Integrity and Corruption Prevention Guide on Managing

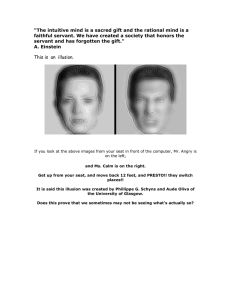

advertisement