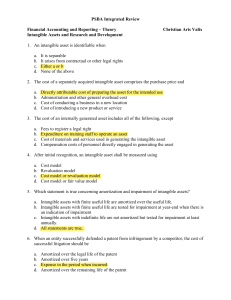

UNIVERSITY OF SANTO TOMAS UST-Alfredo M. Velayo – College of Accountancy España, Manila IAC 11 – INTEGRATED REVIEW IN FINANCIAL ACCOUNTING AND REPORTING 2ND TERM, ACADEMIC YEAR 2019-2020 INTANGIBLE ASSETS 1. On December 31, 2019, Aquafit Company exchanged 100,000 ordinary shares of P50 par value for the following assets: • A trademark valued at P1,500,000 • A land valued at P6,500,000 • A franchise right. No estimate of the value is available at time of exchange. The ordinary share of Aquafit Company is selling at P90 on the date of the exchange. How much should be the value of the franchise on the date of exchange? a. P2,000,000 b. P1,500,000 c. P1,000,000 d. zero Total fair value of shares issued 100,000 x 90 = P9,000,000 Fair value of trademark (1,500,000 Fair value of land (6,500,0000) Value assigned to franchise P1,000,000 2. Dowell Company purchased a patent on January 1, 2016 for P4,500,000. The patent was being amortized over its remaining legal life of 15 years expiring on December 31, 2030. During 2019, Dowell determined that the economic benefits of the patent would not last longer than 12 years from the date of acquisition. What amount should be reported in the December 31, 2019 statement of financial position as patent, net of accumulated amortization? a. P3,000,000 b. P3,200,000 c. P3,300,000 d. P3,600,000 Cost of patent Accumulated amortization, 12/31/2018 4,500,000/15 x 3 Carrying amount, January 1, 2019 2019 amortization 3,600,00/9 Carrying amount, December 31, 2019 P4,500,000 ( 900,000) P3,600,000 ( 400,000) P3,200,000 Dinar Company incurred P100,000 of research and development costs to develop a product for which a patent was granted on January 1, 2017. Legal fees and other costs associated with registration of the patent totaled P300,000. The patent is 3. How much is the amortization expense for the year 2017? a. P5,000 b. P15,000 c. P20,000 d. P30,000 P300,000/ 20 = P15,000 4. How much is the carrying value of the patent on December 31, 2019? a. P255,000 b. P248,800 c. P262,500 d. P335,000 Cost Accumulated amortization, December 31, 2019 P15,000 x 3 Carrying amount, December 31, 2019 P300,000 (45,000) P255,000 5. How much is the total expenses for the year 2019? a. P15,000 b. P95,000 c. P80,000 d. P87,500 Total expenses = P80,000 + P15,000 = P95,000 6. How much is the total expenses for the year 2019 assuming Dinar Company did not win the lawsuit? a. P80,000 b. P262,500 c. P87,500 d. P350,000 Total expenses = P80,000 + (300,000 – 30,000) = P350,000 OR: Legal fees P80,000 Amortization for ½ year 7,500 Carrying amount (for writeoff) at June 30 P300,000 – 37,500 262,500 Total expenses for 2019 P350,000 On January 1, 2019, Yen Company obtained a franchise from Euro Corp. to sell for 20 years Euro’s products. The initial franchise fee as agreed upon shall be P6,000,000, and shall be payable in cash, P1,000,000, when the contract is signed and the balance in four equal installments, thereafter, as evidenced by a non-interest bearing note. The agreement rate for this type of note is 12%. PV of P1 for 4 periods at 12% is .6355 and PV of ordinary annuity for 4 periods at 12% is 3.0373. 7. How much is the initial cost of the franchise? a. P6,000,000 b. P4,796,625 c. P4,177,500 d. P3,796,625 Down payment PV of future payments P1,250,000 x 3.0373 Cost of the franchise P1,000,000 3,796,625 P4,796,625 8. How much is the total amount charged against revenues for the year 2019? a. P458,875 b. P239,831 c. P945,426 d. P489,831 Annual amortization P4,796,625/20 P239,831 Continuing Franchise Fee (Royalty exp.) 5% x P5,000,000 250,000 Interest expense 12% x P3,796,625 455,595 Total expenses P945,426 9. Alcatel Company purchased an entity for P6,000,000 cash on January 1. The book value and fair value of the assets of the acquired entity as of the date of the acquisition follow: Book Value Fair Value Cash P 50,000 P 50,000 Accounts receivable 500,000 500,000 Inventory 1,000,000 1,500,000 Patent 450,000 Property, plant and equipment 2,000,000 3,000,000 In addition, the acquired entity had liabilities totaling P2,000,000 at the time of the acquisition. The acquired entity has no other separately identifiable intangible assets. What is the goodwill arising from the acquisition? a. P4,500,000 b. P2,550,000 c. P2,500,000 d. P500,000 Consideration given Fair value of net assets acquired P5,500,000 – P2,000,000 Goodwill P6,000,000 3,500,000 P2,500,000 10. On December 31, 2018, Irvins Company acquired the following intangible assets: • A