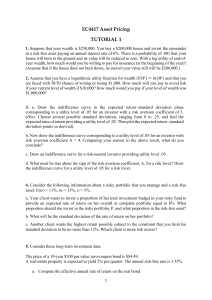

Chapter 6 Risk Aversion and Capital Allocation to Risky Assets 1 Risk vs. Return ⚫First we have to make some assumptions about human behaviors. ⚫A fundamental decision of the asset allocation problem: percentage invested in riskless asset and risky asset, which depends on the risk aversion. ⚫Investors will avoid risk unless there is a reward, i.e., there is always a price for taking risk. ⚫The utility model gives the optimal allocation between a risky portfolio and a risk-free asset. 2 The von Neumann-Morgenstern Theory: Risk & Risk Aversion The first important use of the expected theory was that of John von Neumann and Oskar Morgenstern who used the assumption of expected utility maximization in their formulation of game theory. 3 Risk Aversion 4 The von Neumann-Morgenstern Theory: Risk & Risk Aversion ⚫Utility of Wealth: marginal utility is positive but decreasing ⚫Expected Utility ⚫Certainty Equivalent Wealth (Amount) or Certainty Rate ⚫Risk Premiums ⚫Insurance 5 Example ⚫Suppose U(W) = ln(W) ⚫Start with W0 = $100,000 Face gamble: W1 = 50,000 w/ p = .5 W1 = 150,000 w/ p = .5 E(W) = .5x50,000 + .5x150,000 = 100,000 ===> Fair Game (Note: a fair game is a risky investment with a risk premium of zero) 6 Example ⚫Compare utility of 100,000 for sure with expected utility of gamble: ln(100,000) = 11.51 E(U) = .5xln(50000) + .5xln(150000) = 11.37 Since utility of 100,000 for sure > expected utility, person is said to be risk averse. A risk averse person is unwilling to accept a fair gamble. 7 Fair games and expected utility U(w) U[E(w)] E[U(w)] W1 W0 W1 W A person is risk averse at wealth level W if that person is unwilling to accept a fair gamble at that wealth level. U[E(W)] > E[U(W)] Function lies above chord 8 Risk Aversion - Intuition ⚫Utility gained is less than utility lost ⚫Example: ln(100,000) = 11.51 (utility for sure) ln(150,000) = 11.92 11.92 - 11.51 = .41 utility gained ln(50,000) = 10.82 11.51 - 10.82 = .68 utility lost A risk averser will reject a fair game. 9 Implications ⚫Risk aversion explains the inclination to agree to a situation with a lower average payoff that is more predictable rather than another situation with a less predictable payoff that is higher on average. ⚫For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. 10 Three Questions ⚫What amount of wealth for sure gives same utility of gamble? => Certainty Equivalent Wealth LN(X) = 11.37 ==> X = e11.37 X = $86,682 ⚫What would an investor pay to avoid the gamble? ==> Insurance =100,000-86,682=13,318 ⚫What expected value would induce gamble? ==> Risk premium This risk premium is the amount a risk averse individual would accept to play an actuarially fair game (or the amount a risk averse individual would pay to avoid playing an actuarially fair game) 11 Example ⚫Suppose probabilities remain same. What upside is necessary to induce investment? We want: .5ln(50000) + .5ln(X) = ln(100000) = 11.51 .5ln(X) = 11.51 - 5.4099 ln(X) = 12.2002 X = e12.2002 = 198,829 E(W) = .5 x 50,000 + .5 x 198,829 = 124,414 E(R) = 24.414% Risk Premium=24,414 ➔ the expected value would induce gamble 12 Summary ⚫Marginal utility of wealth is positive ⚫Decreasing marginal utility of wealth ⚫Individual is risk averse ⚫Will pay to avoid risk (insurance) and will reject a fair game. ⚫Demands risk premium to accept risk ⚫All the assumptions that will be used later in the book https://youtu.be/tCreeXzCNRc 13 Table 6.1 Available Risky Portfolios (Riskfree Rate = 5%) How to rank alternative investment choice? Each portfolio receives a utility score to assess the investor’s risk/return trade off 6-14 Quadratic Utility Functions When we use quadratic utility functions, we can nicely express our utility functions; one example is the following: U = E ( R) − 1 A 2 2 Hence, the investor just considers risk and return. In other words, you require a higher expected return, the higher the risk of the investment. U = utility E ( R ) = expected return on the asset or portfolio A = coefficient of risk aversion = variance of returns ½ = a scaling factor 15 Table 6.2 Utility Scores of Alternative Portfolios for Investors with Varying Degree of Risk Aversion 6-16 ⚫ If A>0, then the investor is risk averse. ⚫ If A<0, the investor is risk-loving. ⚫ If A=0, the investor is risk-neutral. 