the race to produce low-carbon cars

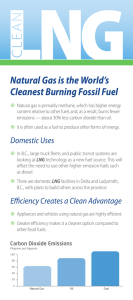

advertisement

THE RACE TO PRODUCE LOW-CARBON CARS WHICH TECHNOLOGY WILL WIN? Report of a Science|Business symposium Supported by This symposium was the sixth in a series of eight highlevel academic policy debates on energy research and innovation. It explored which fuels and technologies hold the best promise to deliver low-carbon road transport at a reasonable cost, and what EU policies might help accelerate investment by industry. Words David Pringle Design Peter Koekoek Editorial Direction Gail Edmondson Photography Vivian Hertz © Science Business Publishing Ltd 2013 www.sciencebusiness.net Supported by Hosted by EXECUTIVE SUMMARY Keir Fitch (left), deputy head of cabinet for Siim Kallas, vice-president of the European Commission, addresses participants T here are no shortage of initiatives throughout the European Union to support green vehicle technologies and sustainable fuels for road transport. But the vision of a market where low-carbon cars and fuels dominate continues to fade into the distant future. Despite more than a decade of support from many EU governments and intensive R&D by industry, “green cars” that significantly lower greenhouse gas emissions represent less than one per cent of total vehicle sales in the EU. The technology race is taking longer than expected, and the policy options are limited. At the same time, the need for low-carbon cars and fuels has only become more urgent. The EU has set an ambitious target to cut greenhouse gas emissions by 80 to 95 per cent by 2050, but emissions from road transport have risen 26 per cent between 1990 and 2008 – an alarming trend – and one-fifth of all CO2 emissions in Europe come from motor vehicles. Breakthroughs in alternative vehicle and fuel technologies will not only help battle climate change, but can help secure jobs and economic growth for the European auto industry while improving air quality and energy security. Which technologies hold the greatest promise for greening road transport? And will the heavy public investment in electric vehicles, hydrogen fuel-cell cars and sustainable biofuels ever pay off? Those questions were addressed by research, industry and policy experts attending the Science|Business symposium “The race to produce low carbon cars – which technology will win?” on 21 June 2013 in Brussels. This report summarises the half-day debate and key ideas and recommendations to accelerate breakthroughs in more sustainable cars and fuels. Over the next 10 years, more efficient petrol and diesel engines will be part of the answer to cutting road transport emissions – automakers estimate engine efficiency still can be improved by 20 per cent. But when it comes to replacing the internal combustion engine with much cleaner alternatives, there are no clear frontrunners among the green vehicle technologies and alternative fuels in the pipeline. And, while it’s preferable to let the market pick winners, it’s also clear that research budgets are limited. As a result, policymakers should enter into an open and honest debate with scientists and industry around the following related questions: ■■ How widely should society experiment with alternatives to petrol and diesel? ■■ How many alternative fuels and technologies are deserving of public support? ■■ Which technologies and fuels have a realistic chance of greening the EU transport system? Experts at the round table called for greater clarity on the ability of technologies under development to compete without subsidies and what time frame would be needed. “If you strip away the marketing, fluff, aspiration, the sell, how close are you really to being able to offer propositions that are competitive?” asked John Polak, professor of transport demand, and head of the Centre for Transport Studies, Imperial College London. Those technologies far from the mark are likely to require additional research before public subsidies could help them become viable alternatives to existing cars and fuels. One key conclusion: The technologies and fuels capable of greening the global transport sector need another decade of research and innovation to drive costs down, creating vehicles and fuels that can compete with the improving efficiency of the internal combustion engine, powered by petrol and diesel. The investment in new energy technologies and systems is always a long-term process, but participants agreed that smart policies can avert wasted funds and reduce time to market. Approximately €7.2 billion is earmarked for transport in the forthcoming Horizon 2020 EU research programme, which covers 2014-2020. Europe now has an opportunity to review its policy and adopt a smart approach to investing in R&D for sustainable road transport. THE RACE TO PRODUCE LOW-CARBON CARS | 3 SUMMARY EUROPEAN POLICY CONTEXT ■■ Europe has world-leading tailpipe emissions standards. ■■ Alternative technologies and fuels will be niche solutions for the next decade – the goal is to make a significant shift towards low-carbon transport by 2030. ■■ Different technologies are likely to be favoured for different use cases and in different regions. ■■ Electricity and hydrogen are energy vectors, not sources of energy; the cheapest