CHAPTER 5: Practice Questions

advertisement

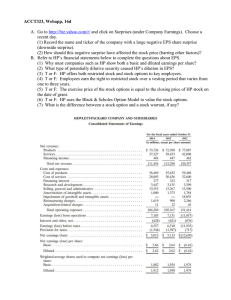

CHAPTER 5: Practice questions Exercise 16: Consider the following three stocks: a. Stock A is expected to provide a dividend of $10 a share forever b. Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever. c. Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for 5 years (until year 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which stock is the most valuable? a. = PA b. = PB c. PC = DIV1 $10 = = $100.00 0.10 r DIV1 $5 = = $83.33 r−g 0.10 − 0.04 5.00 6.00 7.20 8.64 10.37 12.44 12.44 1 + + + + + + × = $104.50 1 2 3 4 5 6 1.10 1.10 1.10 1.10 1.10 1.10 0.10 1.10 6 At a capitalization rate of 10 percent, Stock C is the most valuable. Exercise 21. See BMA for the question text. Extremely high P/EPS ratios can be misleading for a number of reasons. In the case of Textron, the extremely high P/EPS of 63 resulted from a large one-time loss which reduced EPS below what it would otherwise have been, and (perhaps) below what investors expected Textron’s EPS to be in the future. A somewhat more common scenario resulting in an extremely high P/EPS ratio is a growth stock which investors expect will experience significant increases in earnings in the near term future. Mathematically, this is a result similar to Textron’s, but the cause of the expected increase in future earnings and dividends is different. 1 Exercise 24. See BMA for the question text. Share price = EPS1 NPV + r r−g Therefore: Ρα = EPS α 1 Ρβ = EPSβ1 rα rβ + NPVα (rα − 0.15) + NPVβ (rβ − 0.08) The statement in the question implies the following: NPVβ (rβ − 0.08) EPSβ1 NPVβ > NPVα + r (rβ − 0.08) (rα − 0.15) β EPS α1 NPVα + (rα − 0.15) rα 2 Rearranging, we have: NPVβ rβ NPVα r × α < × (rα − 0.15) EPS α1 (rβ − 0.08) EPS β1 a. NPVα < NPVβ, everything else equal. b. (rα - 0.15) > (rβ - 0.08), everything else equal. c. NPVβ NPVα , everything else equal. < (rα − 0.15) (rβ − 0.08) d. rβ rα , everything else equal. < EPS α1 EPSβ1 Exercise 26. Compost Science, Inc. (CSI), is in the business of converting Boston’s sewage sludge into fertilizer. The business is not itself very profitable. However to induce CSI to remain in business, the Metropolitan District Commission (MDC) has agreed to pay whatever amount is necessary to yield CSI a 10% book return on equity. At the end of the year CSI is expected to pay $4 dividend. It has been reinvesting 40% of earnings and growing 4% a year. (a) Suppose CSI continues on this growth trend. What is the expected long-run rate of return from purchasing the stock at $100? What part of the $100 price is attributable to the present value of growth opportunities? (b) Now, the MDC announces a plan for CSI to treat Cambridge sewage. CSI’s plant will, therefore, be expanded gradually over five years. This means that CSI will have to reinvest 80% of its earnings for five years. Starting in year 6, however, it will again be able to pay out 60% of earnings. What will be CSI’s stock price once this announcement is made and its consequences for CSI are known? (a) To calculate the expected long-run rate of return we can apply the standard growing perpetuity formula with DIV1 = $4, g = 0.04 and P0 = $100: P0 = ⇔= r DIV1 (r − g) DIV1 $4 += + 0.04 = 0.08 = 8.0% g P0 $100 From the text we know that the dividends ($4) are 60% of earnings. So we can calculate the earnings per share as: 3 DIV EPS DIV 4 ⇔ EPS = = =$6,67 Payout ratio 0,6 Payout ratio = An from here it is now easy to proceed with the estimation of the PVGOs: EPS1 + PVGO r 6,67 100 = + PVGO 0,08 PVGO = $16,63 = P0 (b) With this new project the dividends of the firm will be affected because the payout ratio is now only 20%. DIV1 will thus decrease to: 0.20 × 6.67 = $1.33 However, by plowing back 80 percent of earnings, CSI will grow by 8 percent per year for five years (because we hold constant the relationship between reinvestment and growth). Thus: Year EPSt DIVt 1 6.67 1.33 2 7.20 1.44 3 7.78 1.55 4 8.40 1.68 5 9.07 1.81 6 9.80 5.88 7, 8 . . . Continued growth at 4 percent ***Note that DIV6 increases sharply as the firm switches back to a 60% payout policy. To forecast the stock price in year 5 we proceed as follows: P5 = DIV6 5.88 = = $147.00 r − g 0.08 − 0 .04 Therefore, CSI’s stock price will increase to: P0 = 1.33 1.44 1.55 1.68 1.81 + 147 + + + + = $106.21 2 3 1.08 1.08 1.08 1.08 4 1.08 5 Exercise 28. Permian Partners (PP) produces from aging oil fields in west Texas. Production is 1,8 million barrels per year in 2006, but production is declining at 7% per year for the foreseeable future. Costs of production, transportation, and administration add up to $25 per barrel. The average oil price was $65 per barrel in 2006. 4 PP has 7 million shares outstanding. The cost of capital is 9%. All of PP’s net income is distributed as dividends. For simplicity assume that the company will stay in business forever and that costs per barrel are constant at $25. Also, ignore taxes. (a) What is the PV of a PP share? Assume that oil prices are expected to fall to $60 per barrel in 2007, $55 per barrel in 2008, and $50 per barrel in 2009. After 2009, assume a long-term trend of oil-price increase at 5% per year. (b) What is PP’s EPS/P ratio and why is not equal to the 9% cost of capital? a. First, we use the following Excel spreadsheet to compute net income (or dividends) for 2006 through 2010: 2006 1.8000 65 25 Production (million barrels) Price of oil/barrel Costs/barrel Revenue Expenses Net Income (= Dividends) 117,000,000 45,000,000 72,000,000 2007 1.6740 60 25 100,440,000 41,850,000 58,590,000 2008 1.5568 55 25 2009 1.4478 50 25 2010 1.3465 52.5 25 85,625,100 38,920,500 46,704,600 72,392,130 36,196,065 36,196,065 70,690,915 33,662,340 37,028,574 Next, we compute the present value of the dividends to be paid in 2007, 2008 and 2009: P0 = 58,590,000 46,704,600 36,196,065 + + = $121,012,624 1.09 1.09 2 1.09 3 The present value of dividends to be paid in 2010 and subsequent years can be computed by recognizing that both revenues and expenses can be treated as growing perpetuities. Since production will decrease 7% per year while costs per barrel remain constant, the growth rate of expenses is: –7.0% To compute the growth rate of revenues, we use the fact that production decreases 7% per year while the price of oil increases 5% per year, so that the growth rate of revenues is: [1.05 × (1 – 0.07)] – 1 = –0.0235 = –2.35% Therefore, the present value (in 2009) of revenues beginning in 2010 is: PV2009 = 70,690,915 = $622,827,4 45 0.09 - (-0.0235) Similarly, the present value (in 2009) of expenses beginning in 2010 is: PV2009 = 33,662,340 = $210,389,6 25 0.09 - (-0.07) 5 Subtracting these present values gives the present value (in 2009) of net income, and then discounting back three years to 2006, we find that the present value of dividends paid in 2010 and subsequent years is: $318,477,671 The total value of the company is: $121,012,624 + $318,477,671 = $439,490,295 Since there are 7,000,000 shares outstanding, the present value per share is: $439,490,295 / 7,000,000 = $62.78 b. EPS2006 = $72,000,000/7,000,000 = $10.29 EPS/P = $10.29/$62.78 = 0.164 6