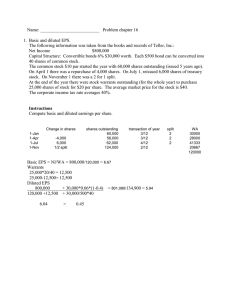

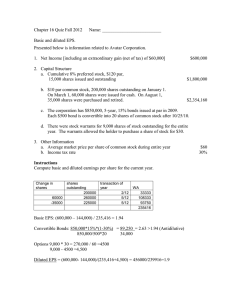

IAS 33 Earnings per Share A practical guide Contents Introduction 2 Presentation of EPS measures 3 Calculation of basic EPS 4 Calculation of diluted EPS 6 Worked example 1 – convertible bond 9 Worked example 2 – employee share options 10 IAS 33 Earnings per Share A practical guide 1 Introduction Although IAS 33 Earnings per Share has not changed for several years, it is still a standard that causes headaches for preparers of financial statements and contains more than a few traps for the unwary. The practical difficulties experienced in calculating earnings per share often stem from the fact that IAS 33 is very rules-based. This lack of an underlying principle means that the calculations required can sometimes give counter-intuitive results, which in turn causes uncertainty for preparers as to whether they have applied the requirements correctly. This practical guide has been put together to help you navigate the complexities, avoid the common pitfalls and ease the process when it comes to calculating earnings per share, or EPS as it is commonly known. It includes a detailed step-by-step guide to calculating both basic and diluted EPS, as well as two worked examples dealing with scenarios that often catch people out. IAS 33 Earnings per Share A practical guide 2 Presentation of EPS measures As well as setting out how EPS should be calculated, IAS 33 also sets out which entities are required to present EPS information and what information they should present. Which companies need to present earnings per share? • Any company that wishes to do so may voluntarily present EPS. However, if it does so, both basic and diluted EPS must be calculated and presented in accordance with IAS 33 (or, for those companies using old UK GAAP, FRS 22). • All companies with ordinary shares or potential ordinary shares (such as options or convertible debt) which are publicly traded must disclose EPS. In addition, any company applying for a listing must also disclose EPS in its prospectus. • A parent company which prepares combined consolidated and separate financial statements may present EPS on a consolidated basis only. • IAS 34 Interim Financial Reporting requires that interim reports for companies wihin the scope of IAS 33 contain EPS disclosures in the same form as required by IAS 33 for full financial statements, presented for the current and all comparative periods. What needs to be presented? IAS 33 sets out two measures of EPS which must be disclosed on the face of the Income Statement – basic and diluted EPS. In addition, if an entity has any discontinued operations as defined by IFRS 5 Non‑current Assets Held for Sale and Discontinued Operations, basic and diluted EPS should be presented separately for both continuing and discontinued operations, as well as for the entity as a whole. Companies may disclose other adjusted EPS measures, but these should not be given more prominence than the required measures. Entities wishing to disclose an adjusted EPS figure may choose any number as the numerator, provided they disclose a reconciliation from it to a number in the income statement. However, adjusted EPS must be presented on both a basic and diluted basis, with the denominator in each calculation determined in accordance with IAS 33. Disclosures about how all EPS measures presented have been calculated are also required in the notes to the financial statements. IAS 33 Earnings per Share A practical guide 3 Calculation of basic EPS Basic EPS is calculated as follows: Profit/(loss) attributable to ordinary equity holders Weighted average number of ordinary shares outstanding Key definitions Profit/(loss) attributable to ordinary equity holders Profit after tax, excluding amounts attributable to non-controlling interests, less any amounts accruing to holders of preference shares which are accounted for as equity. Ordinary shares Equity instruments which have the lowest priority of participation in profit for the period. If an entity has multiple classes of share, it needs to determine which of these has the lowest priority – this will be the 'ordinary share' class for EPS purposes. If two or more classes of shares rank equally at the bottom of the priority list, EPS will need to be calculated for each of these, taking into account the relative rights. Weighted average number of ordinary shares outstanding The number of shares outstanding at the beginning of the period, adjusted by the number of shares bought back or issued during the period on a time‑weighted basis. Potential complexities Preference shares accounted for as equity Any amounts charged or credited directly to equity in relation to preference shares accounted for as equity, whether these are dividends, coupon payments, payments on redemptions made during the period or other accounting adjustments relating to such shares, are likely to impact the numerator in the basic EPS calculation. Shares held by the entity These are not treated as shares in issue, and are therefore deducted from the denominator in the basic EPS calculation. The same applies to shares held by an employee benefit/ESOP trust sponsored by the entity. Partly paid shares These are treated as a fraction of a share reflecting the extent to which they give entitlement to participate in dividends during the period. (N.B – the extent to which they carry voting rights is irrelevant