source of these energy carriers remains fossil fuels, with associated carbon emissions distant from the point of consumption. ■■ Consumers decide what to buy, and they don’t like taking unnecessary risks, especially at a higher upfront cost. ■■ Petrol and diesel taxation today yields over €200 billion per annum for EU nations. This needs to be replaced by alternative sources of taxation as demand for these fuels falls. ■■ EU transport solutions sit in a global context. Global automakers and energy suppliers are also driven by policies in other key markets, such as China, the US and Japan. From centre: Stefan Schmerbeck, manager, future technologies and energy, Volkswagen AG; Keir Fitch, deputy head of cabinet for Siim Kallas, vice-president of the European Commission, Mobility and Transport; David Eyton, group head of technology, BP THE RACE TO PRODUCE LOW-CARBON CARS | 4 EUROPEAN POLICY RECOMMENDATIONS ■■ Be clear on the relative priorities of transport policy goals – be it clean air, low greenhouse gas emissions, energy security or European competitiveness and economic growth. ■■ Continue to drive energy efficiency in transport through tailpipe emissions standards. ■■ Educate citizens, openly and transparently, about the advantages and disadvantages of alternative transport technologies to cut through the fear, uncertainty and doubt that can accompany new technologies. ■■ Focus efforts and subsidies to encourage adoption of electric and other low-carbon transport solutions on fleets and in the urban environment. Great care is needed in scaling technologies, particularly those whose commercial viability is unproven. ■■ Adopt life-cycle analysis to determine the real emissions impact of alternative fuels and vehicles. ■■ Reinvigorate efforts to introduce economy-wide carbon pricing. ■■ Plan ahead on how to fill the fiscal gap that would result from a drop in fuel taxes following widespread adoption of alternative technologies. John Polak, professor of transport demand and head of the Centre for Transport Studies, Imperial College London; Robert Sorrell, vice president for public partnerships, BP THE RACE TO PRODUCE LOW-CARBON CARS | 5 I. INTRODUCTION WHY CONTINUE INVESTING IN R&D? Didier Stevens, senior manager, European & government affairs, Toyota; Richard Dashwood, academic director, head of Materials and Manufacturing Group, CTO, Warwick Manufacturing Group centre High Value Manufacturing Catapult and professor of engineering materials, University of Warwick; Gail Edmondson, editorial director, Science|Business; Michael Wang, senior scientist energy systems, Argonne National Laboratory, US Department of Energy, University of Chicago A lternative automotive fuels and technologies, such as electric vehicles, hydrogen-powered vehicles and biofuels, already have strong public support. The EU’s Framework Programme 7, which supports research and development with public funds, alone spent more than €3.8 billion on transport-related projects between 2007 and 2013 . All this investment has helped drive the development of an array of new automotive technologies and fuels, but none of these alternatives is yet economically viable without public support. The new technologies still lag internal combustion engines in a number of areas, such as driving range, cost, and the availability of refuelling infrastructure. At the same time, the energy efficiency of petrol and diesel engines is rising, resulting in lower CO2 emissions per kilometre travelled. “Our analysis is that new EU regulation [95 grams per kilometre by 2020] will easily be met with internal combustion technology,” noted Ian Hodgson, policy officer, transport and ozone, DG Climate Action, European Commission at the symposium. emission vehicle requirement in California have led to improvements in battery technology for electric drive systems which, Wang said, “continue to push advances in internal combustion engines. Indirectly we got the benefit of improving baseline technology.” Symposium participants agreed that while additional R&D is needed across an array of green vehicle technologies, Europe should continue with a supportive policy framework for bringing alternative technologies to market. Although advances in the fuel efficiency of diesel and petrol engines will continue in the coming decade, new technologies will be needed to cut emissions further. Moreover, reductions in CO2 emissions per kilometre don’t necessarily translate into cleaner air for cities or reduce the EU’s dependence on fossil fuels from foreign countries. Europe’s automakers also need to stay on the forefront of clean vehicle technologies to remain globally competitive. A forward-looking, clear and stable policy framework in their home market will help them do that. David Eyton, group head of technology at BP, pointed out that much of the world has adopted fuel efficiency standards first introduced in the EU. New cars take a long time to develop, so the automotive industry is already contemplating the technologies and fuels that will be deployed in the 2020s and 2030s. The decisions that policymakers and industry leaders make now will determine Europe’s technology future. Laura Lonza, scientific and technical project officer, sustainable transport, Joint