Emerson Electric Co EMR (XNYS)

advertisement

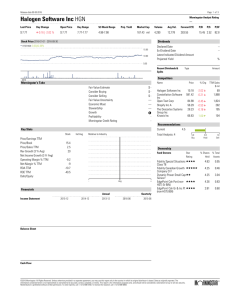

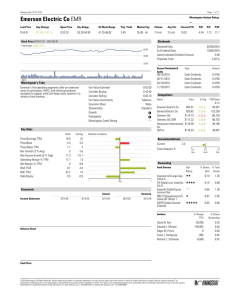

Morningstar Equity Analyst Report | Report as of 02 Feb 2016 | Page 1 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 Morningstar Pillars Analyst Quantitative Economic Moat Valuation Uncertainty Financial Health Wide QQQQ Medium — Wide Undervalued Medium Strong Source: Morningstar Equity Research EMR pUSA Fairly Valued Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Dividend Yield % Barbara Noverini, Analyst, 31 August 2015 returns going forward. Investment Thesis Quantitative Valuation Undervalued Wide Moat Emerson Executes Well in Fiscal First Quarter Despite Tough Spending Environment Overvalued Current 5-Yr Avg 0.79 11.4 13.6 12.2 16.7 4.14 0.95 19.1 — 12.5 15.7 3.06 Sector Country 0.87 16.3 12.5 9.5 16.0 2.43 0.88 18.9 13.1 10.7 17.0 2.43 Emerson’s five operating segments offer an extensive array of automation, HVAC, and electrical products equipped to support small and large-scale systems in a variety of end markets. The most profitable segments manage to translate customer reliance on total system solutions, which bundle proprietary Emerson equipment with human and knowledge capital, into higher-margin sales and stronger customer relationships. This dynamic allows Emerson to rise above commodity producers of parts and equipment in the competitive landscape. Source: Morningstar Bulls Say OEmerson has diligently returned value to shareholders, distributing more than 80% of its free cash flow to the firm through dividends and share buybacks over the past decade. OEmerson's reputation in process automation has enabled it to be an industry leader across key end markets. OEmerson’s commitment to and experience in emerging markets develops strong roots and recognition in fast-growing regions of the world. We view process management as Emerson’s crown jewel, representing nearly one third of sales and boasting average operating margins of nearly 20% over the past five years. The segment benefits from a growing customer desire to remotely control all facility operations from centralized locations, creating opportunity to more deeply penetrate a customer’s enterprise and offer higher-margin products and services. With 43% of revenue tied to oil and gas, we expect process sales to suffer in the near term. However, with two thirds of this energy sector exposure tied to the production-reliant mid- and down-stream markets, we expect a basic level of demand for process optimization to persist. Bears Say ORoughly one third of Emerson’s 2014 sales originated from the energy sector, a weighty exposure that could stress consolidated profitability in an extended downturn. OEmerson may spread itself too thin reaching for growth in swiftly developing emerging markets. OCompetitive issues in network power continue to overshadow other businesses in the portfolio and may monopolize management's focus. Ongoing innovation in regulatory-compliant HVAC products supports strong returns in the climate technologies segment, which represented about one sixth of sales and produced 17% average operating margins over the past five years. Near term, climate is well positioned to benefit from strengthening U.S. construction markets, while longer-term opportunity exists in emerging markets needing infrastructure development. We expect these same macro trends to benefit Emerson’s commercial and residential segment, which sells branded tools and storage products that command the highest margins in the company, at over 22%. We believe persistent underperformance in network power and industrial automation can be blamed on a higher concentration of commoditylike products, as well as some ill-timed acquisitions. Recent divestitures should realign focus on developing total system solutions for these segments, which we believe will improve their Barbara Noverini, Analyst, 02 February 2016 Analyst Note Despite facing significant headwinds in its oil and gas businesses in the first fiscal quarter, Emerson displayed the resilience we’ve come to expect from wide-moat firms during periods of cyclical weakness, and we reiterate our fair value estimate of $62 per share. In our view, successful execution of Emerson’s 2016 plans for long-lasting portfolio improvement through restructuring, asset divestitures, and the impending separation of the Network Power segment supports an estimated upside of about 35%, and we maintain that Emerson has ample opportunity for self-help amidst an otherwise challenging macroeconomic backdrop. Consolidated revenue fell almost 16% year over year to $4.7 billion, as the negative impacts of currency translation and divestitures intensified a 9% decline in Emerson’s underlying sales. The Process Management and Industrial Automation segments suffered ongoing ill effects of reduced spending in upstream oil and gas; however, Process Management continued to shift resources toward serving relatively stronger end markets, such as life sciences and small to midsize projects in downstream power and chemical sectors, while preparations to divest parts of the Industrial Automation segment remain under way. Furthermore, strong activity in U.S. construction markets benefited Emerson’s Climate and Commercial and Residential Solutions segments, which we believe can support stronger underlying sales growth as the year progresses. Although segment operating margins (excluding corporate expenses) contracted 170 basis points year over year to 13.3%, the benefits of restructuring actions in 2015 helped to mitigate the negative effects of volume deleveraging. Management is prepared to flex up restructuring programs should conditions weaken in Emerson's oil and gas-related businesses; however, we expect that improving sales in Emerson's residential, commercial, and consumer-focused businesses will also provide some counterbalance throughout fiscal 2016. Economic Moat © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Morningstar Equity Analyst Report |Page 2 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 Close Competitors Currency (Mil) Market Cap TTM Sales Operating Margin TTM/PE Honeywell International Inc HON USD 79,289 38,865 16.30 18.02 ABB Ltd ABB USD 38,157 37,889 10.80 15.36 Schneider Electric SE SU EUR 27,644 26,087 11.03 16.72 Eaton Corp PLC ETN USD 23,242 21,363 8.22 11.63 Barbara Noverini, Analyst, 31 August 2015 A steady history of midteen returns on invested capital supports our belief that Emerson benefits from a wide economic moat. Over the past 10 years, Emerson averaged over 15% ROICs (including goodwill) relative to a weighted average cost of capital of around 8.4%. That returns remained well above the cost of capital during a period that included one of the more difficult global recessions in recent history speaks to the staying power of Emerson’s portfolio of products and services. In our opinion, the company’s competitive advantages stem from three main moat sources: customer switching costs, intangible assets, and cost advantage. We view a vast installed base as physical evidence of customer switching costs, a strong competitive advantage that protects relationships and drives margin growth as higher-margin revenue streams spring from the installed base over time. Worldwide, Emerson’s installed base represents over $250 billion of infrastructure architecture, a figure that describes the magnitude of customer investment in products and systems, with lifecycles that span anywhere from a few years to several decades. Demand for automation equipment depends on customers' capital expense budgets. However, once a contract is signed, the relationship is fairly sticky. Changing suppliers involves swapping out equipment, and discovering bugs after new installation could result in unplanned facility downtime. As such, opportunity costs often outweigh the benefits of switching. As the incumbent vendor, Emerson benefits from inertia. A customer in motion is motivated to stay in motion by avoiding profit-eroding downtime as much as possible. It would take years for a competitor to completely displace Emerson equipment at a large-scale enterprise customer with several active facilities across the globe, a daunting operational challenge that could easily damp the allure of switching vendors from the customer’s perspective. That said, equipment and part manufacturers are merely commodity producers if they can’t figure out a way to differentiate themselves. Many of Emerson’s products, such as actuators, motors, and valves, lack distinguishing characteristics. The strongest segments in Emerson’s portfolio, process management and climate technologies, manage to separate themselves from commodity producers by increasing customer reliance in two ways: first, offering aftermarket parts, maintenance service, and other enhancements, and second, bundling products into total systems. The former protects the customer’s investment, while the latter allows Emerson to customize solutions for the unique needs of their customers as their businesses evolve. Evidence of sticky customer relationships exists in the 75% of process management customers that view Emerson at some kind of preferential vendor level. In our view, this progression also supports our confidence in Emerson’s sustaining economic profits over the 20 years required by our wide moat classification. Process management equipment lasts on average 20-40 years, securing a lengthy customer relationship. Relatively insulated from competition over the product lifecycle, Emerson has the opportunity to drive additional higher-margin incremental revenue as it graduates from a preferred supplier to a trusted customer adviser over time. Service centers also represent a source of customer switching costs. Emerson’s service infrastructure spans the globe and includes 352 process management centers, 277 network power centers, and 22 climate technology centers. Since 2011, Emerson has increased the number of facilities by 11% and expects to expand the network an additional 10% over the course of the next three years. With service facilities located in close proximity to key customer accounts, reliability assurance adds an additional layer of customer stickiness. Like many diversified industrial companies, Emerson relies on research and development to bring new products to market. However, we’d argue that proprietary patents are less important to the overall business. Rather, other intangible assets such as regulatory approvals and strong brands appear to create more value throughout the enterprise. Maintaining compliance with Environmental Protection Agency emission regulations drives sales in Emerson’s outperforming process management and climate technology segments. In process, for example, systems to operate power plants are designed to satisfy regulatory requirements, whereas in climate, product innovation is driven by the ever-increasing necessity to reduce harmful emissions. In our view, Emerson’s history © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Morningstar Equity Analyst Report |Page 3 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 of winning regulatory approvals for its products is an often-overlooked advantage that sets it apart from new entrants. Brands are especially important in residential and commercial solutions, which rivals process management in operating margins and overall segment returns on total capital. While this segment is more exposed to consumers through its do-it-yourself channel, strong brands protect market leadership and pricing power in this channel. Emerson’s best-known brands include RIGID tools (professional tools are still manufactured by Emerson, whereas Home Depot licenses the RIGID brand for the consumer-oriented product sold in its stores), ClosetMaid organizers, and InSinkErator garbage disposals. We expect consolidated operating margins to average 