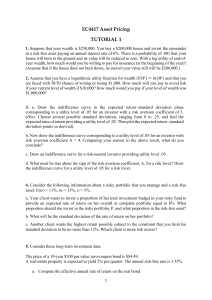

BMAN20072 Investment Analysis Week 1-2: Risk and Capital Allocation BKM Ch 5.3 – 5.4, Ch. 6.1 – 6.6 Overview • How to design an optimal portfolio? – Capital allocation • How to optimally allocate capital between risk-free and risky assets? [this week’s topic] – Asset allocation • How to optimally allocate budget across risky assets? [next week’s topic] • What is an optimal portfolio? – Utility maximization • Risk, Risk aversion, and Utility 1 Key terms • • • • • • • • Expected return, Excess return, Risk premium Measures of Risk Utility function Risk aversion Mean-variance criterion Indifference curve Sharpe ratio (Reward-to-volatility ratio) Capital Allocation Line (CAL) 2 Expected return, Excess return, and Risk premium • Expected return 𝐸 𝑟 = 𝑝 𝑠 𝑟(𝑠) 𝑠 • Excess return: 𝑅 = 𝑟 − 𝑟𝑓 • Risk premium = Expected excess return 𝐸 𝑅 = 𝑝 𝑠 𝑅(𝑠) 𝑠 Measures of Risk • Variance 𝜎 2 = σ𝑠 𝑝(𝑠) 𝑟 𝑠 − 𝐸(𝑟) • Standard deviation 𝜎= 2 𝜎2 • Risk – Standard deviation of the excess return Estimation of Return and Risk If we treat each observation of return as an equally likely scenario: • Estimate of expected return = Arithmetic average 1 𝑛 𝐸 𝑟 = σ𝑠 𝑝 𝑠 𝑟 𝑠 = 𝑟ҧ = σ𝑛𝑠=1 𝑟(𝑠) • Estimate of variance 𝜎ො 2 = 1 σ𝑛𝑠=1 𝑛−1 𝑟 𝑠 − 𝑟ҧ • Estimate of standard deviation: 𝜎ො = 𝜎ො 2 2 Risk Aversion and Utility Values • Utility function 1 2 𝑈 = 𝐸 𝑟 − 𝐴𝜎 2 • • • • • U = utility E(r) = expected return on the asset or portfolio A = coefficient of risk aversion 𝜎 2 = variance of returns ½ = a scaling factor 6 Risk, Risk Aversion, and Utility 7 Risk Aversion and Utility Values • Utility function 1 2 𝑈 = 𝐸 𝑟 − 𝐴𝜎 2 • Risk averse: A > 0 – Risk is “penalized” • Risk-neutral: A = 0 – No penalty for risk • Risk lover: A < 0 – Adjust the expected return upward 8 Trade-off between risk and return Mean-variance (M-V) criterion: Portfolio A dominates portfolio B if 𝐸 𝑟𝐴 ≥ 𝐸 𝑟𝐵 and 𝜎𝐴 ≤ 𝜎𝐵 9 Indifference Curve 10 Capital Allocation • What is an optimal portfolio? – A portfolio that maximize investor’s utility • What is the optimum allocation of capital between risk-free and risky assets? – An allocation that maximizes investor’s utility – Find the best from the feasible set of allocation patterns • How can we find such optimum allocation? 