Research Centre, European Commission In fact, policymakers deserve credit for passing regulations that required automakers to develop more efficient petrol and diesel engines, said Michael Wang, senior scientist, energy systems from the Argonne National Laboratory in Chicago. Policies such as the zeroTHE RACE TO PRODUCE LOW-CARBON CARS | 6 Jean-Francois Gagné, head of energy technology policy division, International Energy Agency THE RACE TO PRODUCE LOW-CARBON CARS | 7 II. HOW LONG A RIDE? WHAT WILL IT TAKE TO DEVELOP A MASS MARKET FOR LOW-CARBON VEHICLES AND WHAT’S AHEAD FOR THE NEXT DECADE Front: Didier Stevens, senior manager, European & government affairs, Toyota; Maurizio Maggiore, research program officer, innovative automotive systems, DG Research and Innovation, European Commission P etrol and diesel engines will continue to dominate for the coming decade and beyond. Alternative technologies and fuels are still too expensive to compete with existing petrol and diesel vehicles. In many cases, they require costly components such as batteries and new fuelling infrastructure. That issue is compounded, initially at least, by a lack of economies of scale. Still, experts believe electric cars and hydrogen fuel-cell cars will become more competitive around 2020. In the meantime, greater use of biofuels and compressed natural gas could help reduce the environmental impact of road transport. Lewis Fulton, codirector of the NextSTEPS Program at the Institute of Transportation Studies, University of California, Davis, predicts that sustained investment over the next five to ten years should lower the cost of alternative technologies, such as electric vehicles and hydrogen fuel cells, to a point where they can compete with the internal combustion engine. Electricity and hydrogen – just getting started Worldwide sales of electric cars hit 200,000 in 2012 – a good start, according to Fulton, who noted that electric vehicle (EV) technology would improve quickly. He argued that ongoing R&D efforts, for example, on ultracapacitors, which store energy using a static charge rather than in chemical form as in a battery, could result in a step change in performance and cost, particularly for battery electric vehicles and plug-in hybrid vehicles. German Chancellor Angela Merkel has set a national target of getting one million electric vehicles on German roads by 2020, but Fulton said one million is a more likely scenario for all of Europe in 2020 – out of five million EVs forecast to be sold worldwide then. Still, one million electric cars would be an important milestone in scaling up the technology, he said. “If we can do that, the costs will really come down.” One of the key reasons why an electric car costs more than the internal combustion equivalent is the high cost of the battery. Fulton estimated that the cost of EV batteries have come down from around $800 per kilowatt-hour to $500 per kilowatt-hour in the past three years. “We should be able to get down under $300 per kilowatt-hour by 2030,” he said. “If we push hard and sell a lot of electric vehicles over the next seven years, it is very possible we could get there by 2020. That would be a revolution for EV marketability.” But that is just one of several possible scenarios. Carlo Pettinelli, director of industrial policy and economic analysis, sustainable growth and EU 2020, at DG Enterprise and Industry, European Commission, is sceptical that radical reductions in the cost of batteries can be achieved. “As a high proportion of the cost of batteries is the raw materials… we are not going to get economies of scale. More demand could send up prices,” he noted. Pettinelli also expressed concerns about the hole in public sector budgets that could emerge if there was a major shift away from petrol and diesel, which are subject to high sales taxes across most of the EU. As well as rolling out electric vehicles, some automakers are pouring R&D funds into the development of commercial cars with fuel cells that run on hydrogen. “We will launch a hydrogen vehicle in 2015 in Japan, the EU and the US,” Didier Stevens, senior manager, European and government affairs, Toyota, told the symposium. The goal, for now, is not sell a certain number of hydrogen vehicles, but to introduce the technology to consumers and develop market acceptability for 2025 and beyond. Juicier carrots, bigger sticks? Many EU governments provide public support for cars using green technologies. However, some experts question whether these subsidies make sense for cash-strapped governments – given the long road ahead to bring costs down. In some cases, such support may actually be ineffective because the THE RACE TO PRODUCE LOW-CARBON CARS | 8 technologies are too far from being truly competitive. Hefty subsidies on electric vehicles in the UK, for example, have failed to attract many buyers. “We have to take into account the grubby realities of the forecourt,” noted John Polak of Imperial College London. “Car salesmen work on commission and it takes a long time to convince someone of all the advantages of electric vehicles. Why on earth should a car salesman spend his time trying to convince a customer to buy this vehicle, rather than shoo them out of the door with a conventional