for this test) Contingently issuable shares These are not included in the denominator when calculating basic EPS. The exception to this is that shares which are issuable dependent only on the passage of time, with all other conditions having been satisfied, are included in the calculation of basic EPS. An example of this would be mandatorily convertible preference shares, whether classified as partly debt and partly equity or wholly equity. For such an instrument, the weighted average number of shares is adjusted as if conversion occurred immediately on the initial date of issue of the convertible instrument. However, no adjustment should be made to reverse any interest expense or preference dividend payable included in the profit or loss attributable to ordinary equity holders – for this figure, conversion is only factored in when it actually occurs. IAS 33 Earnings per Share A practical guide 4 Bonus issues, share splits, share consolidations and any other transactions which change the number of shares in issue without changing the entity’s resources When a bonus issue or similar transaction takes place, the number of ordinary shares outstanding is adjusted as if the transaction had taken place at the start of the earliest period for which EPS is presented, to maintain comparability. This will result in a restatement of prior year EPS figures. Note that if a bonus issue takes place after the end of the period but before the financial statements are issued, EPS should be disclosed on a post-bonus issue basis. Rights issues A rights issue, where typically shares are issued to existing shareholders for less than the current market price, is accounted for by adjusting from the start of the earliest period for the ‘bonus element’ of the rights issue. The ‘bonus element’ arises because the transaction could be viewed as issuing some shares for market value and some for nothing. The bonus element is calculated using a ‘theoretical ex-rights price’ and comparing this to the market price prior to the rights issue. IAS 33 Earnings per Share A practical guide 5 Calculation of diluted EPS The steps for calculating diluted EPS are as follows: 1. Identify all potential ordinary shares that the company has in issue. 2.For each category of potential ordinary share, calculate the earnings (or loss) per incremental share from continuing operations (see overleaf for how to do this). 3.Rank the potential ordinary shares, with the most dilutive (those with the lowest earnings per incremental share or biggest loss per incremental share) at the top of the list. 4.Basic EPS is adjusted by each in order until the earnings per incremental share of subsequent classes is greater than the current adjusted figure. So compare the top figure on the list with your basic EPS from continuing operations. If it is bigger than the basic EPS figure, all of your potential ordinary shares are anti‑dilutive and your diluted EPS figure is the same as your basic EPS figure. (Note that if you have a basic loss per share, only potential ordinary shares with a bigger loss per incremental share could be dilutive). If not, adjust the numerator and denominator in the basic EPS calculation as follows: Earnings figure per basic EPS calculation for continuing operations + earnings impact of the first category of potential ordinary shares No. of shares per basic EPS calculation for continuing operations + No. of shares impact of the first category of potential ordinary shares 5.Compare this adjusted figure with the earnings per incremental share of the next category of potential ordinary shares on your list from step 3. If the earnings per incremental share is bigger, you have finished calculating dilutive EPS – all of your other categories of potential ordinary shares are anti-dilutive. If not, adjust again by factoring in the impact of the next category of potential ordinary shares on the numerator and denominator. 6.Repeat step 5 until you reach a point where all remaining categories of potential ordinary shares are anti-dilutive or you reach the end of your list of categories of potential ordinary shares. You have now calculated your diluted EPS figure from continuing operations. 7.Calculate diluted earnings per share from discontinued operations and for the business as a whole, by adjusting the basic EPS calculation to factor in those potential ordinary shares that were included in the calculation of diluted EPS from continuing operations. This means that in rare circumstances it is possible for diluted EPS for the business as a whole to be greater than basic EPS, where there are potential ordinary shares that have a dilutive effect on EPS from continuing operations but an anti-dilutive effect on overall EPS. Key definitions Potential ordinary shares Options, warrants, convertible debt, convertible preference shares – anything that could be turned into ordinary shares. Includes obligations under share-based payments, such as employee share schemes or contingent consideration arrangements for business acquisitions, even though these may still be partly contingent on future events. Earnings per incremental share The effect on earnings per share that conversion of a category of potential ordinary shares into ordinary shares would have. IAS 33 contains detailed rules on how to calculate this for various types of potential ordinary share – see below. If-converted method Method for calculating earnings per incremental