16.5% throughout our forecast period, about 60 basis points higher than the most recent five-year average. While we expect that Emerson’s more profitable segments will continue to enjoy margin expansion, near-term weakness in process management and industrial automation will probably crimp the overall level of average improvement. That said, we believe this steady cadence of consolidated profitability growth is consistent with Emerson’s history of producing strong returns on invested capital. Our five-year explicit forecast shows ROICs averaging 15% and peaking at just about 15.8% in 2017-18 as process begins to recover. Risk In addition to enhancing returns in stronger segments, Emerson’s economies of scale provide an important advantage for the segments that are more commodity-oriented, such as industrial automation and network power. These segments each have a high proportion of fairly undifferentiated products, leaving them vulnerable to price competition. These segments create value primarily by producing commodity products at the lowest cost, made possible by scale advantages in sourcing. Valuation Barbara Noverini, Analyst, 04 August 2015 We’re cutting our fair value estimate for Emerson Electric to $62 from $65 per share, following fiscal third-quarter results commentary that suggest recovery in key end markets is likely to take longer than we initially anticipated. Weak organic growth in fiscal 2015 is projected to carry through 2016, which crimped our expectations for average organic sales growth over our five-year forecast period to just over 2%. In particular, we expect process management will see sales declines of about 3% through 2016, as oil and gas production rates fall off in mid-2015 and beyond. We forecast GDP-like growth for the segment in the following years. We also assume that acquisitions will add about $2 billion to the top line, a figure that we believe reflects the company’s most recent cadence of bolt-on acquisitions, rather than larger-scale M&A that we are reticent to specifically forecast. At present, we continue to include Network Power in our valuation, despite Emerson's recently announced intentions to ultimately spin off or divest this business. Barbara Noverini, Analyst, 31 August 2015 We assign a medium uncertainty rating to Emerson as the company's exposure to cyclical end markets is mitigated by a diverse set of businesses and customers, reducing volatility to cash flow; we believe this phenomenon is evident in relatively steady returns on invested capital over the years. High operating leverage can affect profitability, especially during cyclical peaks and troughs when volume is most affected; we attempt to temper this effect in our discounted cash flow model by employing what we believe is a sustainable midcycle operating margin. Cash flow generation is also affected by M&A, as the company has historically spent roughly 2% of sales on acquisitions that subject it to both valuation and integration risks. Management Barbara Noverini, Analyst, 02 April 2015 CEO David Farr has more than 30 years of experience with Emerson in various roles. He took the helm in 2000 and also became chairman of the board four years later. While we’d prefer to see the CEO and chairman roles separated, we’ll concede that shareholders have enjoyed an excellent record of value creation under his leadership. Farr demonstrated his focus on longer-term value creation in 2000 by deliberately shedding underperforming businesses and adding high-return businesses in growing markets. Under Farr's watch, the firm has built a healthy presence in emerging markets, adding new sources of income for investors. In addition, Emerson has a long history of returning capital to shareholders in the form of dividends and share buybacks supported by strong free cash flow. We’ll partially attribute this success to performance metrics that focus on cash flow and returns on total capital; as such, we award Emerson a Standard © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Morningstar Equity Analyst Report |Page 4 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 Stewardship Rating. That said, ill-timed acquisitions in network power give us pause and prevent us from awarding Emerson an exemplary rating. Chasing growth in the rapidly evolving segment led to the purchase of Artesyn in 2006 and Chloride in 2010, arguably at the top of the cycle in both cases. Persistent underperformance in the segment led to $500 million-plus worth of impairments in each year during 2012, 2013, and 2014 as Emerson sought to sell these businesses less than half a decade after paying up for them. Farr’s cash bonus was reduced in 2014 because of the Chloride impairment, in particular, which we believe is a good-faith effort on his part to demonstrate responsibility. Returns on invested capital remain strong despite these missteps, and we expect that Farr’s capital-allocation focus will remain more firmly rooted in markets where Emerson displays a clear competitive edge. © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Morningstar Equity Analyst Report |Page 5 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 Barbara Noverini, Analyst, 03 November 2015 Analyst Notes Archive Wide Moat Emerson Executes Well in Fiscal First Quarter Despite Tough Spending Environment Barbara Noverini, Analyst, 02 February 2016 Despite facing significant headwinds in its oil and gas businesses in the first fiscal quarter, Emerson displayed the resilience we’ve come to expect from wide-moat firms during periods of cyclical weakness, and we reiterate our fair value estimate of $62 per share. In our view, successful execution of Emerson’s 2016 plans for long-lasting portfolio improvement through restructuring, asset divestitures, and the impending separation of the Network Power segment supports an estimated upside of about 35%, and we maintain that Emerson has ample opportunity for self-help amidst an otherwise challenging macroeconomic