vehicle?” A more strategic approach: sell alternative technologies to fleet managers, who are more likely to assess the total cost of ownership, than to consumers fixated with the upfront cost. But Polak said that fleet managers will be reluctant to buy alternative vehicles until they have a clear idea of their resale value. As well as providing juicier carrots, governments may also need to wield bigger sticks. Toyota’s Stevens called for more taxation based on vehicles’ CO2 emissions. “This has had a major impact in Norway and the Netherlands,” he said. The economic case for buying an alternative technology car will, of course, depend heavily on both the price of oil and further gains in the fuel efficiency of petrol and diesel engines. Stefan Schmerbeck, manager, future technologies and energy, Volkswagen AG, estimated that the fuel efficiency of the internal combustion engine could improve by a further 20 per cent. There is also scope to optimise vehicle efficiency by reducing their weight and by further hybridisation. The European Commission’s new Clean Power for Transport policy tries to solve this problem by mandating a minimum coverage of infrastructure for each alternative fuel. “We hope this will go a long way to breaking a vicious cycle,” said Keir Fitch, deputy head of cabinet for Siim Kallas, vicepresident of the European Commission, Mobility and Transport. “It needs to be done quickly, it needs to give people sufficient certainty, and we need to ensure that Europe’s manufacturers are leading the technology curve rather than behind it.” But Fitch acknowledged that while the Commission wished to maintain technological neutrality and avoid “picking winners”, it would need a pro-active policy approach to avoid wasteful deployment of multiple refuelling infrastructures. This approach is too complex and costly, said Horst Fehrenbach, biologistresearcher, sustainability assessment for bioenergy, life-cycle assessments, energy and waste management at the Institute for Energy and Environmental Research in Heidelberg, Germany. He argues that Europe must significantly narrow the number of green car technologies it aims to support by 2020. Others noted the market would be capable of delivering the refuelling infrastructure without government intervention if and when investors can see a viable business model. “I have to question whether the chicken-and-egg problem is as prevalent as people claim,” said Thomas Briggs, head of transport energy policy at BP. “In the US, we have a competitive upstream market… As long as there is a viable business model, the ability to ramp up infrastructure should be relatively easy.” More clarity, less politics But private investment is likely to be deterred by the ongoing uncertainty about which, if any, of the alternative fuels can compete with petrol and diesel in the medium term. To get to the next stage, policymakers may need to launch a more transparent dialogue with scientists, industry and other stakeholders to assess which alternative fuels and technologies should receive public support. “I am not sure we are anywhere close to having competitive propositions to petrol and diesel,” said Polak. “Why are we doing what we are doing? Do we really think they are going to get there? Or are we doing it as a rather elaborate form of symbolism? We need to shine a critical light on some of the fundamental assumptions that we are making.” Others also called for science to play a greater role in policymaking. Wang suggested that fuel politics has triumphed over science in the past, pointing to the biofuel debate. “Some stakeholders in the US, and to some extent, the EU too, advocated that biofuels should not play any role in transport and those arguments impacted analyses and policy recommendations,” he contended. Carlo Pettinelli, director, DG Enterprise, European Commission; David Eyton, group head of technology, BP How to avoid running on empty Another factor holding back sales of alternative vehicles is the lack of suitable refuelling stations. Until an extensive refuelling infrastructure exists, consumers and businesses are likely to shy away from alternative technologies, resulting in a chickenand-egg dilemma. Compounding the problem, different European countries tend to favour different fuels, meaning it could be difficult for international travellers to refuel an alternative technology vehicle once they have crossed a border. THE RACE TO PRODUCE LOW-CARBON CARS | 9 ELECTRIC VEHICLES AND HYBRIDS T he technology is improving and the cost of batteries is falling, but electric cars remain too expensive: ■■ Electric vehicles could start to take off after 2025 and become a more dominant market force after 2030. ■■ The range of EVs remains short and best suited for city use, rather than longer journeys. ■■ The acceptance of plug-in hybrids varies by market and is heavily influenced by tax policies. ■■ Electricity to fuel EVs should come from renewable sources. ■■ Security issues for batteries must be resolved. “If I only cared about the next seven years, I wouldn't invest in electric vehicles… The people who are pushing EVs hard are thinking about a market evolution toward where EVs only achieve a sizeable share of car sales (e.g. 25 per cent) after 2030.” Lewis