ni.com

advertisement

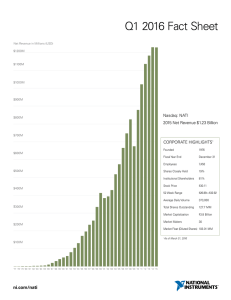

ni.com Safe Harbor Warning During the course of this presentation, we may make projections or other forward-looking statements regarding future events or the future financial performance of the company. We wish to caution you that such statements are just predictions and that actual events or results may differ materially. We refer you to the documents the company files regularly with the Securities and Exchange Commission, specifically the company's most recent Form 10-K and Form10-Q. These documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. ni.com 2 National Instruments We equip engineers and scientists with tools that accelerate productivity, innovation, and discovery Long-term track record of growth and profitability Non-GAAP Revenue: $262 M in Q1 2012 • Global Operations: Approximately 6,300 employees; operations in more than 45 countries • Broad customer base: More than 35,000 companies served annually • Diversity: No industry >15% of revenue • Culture: Ranked among top 25 companies to work for worldwide by the Great Places to Work Institute • Strong Cash Position: Cash and short-term investments of $377M at March 31, 2012 Non-GAAP Revenue* in Millions • *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 3 What We Do Graphical system design combines graphical programming software with modular hardware, leveraging the latest technologies Low-Cost Modular Measurement and Control Hardware ni.com Productive Software Development Tools 4 Highly Integrated Systems Platforms Empowering Users Through Software Providing unique differentiation and preserving customer investments LEGO® MINDSTORMS® NXT CERN Large Hadron Collider “the most powerful instrument on earth” “the smartest, coolest toy of the year” ni.com 5 NI Product and Platform Portfolio Evolution Our increasing value to customers and shareholders ni.com 6 Leveraging Commercial Technology Expanding measurement capability Phase Matrix Products and Technology ni.com 7 Test and Measurement (T&M) ni.com Test and Measurement Market Total Market Size: $17 billion Electrical/ Electronic Wireless/ RF Structural/ Physical $4.4 billion $3.8 billion $4.0 billion Real-Time Test Semiconductor Source: Prime Data and NI Estimates ni.com 9 $2.6 billion $2.2 billion T&M: The Traditional Approach Programmable Switch Function Generator Communications Analyzer Oscilloscope Logic Analyzer Pattern Generator Power Supply LCR Meter DMM Photos Courtesy of Agilent, Keithley, and Nicolet ni.com 10 Spectrum Analyzer T&M: NI Graphical System Design Approach Traditional Solution PXI Solution Lower cost Higher performance Smaller size Flexibility Easily upgradable design User-defined solution ni.com 11 Industrial Embedded ni.com Industrial Embedded Market Total Market Size: Approximately $40 billion PLC/PAC Custom Design SBC/Embedded Plants and machine builders want better control capabilities in their automated systems. Trend toward using FPGAs and higher-level tools for a more integrated tool chain. Need for open, PC-based architectures to quickly develop solutions NI provides optimized automation NI makes design easier NI delivers quality measurements >$13 billion >$24 billion Source: NI Estimates ni.com 13 $3 billion NI IE Opportunity: Areas of Innovation Areas of Innovation •Energy •Medical & Life Sciences •Custom Machines ni.com 14 Embedded Devices and Machines Control Software Display Controller and I/O Drives and Motors Algorithm IP Vision ni.com 15 Financial History ni.com Diversity of Applications No Industry >15% of Revenue Academic Defense/Aerospace ni.com Advanced Research Energy Automotive Life Sciences 17 Big Physics Mobile Devices Consumer Electronics Semiconductors Strong Track Record of Growth & Profitability $1,200 $1,000 Non-GAAP Revenue* in Millions $800 $600 $400 $200 $0 '77 '78 '79 '80 '81 '82 '83 '84 '85 '86 '87 '88 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 18 Q1 2012 Highlights • Revenue of $261 million, up 10 percent year-over-year • Non-GAAP revenue of $262 million, up 10 percent year-over-year • Record revenue for a first quarter in software, PXI, and NI CompactRIO products • GAAP gross margin of 77 percent and non-GAAP gross margin of 78 percent • Fully diluted GAAP EPS of $0.15 • Fully diluted non-GAAP EPS of $0.22 • Record EBITDA of $38 million, or $0.31 per share for a first quarter • Cash and short-term investments of $377 million as of March 31, 2012 *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 19 Personnel Personnel Driving Future Growth ni.com 20 Worldwide Large Order* Growth Orders >$20k YOY Growth Quarterly orders in millions USD Q1 2012 large orders* +136% compared to Q1 2007 and were 47% of total orders *National Instruments defines large orders as orders over $20,000 ni.com 21 Global PMI vs. NI Non-GAAP Revenue* Growth Global Purchasing Managers Index Worldwide Non-GAAP Revenue Growth *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 22 Quarterly revenue in USD Strategic Product Revenue Growth ni.com 23 Non-GAAP Operating Income* and R&D as a % of Revenue *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 24 Non-GAAP Gross Margin* Q1 2012 Non-GAAP gross margin is up approximately 180 basis points compared to Q1 2007 *A reconciliation of GAAP to non-GAAP results is available at investor.ni.com ni.com 25 2012 Strategic Goals Drive Organic Revenue Growth • Sustain our strategic investments in R&D and field sales • Broaden and deepen our customer relationships • Enhancing NI service offerings and partner network Deliver Strong Profitability • Optimize NI operating expenses • Preserve our strong gross margins • Drive efficiency of resources added in 2011 ni.com 26 ni.com