Annual report 2014

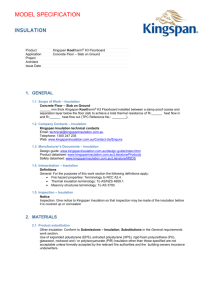

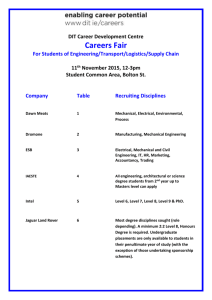

advertisement