backdrop. Consolidated revenue fell almost 16% year over year to $4.7 billion, as the negative impacts of currency translation and divestitures intensified a 9% decline in Emerson’s underlying sales. The Process Management and Industrial Automation segments suffered ongoing ill effects of reduced spending in upstream oil and gas; however, Process Management continued to shift resources toward serving relatively stronger end markets, such as life sciences and small to midsize projects in downstream power and chemical sectors, while preparations to divest parts of the Industrial Automation segment remain under way. Furthermore, strong activity in U.S. construction markets benefited Emerson’s Climate and Commercial and Residential Solutions segments, which we believe can support stronger underlying sales growth as the year progresses. Although segment operating margins (excluding corporate expenses) contracted 170 basis points year over year to 13.3%, the benefits of restructuring actions in 2015 helped to mitigate the negative effects of volume deleveraging. Management is prepared to flex up restructuring programs should conditions weaken in Emerson's oil and gas-related businesses; however, we expect that improving sales in Emerson's residential, commercial, and consumer-focused businesses will also provide some counterbalance throughout fiscal 2016. After Emerson’s fourth-quarter earnings release, we’re maintaining our $62 fair value estimate and wide moat rating. CEO David Farr proclaimed that the end of the fiscal year reflected the acceleration of a global industrial recession brought on by a weakened oil and gas sector and softening growth in emerging markets. Consolidated revenue tumbled nearly 15% year over year to $5.8 billion, as the negative impacts of foreign exchange and divestitures exacerbated a 7% decline in the company’s underlying sales. Emerson’s Process Management and Industrial Automation segments, both heavily exposed to upstream oil activity in several geographies, reported the steepest sales declines of 10% and 12%, respectively, when excluding foreign exchange and divestitures. Lower demand in China contributed to an underlying sales decrease of 5% in Climate Technologies; however, the segment also faced difficult comparisons from an exceptionally strong quarter of sales in the prior period as OEMs built inventory in anticipation of regulatory changes in the residential air conditioning market. Only Commercial & Residential Solutions grew underlying sales year over year, as strength in U.S. construction and higher demand in Europe supported an increase of 3%. Business segment operating margins (excluding corporate costs and divestiture gains) declined 450 basis points year over year to 15.7%, reflecting negative operating leverage from weaker volumes and higher restructuring costs. Although we project 2016 to be another challenging year, the spin-off or sale of Emerson’s Network Power business is an interesting catalyst on the horizon. Divesting this low-margin business should boost Emerson’s cash flow engine over time. In addition, we expect that $221 million of restructuring actions taken throughout fiscal 2015 will begin to bear fruit in 2016, as a lighter cost base protects margins against persistent top-line weakness in the segments most exposed to soft end-market spending. Accelerating End-Market Weakness Weighs on Underlying Sales in Emerson’s Fiscal Fourth Quarter © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Page of 1 Page 6 of1 10 Quantitative Equity Report | Release: 02 Feb 2016, 16:30, GMT-06:00 | Reporting Currency: USD | Trading Currency: USD Emerson Electric Co EMR Last Close 02 Feb 2016 Quantitative Fair Value Est 01 Feb 2016 45.84 57.95 Emerson Electric Co is engaged in designing and supplying products and technology, and delivering engineering services and solutions in industrial, commercial and consumer markets. Market Cap 02 Feb 2016 Sector Rating, please Click Here IndustryFor BOS Product Risk Country of Domicile 29,782.3 Mil p Industrials Diversified Industrials USA United States Price Versus Quantitative Fair Value 2012 2013 2014 2015 2016 2017 Sales/Share Forecast Range Forcasted Price Dividend Split Quantitative Fair Value Estimate 90 Total Return Quantitative Scores 72 Scores Momentum: Negative Standard Deviation: 16.73 Liquidity: High All Rel Sector Rel Country Quantitative Moat Wide 100 Valuation Undervalued 79 Quantitative Uncertainty Medium 100 Financial Health Strong 81 100 83 100 76 54 100 76 99 81 36 41.25 52-Wk 62.75 39.50 5-Yr 70.66 18 EMR pUSA Undervalued Fairly Valued Overvalued Source: Morningstar Equity Research Valuation Sector Median Country Median 0.95 19.1 — 12.5 15.7 3.06 3.9 1.7 0.87 16.3 12.5 9.5 16.0 2.43 1.5 0.8 0.88 18.9 13.1 10.7 17.0 2.43 2.0 1.6 Current 5-Yr Avg Sector Median Country Median 11.0 4.6 457.8 Current 5-Yr Avg Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Dividend Yield % Price/Book Price/Sales 0.79 11.4 13.6 12.2 16.7 4.14 3.7 1.4 Profitability Return on Equity % Return on Assets % Revenue/Employee (K) 29.8 11.7 — 22.7 9.5 — Quantitative Moat 17.1 0.9 3.04 19.0 1.6 35.6 2.5 2.37 25.4 2.1 -9.5 -22.4 2.85 20.2 1.8 -19.5 -20.2 3.94 11.9 1.5 -4.2 1.4 4.14 11.4 1.4 Total Return % +/– Market (Morningstar US Index) Dividend Yield % Price/Earnings Price/Revenue Morningstar RatingQ QQQQQ QQQQ QQQ QQ Q Financials (Fiscal Year in Mil) Revenue % Change 2011 2012 2013 2014 2015 TTM 24,222 15.1 24,412 0.8 24,669 1.1 24,537 -0.5 22,304 -9.1 22,304 0.0 3,854 22.7 2,480 3,740 -3.0 1,968 4,304 15.1 2,004 4,443 3.2 2,147 3,864 -13.0 2,710 3,864 0.0 2,710 Operating Income % Change Net Income 11.9 4.7 303.8 3,233 -647 2,586 10.7 3,053 -665 2,388 9.8 3,649 -678 2,971 12.0 3,692 -767 2,925 11.9 2,529 -685 1,844 8.3 2,529 -685 1,844 8.3 Operating Cash Flow Capital Spending Free Cash Flow % Sales Score 100 3.27 15.1 3.43 2.67 -18.3 3.15 2.76 3.4 3.91 3.03 9.8 4.12 3.99 31.7 3.10 3.99 0.0 2.73 EPS % Change Free Cash Flow/Share 1.38 14.07 722,641 1.60 14.53 704,388 1.64 14.32 688,677 1.72 15.53 654,557 1.88 13.37 — 1.88 12.35 654,557 24.6 10.6 10.2 1.04 2.3 19.0 8.3 8.1 1.02 2.3 19.2 8.3 8.1 1.02 2.3 20.7 8.8 8.8 1.00 2.4 29.8 11.7 12.2 0.96 2.7 29.8 11.7 12.2 0.96 2.7 Profitability Return on Equity % Return on Assets % Net Margin % Asset Turnover Financial Leverage 39.5 15.9 4,324 40.0 15.3 3,787 40.3 17.5 4,055 41.4 18.1 3,559 40.6 17.3 4,289 40.6 17.3 4,289 Gross Margin % Operating Margin % Long-Term Debt 10,399 7.2 10,295 7.0 10,585 6.9 10,119 6.8 8,081 6.2 8,081 6.2 Total Equity Fixed Asset Turns 80 Dividends/Share Book Value/Share Shares Outstanding (K) 60 40 20 0 2009 2010 2011 2012 2013 2014 2015 Financial Health Current 5-Yr Avg Distance to Default Solvency Score Assets/Equity Long-Term Debt/Equity 0.7 335.9 2.7 0.5 0.8 — 2.4 0.4 2016 Sector Median Country Median 0.6 492.0 1.8 0.2 0.6 575.7 1.7 0.3 Growth Per Share Revenue % Operating Income % Earnings % Dividends % Book Value % Stock Total Return % 1-Year 3-Year 5-Year 10-Year -9.1 -13.0 31.4 9.3 -15.0 -19.1 -3.0 -3.7 14.5 5.5 -4.6 -4.1 1.2 4.2 9.0 7.0 -1.0 -2.0 2.6 4.2 9.0 8.5 3.2 4.5 Quarterly Revenue & EPS Revenue (Mil) Dec Mar 2015 5,587.0 5,400.0 2014 5,606.0 5,812.0 2013 5,553.0 5,960.0 2012 5,309.0 5,919.0 Earnings Per Share () 2015 0.75 1.42 2014 0.65 0.77 2013 0.62 0.77 2012 0.50 0.74 Revenue Growth Year On Year % Jun 5,503.0 6,312.0 6,344.0 6,484.0 Sep 5,814.0 6,807.0 6,812.0 6,700.0 Total 22,304.0 24,537.0 24,669.0 24,412.0 0.84 1.03 0.27 1.04 0.98 0.59 1.11 0.39 3.99 3.03 2.76 2.67 1.7 1.0 -0.5 -0.1 -0.3 -2.5 -7.1 -12.8 -14.6 2013 2014 © 2016 All Rights Reserved. ThisRights report Reserved. is being made available to you through an in arrangement BANK you OF SINGAPORE LIMITED Morningstar Australasia Pty Limited. Pleasedistributor refer to theislast page for disclaimers disclosures. © Morningstar 2016. All Unless otherwise provided a separatebetween agreement, may use this reportandonly in the country in which its original based. Theimportant information, data, and analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore is not an offer to buy or sell a security; are not warranted to be correct, complete or accurate; and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. The information herein may not be reproduced, in any manner without the prior written consent of Morningstar. Please see important disclosures at the end of this report. 2015 ® ß Morningstar Morningstar Equity Equity Analyst Analyst Report Report |Page 7 of 10 Morningstar Equity Research Methodology For BOS Product Risk Rating, please Click Here Fundamental Analysis At Morningstar, we believe buying shares of superior businesses at a discount and allowing them to compound over time is the surest way to create wealth in the stock market. The long-term fundamentals of businesses, such as cash flow, competition, economic cycles, and stewardship, are our primary focus. Occasionally, this approach causes our recommendations to appear out of step with the market, but willingness to be contrarian is an important source of outperformance and a benefit of Morningstar’s independence. Our analysts conduct primary research to inform our views on each firm’s moat, fair value and uncertainty. Fundamental Economic Fair Value Moat Rating Estimate Analysis Uncertainty Assessment QQQQQ QQQQ QQQ QQ Q Star Rating Economic Moat The economic moat concept is a cornerstone of Morningstar’s investment philosophy and is used to distinguish high-quality companies with sustainable competitive advantages. An economic moat is a structural feature that allows a firm to sustain excess returns over a long period of time. Without a moat, a company’s profits are more susceptible to competition. Companies with narrow moats are likely to achieve normalized excess returns beyond 10 years while wide-moat companies are likely to sustain excess returns beyond 20 years. The longer a firm generates economic profits, the higher its intrinsic value. We believe lower-quality no-moat companies will see their returns gravitate to- ward the firm’s cost of capital more quickly than companies with moats will. We have identified five sources of economic moats: intangible assets, switching costs, network effect, cost advantage, and efficient scale. Fair Value Estimate Our analyst-driven fair value estimate is based primarily on Morningstar’s proprietary three-stage discounted cash flow model. We also use a variety of supplementary fundamental methods to triangulate a company’s worth, such as sum-of-the-parts, multiples, and yields, among others. We’re looking well beyond next quarter to determine the cash-generating ability of a company’s assets because we believe the market price of a security will migrate toward the firm’s intrinsic value over time. Economic moats are not only an important sorting mechanism for quality in our framework, but the designation also directly contributes to our estimate of a company’s intrinsic value through sustained excess returns on invested capital. Uncertainty Rating The Morningstar Uncertainty Rating demonstrates our assessment of a firm’s cash flow predictability, or valuation risk. From this rating, we determine appropriate margins of safety: The higher the uncertainty, the wider the margin of safety around our fair value estimate before our recommendations are triggered. Our uncertainty ratings are low, medium, high, very high, and extreme. With each uncertainty rating is a corresponding set of price/fair value ratios that drive our recommendations: Lower price/fair value ratios (<1.0) lead to positive recommendations, while higher price/fair value Economic Moat C O M PE T I T I V E F O R C E S WIDE Moat Sources: Intangible Assets NARROW NONE Switching Costs COMPANY PROFITABILITY Network Effect Cost Advantage © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. Efficient Scale ? Morningstar Morningstar Equity Equity Analyst Analyst Report Report |Page 8 of 10 Morningstar Equity Research Methodology For BOS Product Risk Rating, please Click Here ratios (>1.0) lead to negative recommendations. In very rare cases, the fair value estimate for a firm is so unpredictable that a margin of safety cannot be properly estimated. For these firms, we use a rating of extreme. Very high and extreme uncertainty companies tend to have higher risk and volatility. Quantitatively Driven Valuations To complement our analysts’ work, we produce Quantitative Ratings for a much larger universe of companies. These ratings are generated by statistical models that are meant to divine the relationships between Morningstar’s analyst-driven ratings and key financial data points. Consequently, our quantitative ratings are directly analogous to our analyst-driven ratings. Quantitative Fair Value Estimate (QFVE): The QFVE is analogous to Morningstar’s fair value estimate for stocks. It represents the per-share value of the equity of a company. The QFVE is displayed in the same currency as the company’s last close price. Valuation: The valuation is based on the ratio of a company’s quantitative fair value estimate to its last close price. Understanding Differences Between Analyst and Quantitative Valuations If our analyst-driven ratings did not sometimes differ from our quantitative ratings, there would be little value in producing both. Differences occur because our quantitative ratings are essentially a highly sophisticated analysis of the analyst-driven ratings of comparable companies. If a company is unique and has few comparable companies, the quantitative model will have more trouble assigning correct ratings, while an analyst will have an easier time recognizing the true characteristics of the company. On the other hand, the quantitative models incorporate new data efficiently and consistently. Empirically, we find quantitative ratings and analyst-driven ratings to be equally powerful predictors of future performance. When the analystdriven rating and the quantitative rating agree, we find the ratings to be much more predictive than when they differ. In this way, they provide an excellent second opinion for each other. When the ratings differ, it may be wise to follow the analyst’s rating for a truly unique company with its own special situation, and follow the quantitative rating when a company has several reasonable comparable companies and relevant information is flowing at a rapid pace. Quantitative Uncertainty: This rating describes our level of uncertainty about the accuracy of our quantitative fair value estimate. In this way it is analogous to Morningstar’s fair value uncertainty ratings. Quantitative Economic Moat: The quantitative moat rating is analogous to Morningstar’s analyst-driven economic moat rating in that both are meant to describe the strength of a firm’s competitive position. Uncertainty Rating Price/Fair Value 2.00 Q 1.75 175% 1.50 1.25 1.00 0.75 155% 125% 95% QQ 135% 105% 80% 125% 115% 110% QQQ 90% 85% 80% 70% 60% 0.50 50% QQQQ QQQQQ 0.25 Low Uncertainty Rating Medium High Very High © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. See last page for important disclosures. ? Morningstar Equity Analyst Report |Page 9 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 Unless stated otherwise, this Research Report was prepared by the person(s) noted in their capacity as Equity Analysts employed by Morningstar, Inc., or one of its affiliates. This Report has not been made available to the issuer of the relevant financial products prior to publication. The Morningstar Rating for stocks identifies stocks trading at a discount or premium to their intrinsic value. Five-star stocks sell for the biggest risk-adjusted discount whereas one-star stocks trade at premiums to their intrinsic value. Based on a fundamentally focused methodology and a robust, standardized set of procedures and core valuation tools used by Morningstar's Equity Analysts, four key components drive the Morningstar Rating: 1. Assessment of the firm's economic moat, 2. Estimate of the stock's fair value, 3. Uncertainty around that fair value estimate, and 4. Current market price. Further information on Morningstar's methodology is available from http://global.morningstar.com/equitydisclosures. This Report is current as of the date on the Report until it is replaced, updated or withdrawn. This Report may be withdrawn or changed at any time as other information becomes available to us. This Report will be updated if events affecting the Report materially change. Conflicts of Interest: -No material interests are held by Morningstar or the Equity Analyst in the financial products that are the subject of the Reports. -Equity Analysts are required to comply with the CFA Institute's Code of Ethics and Standards of Professional Conduct. -Equity Analysts’ compensation is derived from Morningstar's overall earnings and consists of salary, bonus and in some cases restricted stock. -Equity Analysts do not have authority over Morningstar's investment management group's business arrangements nor allow employees from the investment management group to participate or influence the analysis or opinion prepared by them. Morningstar will not receive any direct benefit from the publication of this Report. - Morningstar does not receive commissions for providing research and does not charge companies to be rated. -Equity Analysts use publicly available information. -Morningstar may provide the product issuer or its related entities with services or products for a fee and on an arms’ length basis including software products and licenses, research and consulting services, data services, licenses to republish our ratings and research in their promotional material, event sponsorship and website advertising. -Further information on Morningstar's conflict of interest policies is available from http://global.mornin­ gstar.com/equitydisclosures. If you wish to obtain further information regarding previous Reports and recommendations and our services, please contact your local Morningstar office. Unless otherwise provided in a separate agreement, you may use this Report only in the country in which the Morningstar distributor is based. Unless stated otherwise, the original distributor of this document is Morningstar Inc. Redistribution, in any capacity, is prohibited without permission. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete or accurate, nor may they be construed as a representation regarding the legality of investing in the security/ies concerned, under the applicable investment or similar laws or regulations of any person or entity accessing this report. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar, its affiliates, and their officers, directors and employees shall not be responsible or liable for any trading decisions, damages or other losses resulting from, or related to, the information, data, analyses or opinions or their use. You should seek the advice of your financial, legal, tax, business and/or other consultant, and read all relevant issue documents pertaining to the security/ies concerned, including without limitation, the detailed risks involved in the investment, before making an investment decision. Please note that investments in securities are subject to market and other risks and there is no assurance or guarantee that the intended investment objectives will be achieved. Past performance of a security may or may not be sustained in future and is no indication of future performance. As the price / value / interest rate of a security fluctuates, the value of your investments in the said security, and in the income, if any, derived therefrom may go up or down. For Recipients in Australia: This report has been authorized by the Head of Equity and Credit Research, Asia Pacific, Morningstar Australasia Pty Limited and is circulated pursuant to RG 79.26(f) as a full © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. ? Morningstar Equity Analyst Report |Page 10 of 10 Emerson Electric Co EMR (XNYS) For BOS Product Risk Rating, please Click Here Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQQQ 45.50 USD 62.00 USD 0.73 4.14 29.78 Diversified Industrials Standard 01 Feb 2016 01 Feb 2016 01 Feb 2016 01 Feb 2016 restatement of an original report (by the named Morningstar analyst) which has already been broadly distributed. To the extent the report contains general advice it has been prepared without reference to your objectives, financial situation or needs. You should consider the advice in light of these matters and, if applicable, the relevant Product Disclosure Statement before making any decision to invest. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/fsg.pdf. For Recipients in Hong Kong: The research is distributed by Morningstar Investment Management Asia Limited, which is regulated by the Hong Kong Securities and Futures Commission to provide services to professional investors only. Neither Morningstar Investment Management Asia Limited, nor its representatives, are acting or will be deemed to be acting as an investment advisor to any recipients of this information unless expressly agreed to by Morningstar Investment Management Asia Limited. For enquiries regarding this research, please contact a Morningstar Investment Management Asia Limited Licensed Representative at http://global.morningstar.com/equitydisclosures. For Recipients in India: This research on securities [as defined in clause (h) of Section 2 of the Securities Contracts (Regulation) Act, 1956], such research being referred to for the purpose of this document as “Investment Research”, is issued by Morningstar Investment Adviser India Private Limited. Morningstar Investment Adviser India Private Limited is registered with the Securities and Exchange Board of India under the SEBI (Investment Advisers) Regulations, 2013, vide Registration number INA000001357, dated March 27, 2014, and in compliance of the aforesaid regulations and the SEBI (Research Analysts) Regulations, 2014, it carries on the business activities of investment advice and research. Morningstar Investment Adviser India Private Limited has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. Morningstar Investment Adviser India Private Limited is a wholly owned subsidiary of Morningstar Associates LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc., and Morningstar, Inc. is a leading provider of independent investment research that offers an extensive line of products and services for individual investors, financial advisors, asset managers, and retirement plan providers and sponsors. In India, Morningstar Investment Adviser India Private Limited has only one associate, viz., Morningstar India Private Limited, and this company predominantly carries on the business activities of providing data input, data transmission and other data related services, financial data analysis, software development etc. The author/creator of this Investment Research (“Research Analyst”) or his/her associates or his/her relatives does/do not have (i) any financial interest in the subject company; (ii) any actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of this Investment Research; and (iii) any other material conflict of interest at the time of publication of this Investment Research. The Research Analyst or his/her associates or his/her relatives has/have not received any (i) compensation from the subject company in the past twelve months; (ii) compensation for products or services from the subject company in the past twelve months; and (iii) compensation or other material benefits from the subject company or third party in connection with this Investment Research. Also, the Research Analyst has not served as an officer, director or employee of the subject company. The terms and conditions on which Morningstar Investment Adviser India Private Limited offers Investment Research to clients, varies