DISCLAIMER Attached please find an electronic copy of the Offering

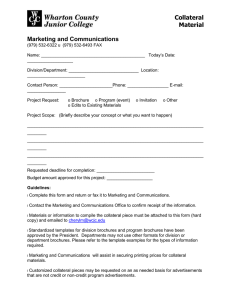

advertisement