11 Portfolio of One Risky Asset and a Risk-Free Asset • Let y the proportion allocated to the risky portfolio, P. • Let 1-y the proportion allocated to the risk-free asset, F. • • • • Rate of return of P : 𝑟𝑃 Expected rate of return of P : 𝐸(𝑟𝑃 ) Standard deviation of P : 𝜎𝑃 Rate of return of F : 𝑟𝑓 • The risk premium on P : 𝐸 𝑟𝑃 − 𝑟𝑓 12 Portfolio of One Risky Asset and a Risk-Free Asset • The rate of return on the complete portfolio, C, is 𝑟𝐶 = 𝑦𝑟𝑃 + 1 − 𝑦 𝑟𝑓 • The expected rate of return is 𝐸(𝑟𝐶 ) = 𝑦𝐸(𝑟𝑃 ) + 1 − 𝑦 𝑟𝑓 = 𝑟𝑓 + 𝑦 𝐸(𝑟𝑃 ) − 𝑟𝑓 • The standard deviation is 𝜎𝐶 = 𝑦𝜎𝑃 13 Portfolio of One Risky Asset and a Risk-Free Asset • Substitute 𝑦 = 𝜎𝐶 Τ𝜎𝑃 : 𝐸 𝑟𝐶 𝜎𝐶 = 𝑟𝑓 + 𝐸(𝑟𝑃 ) − 𝑟𝑓 𝜎𝑃 • 𝐸 𝑟𝐶 is a function of 𝜎𝐶 with intercept 𝑟𝑓 and slope 𝐸(𝑟𝑃 ) − 𝑟𝑓 𝑆= 𝜎𝑃 • The slope is called the reward-to-volatility ratio 14 or the Sharpe ratio. Capital Allocation Line Example: 𝐸 𝑟𝑃 = 15%, 𝜎𝑃 = 22% 𝑟𝑓 = 7%, 𝐸 𝑟𝑃 − 𝑟𝑓 = 8% 15 Utility Maximization • Find an optimal allocation, 𝑦 ∗ , to maximize investor’s utility. • Solve the utility maximization problem: 1 2 max 𝑈 = 𝐸 𝑟𝐶 − 𝐴𝜎𝐶 𝑦 2 1 2 2 = 𝑟𝑓 + 𝑦 𝐸 𝑟𝑃 − 𝑟𝑓 − 𝐴𝑦 𝜎𝑃 2 • Optimal position: 𝐸 𝑟𝑃 − 𝑟𝑓 ∗ 𝑦 = 𝐴𝜎𝑃2 16 Utility as a function of y (A=4) 17 Calculations of Indifference Curves 18 Indifference Curves for U = .09 and .05 with A = 2 and 4 19 Expected Returns on Indifference Curves and CAL (A = 4) 20 Optimal Capital Allocation 21 What is a typical value for A?? • A naive calculation from past data implies A = 2.94 : 𝐸 𝑟𝑀 − 𝑟𝑓 .081 ∗ 𝑦 = = = .656 2 2 𝐴 ×.2048 𝐴𝜎𝑀 𝐴= .081 .656×.20482 = 2.94 Assumptions: – 65.6% estimated from historical data. – Portfolio M that mimics historical S&P500 risk premium and risk: 8.1% and 20.48%. • Several studies estimate in range of 2 to 4. 22 Key terms and formulas • Expected return: 𝐸 𝑟 = σ𝑠 𝑝 𝑠 𝑟(𝑠) • Excess return: 𝑅 = 𝑟 − 𝑟𝑓 • Risk premium = Expected excess return 𝐸 𝑅 = 𝑝 𝑠 𝑅(𝑠) 𝑠 • Variance: 𝜎 2 = σ𝑠 𝑝(𝑠) 𝑟 𝑠 − 𝐸(𝑟) 2 • Standard deviation: 𝜎 = 𝜎 2 23 Key terms and formulas • Estimate of expected return = Arithmetic average 𝐸 𝑟 = σ𝑠 𝑝 𝑠 𝑟 𝑠 = 𝑟ҧ = 1 𝑛 σ 𝑟(𝑠) 𝑛 𝑠=1 • Estimate of variance 𝜎ො 2 = 1 σ𝑛𝑠=1 𝑛−1 𝑟 𝑠 − 𝑟ҧ 2 • Estimate of standard deviation: 𝜎ො = 𝜎ො 2 24 Key terms and formulas • Utility function • • • • 1 2 𝑈 = 𝐸 𝑟 − 𝐴𝜎 2 Risk aversion Mean-variance criterion Indifference curve Sharpe ratio (Reward-to-volatility ratio) 𝐸(𝑟𝑃 ) − 𝑟𝑓 𝑆= 𝜎𝑃 25 Key terms and formulas • Capital Allocation Line (CAL) 𝜎𝐶 𝐸 𝑟𝐶 = 𝑟𝑓 + 𝐸(𝑟𝑃 ) − 𝑟𝑓 𝜎𝑃 = 𝑟𝑓 + 𝑆𝜎𝐶 • Optimal position of risky asset: 𝐸 𝑟𝑃 − 𝑟𝑓 ∗ 𝑦 = 𝐴𝜎𝑃2 26