trademark for P2,000,000. The trademark has 8 years remaining in the legal life. It is anticipated that the trademark will be renewed in the future, indefinitely, without problem. • A patent for P4,000,000. Because of market conditions, it is expected that the patent will have economic life for just 5 years, although the remaining legal life is 10 years. Because of a decline in the economy, the trademark is now expected to generate cash flows of just P120,000 per year. The useful life of the trademark still extends beyond the foreseeable horizon. The cash flows expected to be generated by the patent are P500,000 annually for each of the next years. The appropriate discount rate for all intangible assets is 8%. The present value of 1 at 8% for four periods is 0.74 and the present value of an ordinary annuity of 1 at 8% for four periods is 3.31. Irvins Company shall recognize a total impairment loss in 2019 at a. P2,845,000 b. P2,045,000 c. P1,980,000 d. P1,545,000 Carrying amount (Cost – Accum. Amort) Recoverable amount 500,000 3.31 120,000/8% Impairment loss Patents P3,200,000 1,655,000 P1,545,000 Trademark P2,000,000 1,500,000 P 500,000 11. Carola Inc. has a trademark purchased 5 years ago for P15,600,000. The said trademark was determined to have an indefinite useful life. During the current year, Carola noticed that some indicators of impairment are evident and thus tested the trademark for impairment. The net cash flows to be generated by the trademark have been determined to be either P585,000 with a probability of 70%, or P1,170,000 with a probability of 30%. The appropriate risk-adjusted interest rate is 10%. Determine the impairment loss. a. P14,764,287 b. P11,700,000 c. P7,995,000 d. P0 Carrying amount Recoverable amount (585,000 x 70%) + (1,170,000 x 30%) 10% Impairment loss P15,600,000 7,605,000 P7,995,000 12. On January 1, 2016, Starbucks Company signed a 12-year lease for a building. Starbucks has an option to renew the lease for an additional 6-year period on or before January 1, 2021. During January 2019, Starbucks made substantial improvements to the building. The cost of the improvements was P4,500,000, with an estimated useful life of 10 years. At December 31, 2019, Starbucks intended to exercise the renewal option. Starbucks has taken a full year’s depreciation on this improvement. In the December 31, 2019 statement of financial position, the carrying amount of this leasehold improvement should be a. P4,500,000 b. P4,200,000 c. P4,050,000 d. P4,000,000 Cost of the improvement Accumulated depreciation 4,500,000/10 Carrying amount P4,500,000 450,000 P4,050,000 The leasehold improvement shall be depreciated over the remaining lease term or the useful life, whichever is shorter. Remaining lease term Useful life 12 + 6 – 3 15 years 10 years (shorter) 13. Lucent Company purchased another entity for P8,000,000 cash. The acquiree had total liabilities of P3,000,000. Lucent Company’s assessment of the fair value it obtained when it purchased the other entity is as follows: Cash P1,000,000 Inventory 500,000 In-process research and development 5,000,000 Assembled workforce 1,200,000 What is the goodwill arising from the acquisition? a. P4,500,000 b. P3,300,000 c. P1,500,000 a. P300,000 Consideration given FV of net identifiable assets (P1M + .5M + 5M) – 3M Goodwill P8,000,000 3,500,000 P4,500,000 In-process research is recognized as an asset in business combination (subject to subsequent impairment testing), whereas assembled workforce does not qualify under the definition of asset. 14. Sheaffer Company engaged your services to compute the goodwill in the purchase of another entity which provided the following: Net income Net assets 2017 P 2,000,000 P 7,800,000 2018 2,500,000 8,700,000 2019 3,900,000 9,000,000 Goodwill is measured by capitalizing excess earnings at 25% with normal return on average net assets at 20%. How much is the purchase price for the other entity? a. P13,400,000 b. P12,800,000 c. P11,800,000 d. P10,700,000 Fair value of assets acquired P9,000,000 Goodwill Average returns (average for 3 years) P2,800,000 Normal returns (20% x P8,500,000) 1,700,000 Excess earnings P1,100,000 Divided by capitalization rate 25% Goodwill 4,400,000 Total purchase price P13,400,000 15. The owners of Acer Company are planning to sell the business to new interests. The cumulative net earnings for the past 4 years were P6,000,000 including casualty loss of P200,000. The current value of net assets of Acer Company was P16,000,000. Goodwill is determined by capitalizing