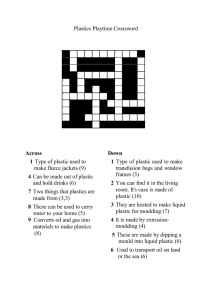

Global recycling markets: plastic waste

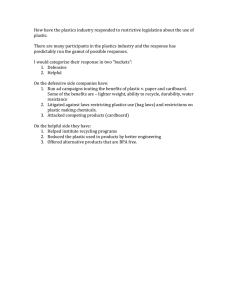

advertisement