17 Risk and Risk Aversion ⚫ Speculation – Taking considerable risk for a commensurate gain – Parties have heterogeneous expectations ⚫ Gamble – Bet or wager on an uncertain outcome for enjoyment – Parties assign the same probabilities to the possible outcomes 6-18 Risk Aversion and Utility Values ⚫ Investors are willing to consider: – risk-free assets – speculative positions with positive risk premiums ⚫ Portfolio attractiveness increases with expected return and decreases with risk. ⚫ What happens when return increases with risk? 6-19 Mean-Variance (M-V) Criterion ⚫Portfolio A dominates portfolio B if: E (rA ) E (rB ) ⚫And A B 6-20 Return I (preferred direction) II III IV P Risk Consider moving from point P to other quadrants 21 Dominance Principle Expected Return 4 2 3 1 How about 1 and 3? Variance or Standard Deviation • 2 dominates 1; has a higher return • 2 dominates 3; has a lower risk • 4 dominates 3; has a higher return 22 Return Indifference Curve Risk 23 Indifference Curves Expected Return Based on previous PPT Increasing Utility Standard Deviation 24 U(w) W Utility Function 25 Discrete R.V.’s - Summary Measures Expected Value – – Mean of Probability Distribution Weighted Average of All Possible Values X = E(X) = Xi P(Xi) = p(X1) X1+ p(X2) X2+ … + p(Xn) Xn Variance (𝝈𝟐 , a risk measure) – Weighted Average Squared Deviation about Mean X2 = E[ (Xi-X) = (Xi-X) P(Xi) = p(X1)(X1- X)2 + p(X2 )(X2- X)2 + … + p(Xn) )(Xn- X)2 Standard deviation (𝝈) – Square root of the variance. Measure of risk shows dispersion of possible outcomes around expected level of outcomes. 26 Asset Expected Return & Risk ⚫ Calculate the Expected Returns of alternative assets. – Rki= Return to Asset k if Event i occurs – P(Rki) = Probability Event i occurs. Economic Conditions Recession Stable Economy Moderate Growth Boom Asset A Asset B Probability % Returns % Returns .10 .40 .30 .20 3.0 7.0 10.0 15.0 5.0 3.0 25.0 40.0 27 Calculating ER and Risk ⚫ Can use the previous table to calculate ER and variance (risk) for each asset. – Show calculations for Asset A below. Economic Conditions P(Ri) Ri for A P()Ri for A Ri - ER Recession Stable Moderate Boom .10 .40 .30 .20 ERA = 9.1% 3.0 7.0 10.0 15.0 .3 .28 .30 .30 ER = 9.1 A = 3.56% -6.1 -2.1 0.9 5.9 (Ri - ER)2 P(Ri) (Ri - ER)2 37.21 4.41 .81 34.81 3.721 1.764 .243 6.962 2 = 12.69 CV=ERA/A = 2.55 28 Covariance ⚫ Covariance between two random variables X and Y is defined as Cov( X , Y ) = ( X , Y ) = XY = E( X − EX )(Y − EY ) – A negative covariance between X and Y means that when X is above its mean its is likely that Y is below its mean value. – If the covariance of the two random variables is zero then on average the values of the two variables are unrelated. – A positive covariance between X and Y means that when X is above its mean its is likely that Y is above its mean value. – Covariance of a random variable with itself, its own covariance, is equal to its variance. 29 Correlation ⚫ Correlation between two random variables X and Y measured as: Corr( X , Y ) = XY = XY = Cov( X , Y ) XY XY – Correlation takes on values between –1 and +1. Correlation is a standardized measure of how two random variables move together, i.e. correlation has no units associated with it. – A correlation of 0 means there is no straight-line (linear) relationship between the two variables. – Increasingly positive (negative) correlations indicate an increasingly strong positive (negative) linear relationship between the variables. – When the correlation equals 1 (-1) there is a perfect positive (negative) linear relationship between the two variables. 30 Portfolio Probability Calculations Portfolio consisting of two assets A and B, wA invested in A. Asset A has expected return rA and variance 2A. Asset B has expected return rB and variance 2B. The correlation between the two returns is AB. Portfolio Expected Return: E(rp) = wA rA + (1-wA )rB Portfolio Variance: r2 = wA2 A2 + (1 − wA )2 B2 + 2wA (1 − wA )Cov(rA , rB ) p or r2 = wA2 A2 + (1 − wA )2 B2 + 2wA (1 − wA ) AB A B p 31 Capital Allocation: Risky and Risk-Free Portfolios Asset Allocation decision: Controlling Risk: ⚫ Is a very important part ⚫ Simplest way: of portfolio construction. Manipulate the fraction of the portfolio invested ⚫ Refers to the choice in risk-free assets versus among broad asset the portion invested in classes especially in the risky assets riskless and risky assets. 