average earnings at 8%. What is the amount of goodwill? a. P1,450,000 b. P1,550,000 c. P2,215,000 d. P3,375,000 Average net annual earnings (P6,000,000 + P200,000)/ 4 = Normal earnings P16,000,000 x 8% Capitalized at Purchase price Net assets at fair value Goodwill P1,550,000 8% 19,375,000 16,000,000 P3,375,000 16. HP Company acquired another entity on January 1. As part of the acquisition, P5,000,000 in goodwill was recognized. This goodwill was assigned to HP’s Internet cash generating unit. During the year, the Internet cash generating unit reported revenue of P8,000,000. Publicly traded companies with operations similar to those of the Internet cash generating unit had price-to-revenue ratio averaging 1.50. The book value of the assets and liabilities of HP’s Internet cash HP Company should recognize goodwill impairment loss of a. P6,000,000 b. P5,000,000 c. P4,800,000 d. P1,200,000 Fair value of the CGU based on PTR ratio P8,000,000 x 1.5 P12,000,000 Carrying amount of the CGU 25M – 7M 18,000,000 Impairment loss P 6,000,000 Impairment loss allocated to GW 5,000,000 Impairment loss allocated to identified assets P1,000,000 17. Coffee Bean Company incurred research and development costs in the current year as follows: Equipment acquired use in various researches and development projects Depreciation on the above equipment Materials used Compensation costs of personnel Outside consulting fees Indirect costs appropriately allocated The total research and development costs in income statement for the current year should be a. P850,000 b. P1,085,000 c. P1,235,000 d. P1,825,000 Total research and development costs P975,000 135,000 200,000 500,000 150,000 200,000 Coffee Bean’s P1,185,000 18. The research and development division of Dollar Company undertakes both research and development activities of the company. Its current development project on a prototype is near completion. The cost identified in this project consists of the following: Cost of materials used Training cost to operate the asset Fees to register trade design Initial operating losses Salaries of consultant for the projects Amortization of patent and license used in the project Selling and administrative expenses P5,000,000 100,000 50,000 500,000 2,000,000 100,000 1,000,000 What is the amount of development costs that should be capitalized? a. P7,150,000 19. Pataca Corporation provided the following information regarding its Research COVID-19XXX included in the company’s Intangible account as of December 31, 2019: Research MOP517 is for a research project which consists of the following charges: Salaries of research staff Patent acquired solely for the use in the project Special equipment acquired and useful for various similar research activities Patent acquired for use in several research projects including COVID-19XXX P18,000 12,000 10,000 16,000 The equipment and patents have been found to be useful for approximately five years. You have further discovered both patents and the equipment were acquired at the beginning of 2019. How much should be recognized as research and development expense for the year 2019? a. P56,000 b. P18,000 c. P35,200 d. P0 Total salaries and patent for use in the project Depreciation of equipment Amortization of patent 16,000/5 Research and development expense P30,000 2,000 3,200 P35,200 20. Won Company provided you the following information pertaining to its Research and Development activities for the year 2019: Searching for applications of new research findings Trouble-shooting in connection with breakdowns during commercial production Adaptation of an existing capability to a particular requirement or customer’s need as a part of continuing commercial activity Engineering follow-through in an early phase of commercial production Laboratory research aimed at discovery of new knowledge Design of tools, jigs, and molds involving new technology Quality control during commercial production, including routine testing of products Testing in search for product or process alternative Design and construction of preproduction prototype and model P 57,000 87,000 39,000 45,000 204,000 72,000 174,000 300,000 384,000 What is the total amount to be classified and expensed as research and development for 2019? a. P1,095,000 b. P1,017,000 c. P456,000 d. P561,000 During 2019, Fajardo Company incurred the following costs to develop and produce a computer software product: Completion of detailed program design Costs incurred for coding and testing to Establish technological feasibility Other