Fulton, co-director of the NextSTEPS Program at the Institute of Transportation Studies, University of California, Davis HYDROGEN FUEL CELLS ■■ In the long-term, hydrogen is potentially a clean form of transport energy storage. ■■ It is competitive in terms of range, performance and refuelling time, but is very expensive. ■■ There is a perception that hydrogen may not be sufficiently safe . ■■ Hydrogen-powered cars will go on sale in the next few years, but are unlikely to have a mass-market presence until 2025 to 2030. ■■ Hydrogen fuel should be produced using renewable energy or natural gas. “What are the customers’ expectations of a future vehicle? It needs to have the driving performance of today, it should be zero emissions, independent of fossil fuel, recharge in five minutes and have a 500-kilometre range and be economically feasible… Hydrogen meets that criteria except for cost... Customer acceptance that hydrogen is safe… that is the biggest challenge we have ahead of us.” Didier Stevens, senior manager, European and government affairs, Toyota THE RACE TO PRODUCE LOW-CARBON CARS | 10 BIOFUELS ■■ Biofuels are gaining traction in some markets, such as Austria and Germany, supported by the local policy framework. ■■ They are compatible with existing refuelling infrastructure. ■■ There are minimal consumer-acceptance issues – biofuels can be mixed easily with regular petrol or diesel. ■■ Second-generation biofuels based on straw and wood (requiring less agricultural land) are under development, but it is not clear whether there will be sufficient biofuels available for widespread use in EU vehicles. “The winner in the race right now is biofuels… In Austria, it is 7 per cent of the market… in Germany a little below that... Why did it work? The technology is ready, the political framework is there and the greenhouse gas and share of renewable transportation fuels targets give the investors the security to invest… You don’t need new cars, new filling stations, you just blend biofuels in. Consumers don’t know they have it in the tank.” Gerfried Jungmeier, senior researcher, Joanneum Research Institute for Water, Energy and Sustainability in Graz, Austria COMPRESSED NATURAL GAS (CNG) ■■ Dual-fuel cars that can run both CNG and petrol or diesel are becoming available. ■■ CNG won’t lead to dramatic reductions in greenhouse gas emissions: using CNG is estimated to lower CO2 emissions by up to a quarter over petrol or diesel (not a whole life-cycle calculation). ■■ If the consumer takes the cost of fuel into account, CNG can be cheaper than petrol or diesel. ■■ The refuelling infrastructure is patchy across the EU. “CNG is a really strategic [transport] energy carrier for 2020 and beyond…. We will launch a CNG model this year on our GolfMQB platform, which could be used for 40 models in the group... The price gap is between €1500 to €2000… but after 30,000 kilometres of driving, CNG is generally cheaper (depending on taxes and the vehicle model). We need to convince the customer that CNG is really the most economical fuel and it is really safe… We are starting to do a good job.” Stefan Schmerbeck, manager future technologies and energy, Volkswagen AG THE RACE TO PRODUCE LOW-CARBON CARS | 11 Thomas Briggs, head of transport energy policy, BP; Michael Wang, senior scientist energy systems, Argonne National Laboratory, US Department of Energy, University of Chicago Keir Fitch, deputy head of Cabinet for Siim Kallas, vice-president of the European Commission, Mobility and Transport Martin Dornheim, head of Nanotechnology Department, Helmholtz Institute for Nanotechnology and Materials Technology John Jostins, professor of sustainable transport design, Coventry University; and CEO, Microcab Industries Ltd. Image: Ga. Dic temperum, sitatum aute ea con nimodicid que repelest,Nis vide eum re perum, ut prat et labo. Nam si volorat ectotae III. WHICH TECHNOLOGY WILL WIN? A GLIMPSE AT 2030 AND BEYOND T he real payback for a supportive policy framework and subsidies for alternative fuels is likely to start around 2030. By then, alternative technologies and fuels could have made major inroads into the global automotive market. The International Energy Agency forecasts that conventional models will still account for about two-thirds of lightduty vehicle (car) sales between 2020 and 2030, but it predicts that about 150 million alternative vehicles will be sold in that timeframe in OECD countries, assuming a carbon-conscious world. Beyond 2030, electric batteries and hydrogen fuel cells are likely to show up in mass-market cars, as well as premium models. As they gain economies of scale and the technology improves, these alternative cars could actually become cheaper than their conventional equivalents. “If you look at the brand new National Research Council report in the US, which is a pretty august group of scientists… almost every single one of those [green cars] is cheaper than a conventional gasoline vehicle in 2040,” said Fulton. “Fuel cells are in fact the cheapest. But of course, such forecasts could be wrong.” of internal combustion cars at 2040,” noted Fulton. “It takes a long, long time to build up that market.” Some experts predict that many cars will be equipped with multiple technologies