Successful Bonding of Reservation Projects and Tribal Entities- Edward Rubacha

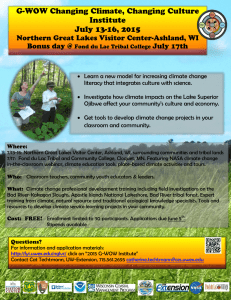

advertisement