8/23/2009

advertisement

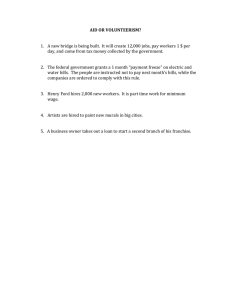

8/23/2009 1. Don’t charge what you can’t afford—even if it looks really good on you. Lesson 6 2. Pay bills on time, and build a good credit history. Pay bills late, and you’ll incur something worse than the embarrassment of walking into the wrong class—a late charge. 3. Set a monthly spending limit, and stick to it. 4. Shop around for the best credit card terms—find the card that meets your needs best. 5. Don’t let the terms of a credit card agreement sneak up on you like a pop quiz. Understand them completely when you accept a credit card. 6. Save money each payday for emergencies. That doesn’t mean latenight pizza cravings. 7. Shop as carefully with a credit card as you do with cash—your own cash, that is. 8. If you charge day-to-day expenses, pay them in full each month. You don’t want to be paying interest charges on a bag of chips. 9. Keep credit card information (including phone number of issuer) in a safe place in case your cards are lost or stolen. 1 8/23/2009 10. Keep copies of sales slips and compare charges when statements arrive. If there’s a mistake, call your issuer right away. Unlike wrong answers on exams, these mistakes can be changed 2