List of Frequently Used Symbols and Notation A text such as

advertisement

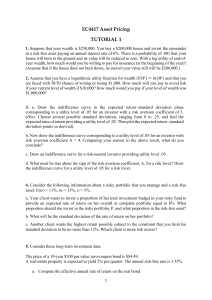

List of Frequently Used Symbols and Notation A text such as Intermediate Financial Theory is, by nature, relatively notation intensive. We have adopted a strategy to minimize the notational burden within each individual chapter at the cost of being, at times, inconsistent in our use of symbols across chapters. We list here a set of symbols regularly used with their specific meaning. At times, however, we have found it more practical to use some of the listed symbols to represent a different concept. In other instances, clarity required making the symbolic representation more precise (e.g., by being more specific as to the time dimension of an interest rate). Roman Alphabet a Amount invested in the risky asset; in Chapter 14, fraction of wealth invested in the risky asset or portfolio AT Transpose of the matrix (or vector)A c Consumption; in Chapter 14 only, consumption is represented by C, while c represents ln C ckθ Consumption of agent k in state of nature θ CE Certainty equivalent CA Price of an American call option CE Price of a European call option d Dividend rate or amount ∆ Number of shares in the replicating portfolio (Chapter xx E The expectations operator ekθ Endowment of agent k in state of nature θ f Futures position (Chapter 16); pf Price of a futures contract (Chapter 16) F, G Cumulative distribution functions associated with densities: f, g Probability density functions K The strike or exercise price of an option K(x̃) Kurtosis of the random variable x̃ L A lottery L Lagrangian m Pricing kernel M The market portfolio M Uθk Marginal utility of agent k in state θ p Price of an arbitrary asset P Measure of Absolute Prudence q Arrow-Debreu price qb Price of risk-free discount bond, occasionally denoted prf e q Price of equity rf Rate of return on a risk-free asset Rf Gross rate of return on a risk-free asset r̃ Rate of return on a risky asset R̃ Gross rate of return on a risky asset 1 RA RR s S S(x̃) T U U V Vp VF wi Y0 Absolute risk aversion coefficient Relative risk aversion coefficient Usually denotes the amount saved In the context of discussing options, used to denote the price of the underlying stock Skewness of the random variable x̃ Transition matrix Utility function von Neuman-Morgenstern utility function Usually denotes variance-covariance matrix of asset returns; occasionally is used as another utility function symbol; may also signify value as in The value of portfolio P or The value of the firm Portfolio weight of asset i in a given portfolio Initial wealth Greek Alphabet α Intercept coefficient in the market model (alpha) β The slope coefficient in the market model (beta) δ Time discount factor η Elasticity λ Lagrange multiplier µ Mean πθ State probability of state θ πθRN Risk-neutral probability of state θ Π Risk premium ρ(x̃, ỹ) Correlation of random variables x̃ and ỹ ρ Elasticity of intertemporal substitution (Chapter 14) σ Standard deviation σij Covariance between random variables i and j θ Index for state of nature Ω Rate of depreciation of physical capital ψ Compensating precautionary premium Numerals and Other Terms 1 Â Â GBM F SD SSD Vector of ones Is strictly preferred to Is preferred to (non strictly, that is allowing for indifference) Geometric Brownian Motion stochastic process First-order stochastic dominance Second-order stochastic dominance 2