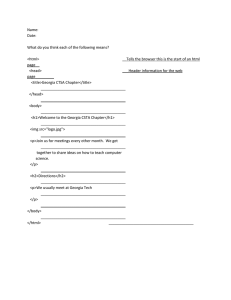

SMALL BUSINESS RESOURCE GUIDE

advertisement