share for convertible instruments (debt or equity). Treasury stock method Method for calculating earnings per incremental share for options, warrants and similar items (including share option schemes). Dilutive potential ordinary shares Potential ordinary shares for which the earnings per incremental share is lower than the following figure: basic EPS from continuing operations, adjusted for any other categories of potential ordinary share with a lower earnings per incremental share than this category. Anti-dilutive potential ordinary shares Potential ordinary shares that are not dilutive. IAS 33 Earnings per Share A practical guide 6 Calculating earnings per incremental share Earnings effect The effect on earnings is generally the actual charge to P&L that would be avoided by conversion: • For a convertible instrument, this will be interest costs less any associated tax deductions for liabilities held at amortised cost, or fair value movements taken to the P&L for liabilities held at fair value through the profit and loss. • For an option or warrant, this will be nil if it is classified as equity (as it will have no earnings impact) or the post-tax amount of the fair value movement during the period if it is accounted for at fair value through profit or loss. • For a share-based payment scheme, there will generally be no adjustment to earnings for the charge incurred as a result of applying the requirements of IFRS 2 Share-based Payment, unless the scheme offers a choice of settlement in cash or shares but is accounted for as cash-settled. Number of shares effect When calculating the number of incremental shares in relation to a category of potential ordinary shares, the approach used to determine the numerical effect depends on the type of instrument: • For convertible debt, convertible preference shares or other similar convertible instruments, the denominator is increased by the number of shares that would be issued if the instrument were converted – this is referred to as the ‘if-converted’ method. This can give slightly counter-intuitive answers, as conversion is assumed even if the conversion option is ‘out of the money’. • Options (and warrants) can only ever be dilutive if the exercise price is less than the average share price for the period. To calculate the number of incremental shares: a) Calculate the total proceeds that will be received if all of the options or warrants are exercised. b)Calculate the number of shares that this would buy based on market prices by dividing the total proceeds of the exercise of the options by the company’s average share price for the period. c)Calculate the difference between the answer to (b) and the total number of shares that will be issued when the options or warrants are exercised. IAS 33 uses the resulting number of ‘free’ shares as the ‘number of shares’ effect of the options or warrants. This is referred to as the ‘treasury stock’ method and, unlike the if-converted method, does take into account if the option is ‘in the money’ or not. For both categories of instrument, any potential ordinary shares that are dilutive are deemed to be converted into shares at the beginning of the reporting period, or the date of issue if this is later. Potential complexities Contingently issuable shares Contingently issuable shares are shares which may be issued in the future, depending on performance criteria. IAS 33 specifies that these should be included in the calculation of diluted EPS based on the number of shares which would be issued if the end of the reporting period were the end of the contingency period. Contingently issuable shares never have an earnings impact, so they will always be dilutive. IAS 33 Earnings per Share A practical guide 7 If the contingency is in the form of total earnings during a period (e.g. total PBT of £3m over the next three years), this assessment is straightforward e.g. if the £3m has been met at the end of the first year then the additional ordinary shares are taken into account in the calculation of diluted EPS. However, if it is expressed as average earnings (PBT of £1 m per year for each of the next three years) this should be converted to the equivalent total earnings position (total PBT of £3m over the next three years) in order to make the assessment. So if the profits are £1.5m at the end of the first year, no additional shares are brought into the calculation. However, if profits are £5m at the end of the first year, the additional shares are included in the calculation of diluted EPS because, if the end of the first period were the end of the contingency period, the condition would have been achieved. Contingently issuable potential ordinary shares A further level of complexity is introduced where potential ordinary shares may be issuable dependent on a contingency, for example remuneration schemes where share options may be issued to employees dependent on the future performance of the company. The general rule is: 1.Apply the requirements for contingently issuable shares to work out whether the potential ordinary share will be issued. 