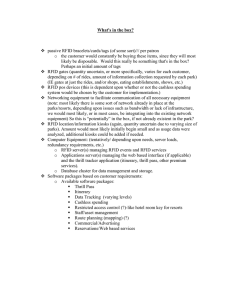

Radio-frequency Identification

advertisement