capable of using multiple fuels, depending on what they are being used for and where. “I hope as many technologies as possible will win,” said Toyota’s Stevens. “The ones that suit demand will win… EVs are good, if the distance is small… long distance will be hydrogen and in the middle will be the hybrid and plug-in hybrid… everything will depend on what you want.” In fact, the optimum source of fuel could depend on which part of the EU you are in. For example, biofuels could play a significant role in countries with large managed forests, while electric vehicles may be more attractive in countries with abundant wind or solar power, such as Denmark and Portugal. “We need to utilise the most productive energy source for mobility in each country,” said Schmerbeck of Volkswagen. “The automotive sector is enlarging everywhere in the world, so I suspect we will need to be prepared to use all the technologies… it is challenging to do all of these, but we will do it.” David Eyton, group head of technology, BP Indeed, by 2040, cars equipped with alternative technologies could be selling at the same rate as cars with internal combustion engines, according to one IEA scenario, in which the world manages to limit the average global temperature rise to 2 °C. “In the IEA scenarios, you have a fast and steady ramp-up of plugin and fuel-cell vehicles over the coming decades and they dominate by 2050 – but they only reach the sales level THE RACE TO PRODUCE LOW-CARBON CARS | 13 IV. CONCLUSIONS T he technology race is far from over – and the outcome in 2030 and beyond will depend heavily on the EU policy framework. Developing truly sustainable cars and fuels needs a smart policy approach, which takes into account the following factors: ■■The energy density of fuels, which is a key determinant in the cost of storing and transporting the fuel, is a key factor. ■■The energy market is dynamic and heavily influenced by regional factors. Despite the need for economies of scale, energy sources will vary across Europe, according to the availability of solar, wind, natural gas, biofuels and hydroelectric power. Moreover, greater competition from alternative sources of energy could prompt the oil industry to lower prices to defend market share. ■■Policymakers need to pay attention to full life-cycle analysis of carbon, from source to use. Electricity and hydrogen, for example, need to be produced and their impact on the environment depends heavily on the source of energy used. ■■It is not clear when electric vehicles and fuel cells will become competitive with incumbent technologies. Moreover, changing consumers’ preferences takes time and effort. Therefore, the internal combustion engine, supplemented by hybrids and biofuels, will continue to be dominant for at least another decade. ■■The European Commission needs to base its policymaking on a full and objective assessment of technology maturity. It should not seek to scale solutions too early, but rather conduct experiments and learn from these. In summary, it is time for a reality check. Research and innovation in low-carbon transit – and policy planning – would be more effective if based on a more open and realistic dialogue between scientists, business leaders and policymakers about what green technologies and fuels can actually achieve in the medium term. Political leaders need to acknowledge that the efficiency of petrol and diesel vehicles will be the overriding factor in determining the greenhouse gas emissions of private transport in the next decade. In the same vein, both politicians and automakers need to consider how alternative fuels and technologies address the needs of consumers rather than assuming consumers will embrace whatever green cars hit the market. A single man in Copenhagen may be happy to drive an electric vehicle, while a mother of three in rural Germany may prefer to fill up her tank with biofuel. As different low-carbon technologies address divergent requirements, from short urban transit to long-haul traffic, economies of scale are likely to be lower in the coming transport era. The world has moved on in the century since Henry Ford’s famous remark that customers can have any colour car they want as long as it is black. The transition to sustainable transport is complex, requiring systemic change, continual reassessment and leadership. Rather than promoting specific technologies and fuels as potential panaceas, policymakers and experts need to prepare for a more complex world in which a multitude of solutions are deployed to lower greenhouse gas emissions, increase energy security and improve air quality. THE RACE TO PRODUCE LOW-CARBON CARS | 14 Copies of the individual reports from this series of Science|Business symposia on energy research and innovation policy are available at: www.sciencebusiness.net BREAKING THE DEADLOCK RESOURCE INNOVATION NEW IDEAS FOR MANAGING SCARCE RESOURCES AND ENERGY GETTING CARBON CAPTURE AND STORAGE TECHNOLOGIES TO MARKET Report of a Science|Business symposium Report of a Science|Business symposium Supported by Supported by Breaking the Deadlock GETTING CARBON CAPTURE AND STORAGE TECHNOLOGIES TO MARKET 1 A symposium series supported by THE RACE TO PRODUCE LOW-CARBON CARS | 15 www.sciencebusiness.net