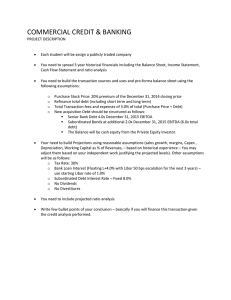

The fundamentals of a Successful Mission – A healthy

advertisement

#missioncritical The fundamentals of a Successful Mission – A healthy Business Partner Steve Spooner, CFO Fiscal Year 2013 Results $M Revenue FY13 $576.9 YoY Growth -5.7% Margin 55.6% OPEX ($) Non-GAAP NI* ($) EBITDA* ($) $276.7 / 48.0% $45.6 / 7.9% $85.0 / 14.7% Industry Leading Productivity Revenue per Average Headcount ($000s) * Trailing twelve months, most recent quarter A Well Run Business EBITDA Margin from Continuing Operations In the past 5 years Mitel has generated $412M of EBITDA Mitel: the only competitor with improved EBITDA margins! EBITDA / BPS EBITDA (%) TTM (Mrq) BPS Increase (Decrease) vs. PY (ttm) EBITDA calculated on same basis as Mitel Debt Position Net Debt Mitel’s Debt Reduction Net Debt $208M of Debt Reduction in the Past 5 Years Debt vs. the Competition $250 $200 $150 $100 $50 $0 -$50 -$100 -$150 Net Debt Debt vs. the Competition $7,000 $6,000 $5,000 $4,000 $3,000 $2,000 $1,000 $0 -$1,000 Net Debt $5.8 Billion Debt vs. EBITDA Gross Debt / EBITDA x x x x x x x x x Note: Comparables based on TTM results (Avaya, Shoretel, Aastra) Cashflow Consumed by Interest Costs Available Cashflow from Operations Consumed by Interest Cashflow from operating activities $44M $101M Interest expense $20M $438M $64M $539M 31% 81% Cashflow available to pay interest Interest expense / available cashflow Note: Avaya results TTM period ended March 31, 2013 A Solid Financial Footing In February 2013 we refinanced our Senior Long Term debt by entering into new credit agreements, consisting of: – – – $40M revolving credit facility – maturing in Feb 2018 $200M first lien term loan – maturing in Feb 2019 $80M second lien term loan – maturing in Feb 2020 Used excess cash to reduce overall debt levels Benefits of the new credit facilities – – – Extended the term on our existing facilities, which were due to mature in August 2014 $40M revolver provides additional liquidity (revolver on existing credit matured in August 2012) More favorable covenants Recent upgrades by credit rating agencies Upgraded Mitel’s liquidity rating, revised Mitel’s rating outlook to STABLE and affirmed Mitel’s ‘B3’ corporate family rating. Moody’s – February 27, 2013 Revised Mitel’s rating outlook to STABLE and affirmed Mitel’s ‘B’ long-term corporate credit rating. Standard and Poors – March 3, 2013 Minding the Store! Cash Flow From Operations $155M of Cashflow Generated in the Past 5 Years Strategy Execution DataNet / CommSource prairieFyre Software Inc. Recent Investment Analyst Ratings (post Q1) • BUY – Bank of America/Merrill • Sector Outperformer - CIBC • BUY – Canaccord • Sector Perform – RBC • BUY – MPartners • BUY – Cormark Securities What the Street is Saying “Mitel is innovating its solutions toward the tech trends of today, namely virtualization and cloud.” Cormark Securities – March 2013 “… business model is delivering solid operating leverage.” Bank of America – February 2013 “We view the debt refinancing with favorable terms as a positive …” Canaccord – March 2013 “… strong differentiation makes Mitel’s earnings leverage among the highest of its peers.” MPartners – March 2013 Financial Performance Enables Investment! Innovation Marketing Building the “A” team Channel success >> Mitel Director’s Briefing Amsterdam, 9–11 September 2013 #missioncritical