2.If the contingency is not met for the purposes of IAS 33, ignore the instrument. If it is met, apply the if-converted or treasury stock method to the instrument as normal. Employee share options Employee share option schemes are a particularly common type of contingently issuable potential ordinary share – hence they may have a dilutive effect on EPS even prior to vesting. For unvested options which are contingent on performance measures, the entity will need to determine whether or not they are expected to vest, as described above for contingently issuable shares and options. If vesting depends purely on completion of a period of service, the calculation is done on the basis that all employees in employment at the end of the reporting period complete the period of service. An earnings adjustment is generally not necessary for share option schemes. The exception to this is for schemes which can be settled either in cash or in shares at the discretion of the employee. For this type of award, IFRS 2 requires that cash settlement is assumed but IAS 33 requires that equity settlement is assumed. Therefore, the charge to the income statement for the cash settled scheme should be reversed and the charge that would be recognised for an equity-settled scheme included instead. When applying the treasury stock method to calculate the number of incremental shares for a share option scheme, for IAS 33 purposes the exercise price of the option is deemed to be the cash exercise price plus the remaining IFRS 2 charge per share which has not yet been recognised in the income statement. ESOP trusts Where shares are held in an ESOP trust or similar vehicle for the purposes of settling share schemes in the future, the amount of shares held does not impact the calculation of incremental shares set out above. The only impact that the number of shares held by an ESOP trust or similar vehicle will have on the calculation of EPS is that they reduce the number of shares treated as being in issue for the purposes of calculating the denominator in the basic EPS calculation, as set out above. IAS 33 Earnings per Share A practical guide 8 Worked example 1 – convertible bond Scenario ABC Plc has 1,000,000 £1 ordinary shares and 1,000 £100 10% convertible bonds (for simplicity assumed to be issued at par), each convertible into 20 ordinary shares on demand, all of which have been in issue for the whole of the reporting period. ABC Plc’s share price is £4.50 per share and earnings for the period are £500,000. The tax rate applicable to the entity is 21%. EPS calculations Basic EPS is 50p per share (500,000/1,000,000). The earnings per incremental share for the convertible bonds is calculated as follows: Earnings effect = No. of bonds x nominal value x interest cost, less tax deduction at 21% = 1,000 x 100 x 10% x (1-21%) = £7,900 Incremental shares calculation Assume all bonds are converted to shares, even though this converts £100 worth of bonds into 20 shares worth only £90 and is therefore not economically rational. This gives 1000 x 20 = 20,000 additional shares. Earnings per incremental share = £7,900 = 39.5p 20,000 Therefore the bonds are dilutive. Diluted EPS = £500,000 + £7,900 = 49.8p per share 1,000,000 + 20,000 IAS 33 Earnings per Share A practical guide 9 Worked example 2 – employee share options Scenario ABC Plc has 50 employees, each of whom has 1,000 unvested share options in a share option scheme. The exercise price of the options is £5 and the fair value of services still to be rendered by each employee, calculated in accordance with IFRS 2, is £1,200. ABC Plc has 1,000,000 ordinary shares in issue and the average share price for the period was £10. Earnings for the period are £500,000. EPS calculations Basic EPS is 50p per share (500,000/1,000,000). The earnings per incremental share for the employee share options is calculated using the treasury stock method as follows: Earnings effect = nil Incremental shares calculation Total exercise price of share options = nominal exercise price + remaining IFRS 2 charge per option =5+ Number of ‘full price’ shares = = 1,200 = £6.20 1,000 Number of options x exercise price Average price for the period 50 x 1,000 x 6.2 = 31,000 10 Number of ‘free’ shares = number of options – number of ‘full price’ shares = 50,000 – 31,000 = 19,000 Diluted EPS = £500,000 + £0 = 49.1p per share 1,000,000 + 19,000 IAS 33 Earnings per Share A practical guide 10 Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), a UK private company limited by guarantee, and its network of member firms, each of which is a legally separate and independent entity. Please see www.deloitte.co.uk/about for a detailed description of the legal structure of DTTL and its member firms. Deloitte LLP is the United Kingdom member firm of DTTL. This publication has been written in general terms and therefore cannot be relied on to cover specific situations; application of the principles set out will depend upon the particular circumstances involved and we recommend that you obtain professional advice before acting or refraining from acting on any of the contents of this publication. Deloitte LLP would be pleased to advise readers on how to apply the principles set out in this publication to their specific circumstances. Deloitte LLP accepts no duty of care or liability for any loss occasioned to any person acting or refraining from action as a result of any material in this publication. © 2015 Deloitte LLP. All rights reserved. Deloitte LLP is a limited liability partnership registered in England and Wales with registered number OC303675 and its registered office at 2 New Street Square, London EC4A 3BZ, United Kingdom. Tel: +44 (0) 20 7936 3000 Fax: +44 (0) 20 7583 1198. Designed and produced by The Creative Studio at Deloitte, London. 42674A