Release date 10-01-2016

Page 1 of 3

Morningstar Analyst Rating

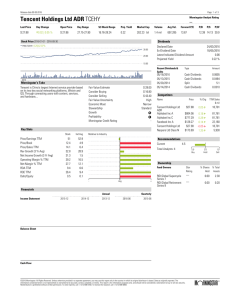

Emerson Electric Co EMR

.

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 54.51

]1.49 | 2.81 %

$ 53.20

53.20-54.90

41.25-56.82

3.49

35.08 bil

7.4 mil

3.5 mil

16.52

4.44

1.72

11.7

Dividends

Stock Price 2016-01-01 - 2016-09-30

XNYS:EMR: 6.68|13.97%

Declared Date

Ex-Dividend Date

Latest Indicated Dividend Amount

Projected Yield

60.00

40.00

02/08/2016

10/08/2016

0.48

3.49 %

20.00

2016

Morningstar’s Take

Emerson’s five operating segments offer an extensive

array of automation, HVAC, and electrical products

equipped to support small and large-scale systems in a

variety of end markets....

Fair Value Estimate

Consider Buying

Consider Selling

Fair Value Uncertainty

Economic Moat

Stewardship

Growth

Profitability

Morningstar Credit Rating

$ 62.00

$ 43.40

$ 83.70

Medium

Wide

Standard

C

C

—

Key Stats

Price/Earnings TTM

Price/Book

Price/Sales TTM

Rev Growth (3 Yr Avg)

Net Income Growth (3 Yr Avg)

Operating Margin % TTM

Net Margin % TTM

ROA TTM

ROE TTM

Debt/Equity

Stock

Ind Avg

18.8

4.3

1.7

-3

11.3

17.1

9

8.1

22.2

0.5

22

3.3

2

-1.6

-15.1

13

8.9

4.4

15

0.9

08/10/2016

05/11/2016

02/10/2016

11/10/2015

Cash Dividends

Cash Dividends

Cash Dividends

Cash Dividends

0.4750

0.4750

0.4750

0.4750

Competitors

Name

Emerson Electric Co

General Electric Co

Siemens AG

Siemens AG ADR

Honeywell International

Inc

3M Co

Price

% Chg

TTM Sales

$ mil

$54.51

$29.62

$114.73

$117.32

$116.59

2.81 ]

0.30 ]

-2.32 [

2.38 ]

0.34 ]

20,581

123,259

88,735

88,735

39,106

$176.23

0.49 ]

30,081

Recommendations

3.4

Total Analysts: 8

5.0

Buy

3.0

Hold

1.0

Sell

Ownership

Avg

+

Annual

Balance Sheet

Amount

Current

Financials

2015-09

Type

Relative to Industry

-

Income Statement

Recent Dividends &

Splits

2014-09

2013-09

Quarterly

2016-06

2015-06

Fund Owners

Star

Rating

% Shares

Held

% Total

Assets

Investors US Large Cap

Value A

TD Global Low Volatility

Ser D

Imperial Global Equity

Income Pool

RBC O'Shaughnessy US

Value GIF Series 1

CDSPI Global Growth

(Capital)

QQ

0.10

1.26

QQQQ

0.10

0.66

—

0.09

1.36

Q

0.07

2.05

QQQQQ

0.05

0.56

Insiders

% Change

TTM

% Shares

Outstanding

David N. Farr

Edward L. Monser

Edgar M. Purvis

Frank J. Dellaquila

Richard J. Schlueter

-29,090

-148,804

0

-995

-6,669

0.25

0.02

0.02

0.02

0.01

Cash Flow

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß

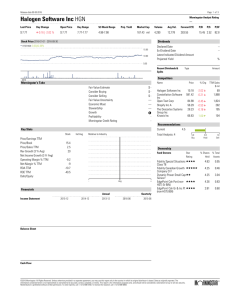

Release date 10-01-2016

Page 2 of 3

Morningstar Analyst Rating

Emerson Electric Co EMR

.

Last Price

Day Change

Open Price

Day Range

52-Week Range

Proj. Yield

Market Cap

Volume

Avg Vol.

Forward P/E

P/B

P/S

P/CF

$ 54.51

]1.49 | 2.81 %

$ 53.20

53.20-54.90

41.25-56.82

3.49

35.08 bil

7.4 mil

3.5 mil

16.52

4.44

1.72

11.7

Financials

Annual

Quarterly

In millions except "EPS". Currency in USD.

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß

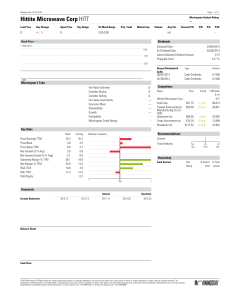

Release date 10-01-2016

Page 3 of 3

Emerson Electric Co EMR

Quote

Stock Type

Last Close 30/09/2016

Fair Value Estimate

Morningstar Rating TM

Cyclical

54.51

$ 62.00

QQQQ

©2016 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The

information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security.

Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869.

®

ß