - no creditors can take action during the administration. (2) The directors will be unable to engage in trade during this period, and so will be protected from insolvent trading (s588a). (3) The creditors may be persuadable to accept a deed of arrangement, reducing the debts or giving AV more time. IF AV has the backing of O, this would be more likely. The result of this is that AV should go into administration, or face a greater risk of winding up proceedings being instituted against it by a creditor under s461 and 462. Although most companies do still collapse after this, there is still a greater chance of survival.