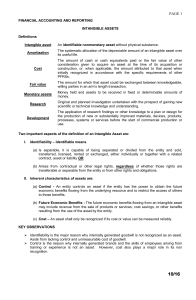

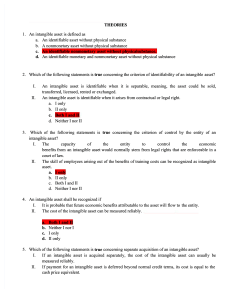

Chapter 8 “Intangible Assets” Covered by AASB 138/ IAS 38 Intangible Assets - are non-monetary assets without physical substance - includes patents, goodwill, mastheads, brand names, copyrights, r&d, and trademarks - must be separately disclosed in the statement of financial position (balance sheet) Class of intangible assets 1. Internally generated - specific value can’t be placed on each individual asset, and they cant be separately identified and sold - Not separable and not identifiable - Costs incurred as expense - cannot be revalued 2. Purchased - a specific value can be placed on each individual asset and can be separately identified and sold. - acquired intangibles includes patents, goodwill, mastheads, brand names, copyrights, r&d, and trademarks - separable and identifiable - costs incurred shown as asset - can be revalued if there is an active market Amortisation ● ● Limited Life - Amortised (begins when the asset is available for use) - Time period (max 20 years) or expected production units - residual amount zero Indefinite life - not amortised but impaired - carrying amount less recoverable amount Research and Development (a special case studied with intangibles) - may account for a large proportion of expenditure for some entities. - AASB 138 applies the simplifying assumption that all expenditure undertaken in the research and development is to be expensed. Research - considered separately from development - defined as original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. Development - (AASB 138, para 8) application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials, devices, products, processes, systems or services prior to the commencement of commercial production or use - typically involves the commercial application of knowledge generated in earlier research phases. - examples on lecture slide # 23 Please note: lecture slides: 24 and 26 Good Will (a special case of unidentifiable intangible) - Internally-generated: shown as an expense - Acquired: Shown as an asset : Cost of acquisition less FV of net assets and contingent liabilities. : Impairment loss is recognised. : Revaluation is not allowed. - Necessary to allocate purchased goodwill to specific cash-generating units - If recoverable amount of a cash generating unit is below its carrying amount, then any amount of goodwill attributed to that unit must firstly be reduced. - Please take note lecture slide: 42