coding costs after establishment of technological feasibility Other testing costs after establishment of technological feasibility Cost of producing product masters for training materials Duplication of computer software and training materials from product masters Packaging product P1,495,000 1,150,000 2,760,000 2,300,000 1,725,000 2,875,000 1,035,000 Fajardo correctly capitalized some of these expenditures as cost of the computer software. Fajardo determined the life of the software to be 5 years and it has a policy to take full year amortization in the year an internally generated asset was recognized. Based on its forecast, the pattern of future revenue from the software can be determined reliably and the software would bring total revenue of P10,000,000 over its life. In 2019, Fajardo reported a revenue of P1,500,000. 21. Determine the capitalized software cost. a. P9,660,000 b. P6,785,000 c. P5,060,000 d. P6,210,000 Research Commercial and technological feasibility not yet established and recognition criteria not yet met Period cost – Expense Development After establishment of commercial and technological feasibility (and other capitalization criteria for development costs are met) Intangible Asset Commercial Production Product Cost UNIVERSITY OF SANTO TOMAS UST-Alfredo M. Velayo – College of Accountancy España, Manila 22. Determine the amortization of computer software in 2019. a. P759,000 b. P1,012,000 c. P1,017,750 d. P1,357,00 P6,785,000/5 = P1,357,000 Default amortization method for intangible is straight-line, unless the enterprise can demonstrate another pattern of expected economic benefit from the asset, in which case, the justification for the use of this amortization method (other than straight-line) must be disclosed in the notes to the financial statements. IAC 11 – INTEGRATED REVIEW IN FINANCIAL ACCOUNTING AND REPORTING 2ND TERM, ACADEMIC YEAR 2019-2020 INTANGIBLE ASSETS – THEORY 1. Which is not within the definition of an intangible asset? a. Held for use in the production or supply of goods or services, for rental to others, or for administrative purposes b. Identifiable nonmonetary asset without physical substance c. A resource controlled by an enterprise as a result of past events d. A resource from which future economic benefits are expected to flow to the enterprise To qualify as intangible asset, an item must meet all of the following definition criteria: identifiability, control, and existence of future economic benefits (IAS 38). 2. Which is incorrect concerning the recognition and measurement of an intangible asset? a. If an intangible asset is acquired separately, the cost comprises its purchase price, including import duties and taxes and any directly attributable expenditure of preparing the asset for its intended use. b. If an intangible asset is acquired in a business combination that is an acquisition, the cost is based on its fair value at the date of acquisition. c. If an intangible asset is acquired free of charge or by way of government grant, the cost is equal to its fair value. d. If payment for an intangible asset is deferred beyond normal credit terms, its cost is equal to the total payments over the credit period. The purchase price in item d must be equal to the fair value of the asset, if practicably determinable, or its equivalent cash price, being the sum of the down payment plus the PV of all future payments. 3. The cost of intangible asset is composed of a. Purchase price excluding import duties taxes b. Purchase price including import duties taxes c. Purchase price including both refundable taxes d. Purchase price including trade discounts deducting import duties and nonrefundable and nonrefundable and nonrefundable and nonrefundable and rebates after taxes 4. Legal fees incurred by a company in defending its patent rights should be expensed when the outcome of the litigation is Successful Unsuccessful Expenditures incurred on an intangible asset subsequent to acquisition shall be recognized as expenses, unless the expenditure clearly provides economic benefits in excess of originally assessed standard of performance. In the above item, other than expensing the legal fees to defend the asset, if the defense proved to be unsuccessful, the remaining carrying value of the asset shall be written off. 5. Which one of the following is not a component of the cost of internally generated intangible asset? a. Cost of materials and services used or consumed in generating the intangible asset b. Cost of employee benefits arising from the generation of the intangible asset c. Fees to register a legal right d. Expenditure on training staff to operate the asset (expense because of uncertainty of economic benefit) 6. Which statement is incorrect concerning internally generated intangible asset? a. To assess whether an internally generated intangible asset meets the criteria for recognition, an enterprise classifies the generation of the asset into a research phase and a development phase. b. The cost of an internally generated asset comprises all directly attributable costs necessary to create, produce and prepare the asset for its intended use. c. Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance should not be recognized as intangible assets. d. Internally generated goodwill may be recognized as an intangible asset. Goodwill shall only be recognized when it arises business combination treated as an acquisition. from a 7. The following expenditures should be expensed when incurred, except a. Advance payment for delivery of goods or rendering of services (advances to suppliers) b. Relocation costs c. Advertising and promotion costs d. Organization and other start up costs 8. A lessee incurred costs to construct office space in a leased warehouse. The estimated useful life of the office is 10 years. The remaining term of the nonrenewable lease is 15 years. The cost should be a. Capitalized as leasehold improvement and depreciated over d. Expensed as incurred An item of PPE shall be depreciated over the expected pattern of economic benefits, which in the case of leasehold improvements is the shorter between the useful life and the remaining lease term. The shorter period is the estimated useful life. 9. An entity shall choose either the cost model or revaluation model as its accounting policy in measuring intangible asset. Which statement is correct? i. The cost model means that an intangible asset shall be carried at cost less any accumulated amortization and any accumulated impairment loss. ii. The revaluation model means that an intangible asset shall be carried at revalued amount less any subsequent accumulated amortization and any subsequent accumulated impairment loss. a. Both I and II b. Neither I nor II c. I only d. II only 10. It is the systematic allocation of the cost of an intangible asset less any residual value as an expense over the asset’s useful life? a. Depreciation b. Depletion c. Amortization d. Realization However, IAS definition. 38 still uses the term depreciation for this 11. In relation to amortization of intangible assets, if an intangible asset has a finite useful life a. It must be amortized over a period not exceeding 40 years b. It must be amortized across a period not exceeding 5 years c. It is not subject to an annual amortization charge d. It must be amortized over that life 12. In relation to amortization of intangible assets, PAS 38 Intangibles, requires that intangible asset with indefinite useful lives a. Are amortized by the straight-line method across their useful lives b. Must be amortized across a period of no more than 20 years c. Are not subject to an amortization charges d. Should not be amortized in a period in which maintenance of the asset occurs The following intangible assets are not amortized: intangible not yet available for use, assets with indefinite useful life, ad goodwill. 13. What is the proper time or time period over which to match the cost of an intangible asset with revenues if it is likely that the benefit of the asset will last for an indefinite period? a. 40 years b. 50 years c. Immediately d. At such time as a reduction in value can be quantitatively determined Item d is in effect impairment. Testing for impairment shall be made at least annually and whenever there is indication of impairment. 14. The appropriate method of amortizing intangible asset is best described by which of the following? a. The straight line method, unless the pattern in which the asset’s economic benefits are consumed by the enterprise can be determined reliably b. The double declining balance in all circumstances c. Management can make a subjective amount of periodic amortization without regard to any particular method d. The straight line method in all circumstances Default amortization method for intangible is straight-line, unless the enterprise can demonstrate another pattern of expected economic benefit from the asset, in which case, the justification for the use of this amortization method (other than straight-line) must be disclosed in the notes to the financial statements. 