from client to client, and are spelt out in detail in the respective client agreement. © Morningstar. All Rights Reserved. Unless in aanseparate agreement, mayOFuse this report only inand theMorningstar country in which its original distributor based. as originally reported. The information contained © 2016 2016 All Rights Reserved. This report is being madeotherwise available toprovided you through arrangement betweenyou BANK SINGAPORE LIMITED Australasia Pty Limited. Please is refer to theData last page for important disclaimers and disclosures. herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. ? For BOS Product Risk Rating, please Click Here Bank of Singapore Disclaimer This report is being made available to you through an herein which are subject to change without notice and may currency exchange rates, and (vii) changes in the policies arrangement between BANK OF SINGAPORE LIMITED only be correct at the stated date of their issue. of governments and /or regulatory authorities. Investors and Morningstar Australasia Pty Limited(‘‘Morningstar’’). should be aware that any products or securities that are Please contact BANK OF SINGAPORE LIMITED with respect mentioned in this Research have their own particular to any matter arising from, or in connection with, this report terms and conditions. This material is not intended for any Pursuant to Regulation 32C of the Singapore Financial or the analysis within. This report should not be considered specific investor and does not take into account particular Advisers Regulations (Cap. 110, REG 2), if you are not a solicitation by BANK OF SINGAPORE LIMITED or investment objectives, financial situations or needs. an accredited investor, expert investor or institutional Morningstar Australasia to buy or sell any security. investor, BANK OF SINGAPORE LIMITED accepts legal Redistribution is prohibited without written permission. responsibility for the contents of this report. The content of this Research is based upon publicly available sources of information which are believed to be No Morningstar employees are officers or directors of this reliable. However, because of possible human or If you are an accredited investor, expert investor or company. Morningstar does not own more than 1% of the mechanical error by Morningstar, by Bank of Singapore institutional investor, please note that the content of shares of this company. Analysts covering this company do Limited, by any of their branches,subsidiaries or affiliates ) this report is based upon publicly available sources of not own its stock. The information contained herein is not or their sources, no guarantee, warranty or representation, information which are believed to be reliable, and represented or warranted to be accurate, correct, complete, express or implied, can be given by the same as to the forecasts, opinions or recommendations which are or timely. This report is for information purposes only, and accuracy,adequacy or completeness of the information derived from such publicly available sources of should not be considered a solicitation to buy or sell any contained in this Research and neither Morningstar,nor information. However, because of possible human or security. Bank of Singapore Limited nor any of their respective mechanical error by Morningstar, by BANK OF branches, subsidiaries or affiliates or sources is SINGAPORE LIMITED, by any of their The research to which this notice is attached (‘‘Research’’) responsible for any errors or omissions or for results branches,subsidiaries or affiliates or their sources, no has been prepared by Morningstar solely for general obtained from use of such information.Neither guarantee, warranty or representation, express or information purposes to the persons to which Bank of Morningstar, nor Bank of Singapore Limited nor any of implied, can be given by the same as to the Singapore Limited has given access and does not constitute their branches, subsidiaries, affiliates,officers, directors or accuracy,adequacy or completeness of the an offer or a solicitation to buy, sell or deal with any employees or sources accepts any liability or responsibility information,forecasts, opinions or recommendations investment referred to herein or a participation in any in respect of the information or any recommendations contained in this report and neither Morningstar, nor trading strategy. The value of shares and any income expressed herein which are subject to change without BANK OF SINGAPORE LIMITED nor any of their generated may go down as well as up and is not notice and may only be correct at the stated date of their respective branches, subsidiaries or affiliates or guaranteed. Past performance is not indicative to future issue. All rights reserved. No part of this Research may be sources is responsible for any errors or omissions or for performance. Actual results, performance or events may reproduced, stored in a retrieval system or transmitted in results obtained from use of such information, differ materially from those in such statements due to, any form or by any means, mechanical,photocopying, forecasts,opinions or recommendations. Neither among other things, (i) general economic conditions in the recording or otherwise without the prior permission of the Morningstar,nor BANK OF SINGAPORE nor any of their markets, (ii) performance of financial markets, including copyright-holder. branches,subsidiaries, affiliates, officers, directors or emerging markets, (iii) mortality and morbidity levels and employees or sources accepts any liability or trends, (iv) persistency levels, (v) interest rate levels, (vi) responsibility in respect of the information, forecasts,opinions or recommendations expressed © 2016 All Rights Reserved. This report is being made available to you through an arrangement between BANK OF SINGAPORE LIMITED and Morningstar Australasia Pty Limited. Please refer to the last page for important disclaimers and disclosures.