6-32 The Risk-Free Asset ⚫Only the government can issue default-free bonds. – Risk-free in real terms only if price indexed and maturity equal to investor’s holding period. ⚫T-bills viewed as “the” risk-free asset ⚫Money market funds also considered risk-free in practice 6-33 Portfolios of One Risky Asset and a Risk-Free Asset ⚫ It’s possible to create a complete portfolio by splitting investment funds between safe and risky assets. – Let y=portion allocated to the risky portfolio, P – (1-y)=portion to be invested in risk-free asset, F. 6-34 Example Using Chapter 6.4 Numbers rf = 7% rf = 0% E(rp) = 15% p = 22% y = % in p (1-y) = % in rf 6-35 Example (Ctd.) The expected return on the complete portfolio is the risk-free rate plus the weight of P times the risk premium of P E (rc ) = (1 − y )rf + yE (rP ) = rf + y E (rP ) − rf E (rc ) = 7 + y (15 − 7 ) Risk premium Base riskless rate 6-36 Example (Ctd.) ⚫ The risk of the complete portfolio is the weight of P times the risk of P: C = y P = 22 y Don’t forget the formula at Ch.4: = w + (1 − wA ) B2 + 2wA (1 − wA ) AB A B 2 rp 2 A 2 A 2 6-37 Example (Ctd.) ⚫Rearrange and substitute y=C/P: C 8 E (rC ) = rf + E (rP ) − rf = 7 + C P 22 Slope = E (rP ) − rf P 8 = 22 risk premium per unit of risk: reward –to-variability ratio 6-38 Figure 6.4 :The Investment Opportunity Set CAL: depicts all the feasible risk-return combinations available to investors. 6-39 Capital Allocation Line with Leverage ⚫Lend at rf=7% and borrow at rf=9% – Lending range slope = 8/22 = 0.36 – Borrowing range slope = 6/22 = 0.27 ⚫If there is a capital market where you can borrow to invest in the risky assets, then CAL kinks at P. 6-40 Figure 6.5 The Opportunity Set with Differential Borrowing and Lending Rates 6-41 Risk Tolerance and Asset Allocation ⚫ The investor must choose one optimal portfolio, C, from the set of feasible choices – Expected return of the complete portfolio: E (rc ) = rf + y E (rP ) − rf – Variance: =y 2 C 2 2 P 6-42 How Investors Choose y? ⚫Maximize the utility by choosing the best allocation to the risky asset y: U = E ( R) − 1 2 A 2 ⚫If y increases, E(R) increases but so does volatility, so U can increase or decrease. ⚫A is the degree of risk-aversion. 43 Table 6.4 Utility Levels for Various Positions in Risky Assets (y) for an Investor with Risk Aversion A = 4 Max U = E (r ) − 1 A 2 = rf + y[ E ( rp ) − rf ] − 1 y* = = 2 E ( rP ) − rf A P2 2 Ay 2 2 0.15 − 0.07 = 0.41 4 0.222 6-44 Figure 6.6 Utility as a Function of Allocation to the Risky Asset, y 6-45 Table 6.5 Spreadsheet Calculations of Returns for Indifference Curves Assume two investors with A= 2 and A=4 6-46 Figure 6.7 Indifference Curves for U = .05 and U = .09 with A = 2 and A = 4 More risk-averse 6-47 Figure 6.8 Finding the Optimal Complete Portfolio Using Indifference Curves (A=4) 6-48 Table 6.6 Expected Returns on Four Indifference Curves and the CAL (A=4) Tagent to CML Imply y*=0.41 6-49 Passive Strategies: The Capital Market Line ⚫The passive strategy avoids any direct or indirect security analysis ⚫Supply and demand forces may make such a strategy a reasonable choice for many investors 6-50 Passive Strategies: The Capital Market Line ⚫A natural candidate for a passively held risky asset would be a well-diversified portfolio of common stocks such as the S&P 500. ⚫The capital market line (CML) is the capital allocation line formed from 1month T-bills and a broad index of common stocks (e.g. the S&P 500). 6-51 Passive Strategies: The Capital Market Line ⚫The CML is given by a strategy that involves investment in two passive portfolios: 1. virtually risk-free short-term T-bills (or a money market fund) 2. a fund of common stocks that mimics a broad market index. 6-52 Passive Strategies: The Capital Market Line ⚫From 1926 to 2012, the passive risky portfolio offered an average risk premium of 8.1% with a standard deviation of 20.48%, resulting in a reward-to-volatility ratio of 0.40. 6-53