15. The best definition of useful life of an intangible asset is a. The legal life of the intangible. b. The period over which management believes the intangible asset will contribute to the revenue-producing process. c. Twenty years. d. The period over which the cost of the asset can be deducted for income tax purposes. 16. Which of the following factors should not be considered in estimating the useful life of intangible asset? a. Legal, regulatory or contractual provision b. Expected action by competitors or potential competitors c. Residual value d. Typical product life cycle of the asset 17. The residual value of an intangible asset should be presumed zero, unless i. There is a commitment by a third party to purchase the asset at the end of its useful life. ii. There is an active market for the asset and residual c. I only d. II only See par. 100, IAS 38. 18. Research is i. Original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. (Research) ii. Application of research finding or other knowledge to a plan or design for the production of new or substantially improved material, device, product, process, system or service, prior to the commencement of commercial production or use. (Development) a. Both I and II b. Neither I nor II c. I only d. II only 19. If a company constructs a laboratory building to be used as a research and development facility, the cost of the laboratory building is matched against earnings as a. Research and development expense in the period of construction b. Depreciation deducted as part of research and development cost c. Depreciation or immediate write-off depending on company policy d. An expense at such time as productive research has been obtained from the facility It is practicably assumed that the building has an alternative use, so only the depreciation during research and development period is expensed. 20. A research and development activity for which the cost should be expensed as incurred is a. Engineering follow-through in early phase of commercial production (overhead) b. Design, construction, and testing of preproduction prototypes and models (development) c. Trouble shooting in connection with breakdowns during commercial production (overhead) d. Periodic design changes to existing products (overhead) 21. The proper accounting for the costs incurred in creating computer software products is to a. Capitalize all costs until the software is sold. b. Charge research and development expense when incurred until technological feasibility has been established for the product. c. Charge research and development expense only if the computer software has alternative future use. 22. Which statement is correct regarding the proper accounting treatment for internal-use software costs? i. Preliminary costs should be capitalized as incurred. ii. Application and development costs should be capitalized as incurred. a. Both I and II b. Neither I nor II c. I only d. II only It is assumed in ii that the subsequent incurred meet the capitalization criteria. development costs 23. Which of the following statements is incorrect regarding internal – use software? a. The application and development costs of internal-use software should be amortized on the straight line basis unless another systematic and rational basis is more appropriate. b. Internal-use software is considered to be software that is marketed as a separate product or as part of a product or process. c. The costs of testing and installing computer hardware should be capitalized as incurred. d. The costs of training and application maintenance should be expensed as incurred. 24. Which following statements is correct regarding the treatment of start-up activities related to the opening of the new facility? i. Cost of raising capital should be expensed as incurred. ii. Costs of acquiring or constructing long-lived assets and getting them ready for their intended use should be expensed as incurred. a. Both I and II b. Neither I nor II c. I only d. II only Some costs relating to issue of shares are netted against the proceeds to arrive at contributed capital, while item ii is directly attributable cost that is capitalized. 25. Operating losses incurred during the start-up years of a new business should be a. Accounted for and reported like the operating losses of any other business b. Written off directly against accumulated profits c. Capitalized as a deferred charge and amortized over 5 years. d. Capitalized as an intangible asset and amortized over 5 years.